Nouvelles de la société

Actualités de l'industrie

Canada, ON: Workers reach final deal as Diageo closes Crown Royal plant in Amherstburg

Australia: ABAREs lifts forecast for wheat, barley, canola crops

USA, WI: Nicolet Ale Works to move into a permanent new home

Pakistan: Murree Brewery restarts beer exports for the first time since prohibition imposed in 1977

Nos malts

Nos houblons

Nouveaux houblons

Nos levures

Nos épices

Nos sucres

Nos capsules

-

Capsules 26mm TFS-PVC Free, Champagne Opaque col. 2713 (10000/boîte)

Ajouter au panier

Capsules 26mm TFS-PVC Free, Champagne Opaque col. 2713 (10000/boîte)

Ajouter au panier

-

Kegcaps 69 mm, Marron 154 Grundey G-type (850/boîte)

Ajouter au panier

Kegcaps 69 mm, Marron 154 Grundey G-type (850/boîte)

Ajouter au panier

-

Kegcaps 64 mm, Rouge 150 Sankey S-type (EU) (1000/boîte)

Ajouter au panier

Kegcaps 64 mm, Rouge 150 Sankey S-type (EU) (1000/boîte)

Ajouter au panier

-

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/boîte)

Ajouter au panier

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/boîte)

Ajouter au panier

-

Capsules 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/boîte)

Ajouter au panier

Capsules 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/boîte)

Ajouter au panier

Recettes de Bière

Certificats

Suggestion

USA: Molson Coors planning to acquire more non-alcoholic beer brands

USA: Molson Coors planning to acquire more non-alcoholic beer brands

Molson Coors Beverage Co. is planning on acquiring more non-alcoholic beer brands in an effort to appeal to the public's changing drinking habits, according to company executives, Benzinga reported on December 2.

"While beer is our roots and at the core of our business, you can also expect us to step up our focus on beyond beer because we believe we can win here," CEO Rahul Goyal said on Molson-Coors's Q3 earnings call earlier this month. "Not only does it help to premiumize our business, but it also creates value for our customers by appealing to a wider range of consumer preferences and serving more occasions."

Molson Coors already produces non-alcoholic versions of its Coors, Blue Moon, and other brands. There are plans to "fill some gaps" in the zero-proof part of the company's portfolio and make it a bigger part of the overall business strategy, Goyal said on the call.

"So in terms of deploying capital, you will see us probably lean in a lot more on the beyond beer space than the beer space," he said.

Alcohol consumption is at an all-time low, with only 54% of US adults saying they consume alcoholic beverages, according to a Gallup poll released in August.

As more Americans give up alcohol, breweries and craft beer manufacturers have started offering new non-alcoholic brews or near beer, beers with very low alcohol content. The global non-alcoholic beer market is expected to reach $34.98 billion by 2029, The Business Research Company said in January.

Molson Coors acquired a minority stake in U.K.-based beverage company Fever-Tree earlier this year. That acquisition could serve as a model for future M&A opportunities to expand its non-alcoholic portfolio, Goyal said on the Q3 earnings call.

"We want to make sure we deploy capital for brands that fill gaps in our portfolio," he said.

Coors isn't the only beer brand putting a heavier emphasis on non-beer categories. Anheuser-Busch saw net revenue of non-alcoholic drinks jump 27% year over year, CEO Michel Doukeris said during the company's Q3 earnings call.

"Non-alcohol beer is a key opportunity to develop new consumption occasions and increase participation, and we are investing and innovating to lead the growth," Doukeris said on the call.

While beyond beer only accounts for 2% of Anheuser-Busch's overall volume, the company plans on spending more on it in the coming months, according to Doukeris.

"The opportunity here is huge because the addressable market outside of the beer category is very relevant and is bigger than the beer category itself," he said. "It is a huge addressable market. Today it is a very small portion of our volumes, but it is growing very fast."

Revenir

Fermentis - Yeast Kosher Certificates 2023

Fermentis - Yeast Kosher Certificates 2023

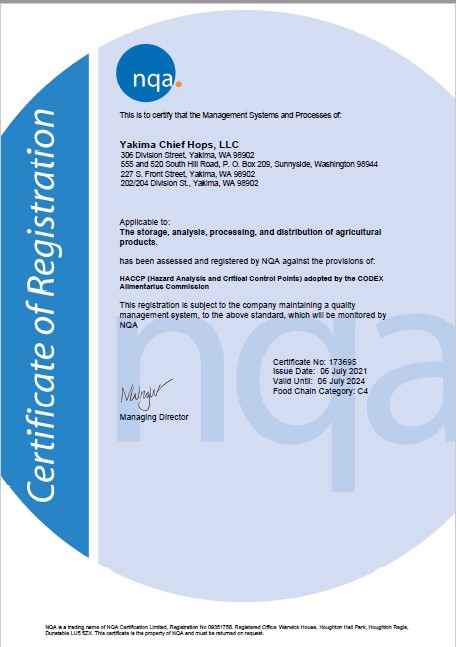

Hops Yakima Chief, HACCP Hazard Analysis Certificate EN,2021-2024

Hops Yakima Chief, HACCP Hazard Analysis Certificate EN,2021-2024

ChF - Hops Kosher Certificate 2022-2023

ChF - Hops Kosher Certificate 2022-2023

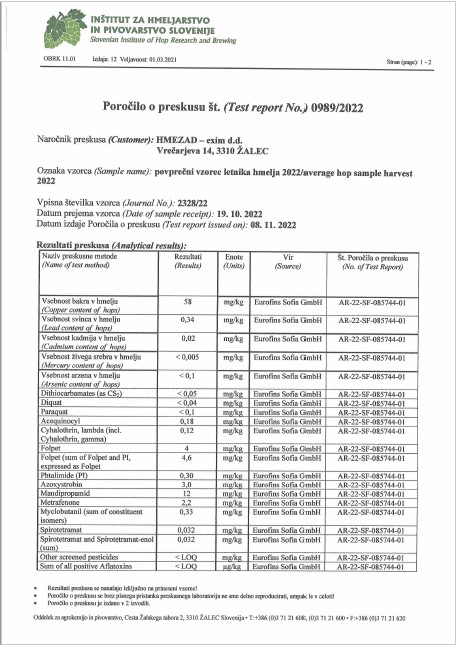

Hmezad Hops, Heavy Metals Certificate 2022

Hmezad Hops, Heavy Metals Certificate 2022

Malt Kosher Certificate July 2024-June 2025

Malt Kosher Certificate July 2024-June 2025