Votre panier

Nouvelles de la société

Actualités de l'industrie

India: Pernod Ricard retains position as India�s largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Nos malts

Nos houblons

Nouveaux houblons

Nos levures

Nos épices

Nos sucres

Nos capsules

-

Kegcaps 64 mm, Jaune 4 Sankey S-type (EU) (1000/boîte)

Ajouter au panier

Kegcaps 64 mm, Jaune 4 Sankey S-type (EU) (1000/boîte)

Ajouter au panier

-

Kegcaps 74 mm, Or 116 Flatfitting A-type (700/boîte)

Ajouter au panier

Kegcaps 74 mm, Or 116 Flatfitting A-type (700/boîte)

Ajouter au panier

-

Kegcaps 74 mm, Marron 154 Flatfitting A-type (700/boîte)

Ajouter au panier

Kegcaps 74 mm, Marron 154 Flatfitting A-type (700/boîte)

Ajouter au panier

-

Capsules 26mm TFS-PVC Free, Cyan Transparent col. 2892 (10000/boîte)

Ajouter au panier

Capsules 26mm TFS-PVC Free, Cyan Transparent col. 2892 (10000/boîte)

Ajouter au panier

-

CC29mm TFS-PVC Free, Vert avec j.abs.oxygene (6500/boîte)

Ajouter au panier

CC29mm TFS-PVC Free, Vert avec j.abs.oxygene (6500/boîte)

Ajouter au panier

Recettes de Bière

Certificats

Suggestion

Japan: Asahi aiming at cracking non-alcohol drinks market

Japan: Asahi aiming at cracking non-alcohol drinks market

Asahi wants to crack a market that has proved surprisingly resilient during the coronavirus pandemic: non-alcohol drinks, the Financial Times reported on May 3.

Asahi’s decision followed a $20 bln splurge on beer brands including Peroni, Pilsner Urquell to Carlton Draught in recent years. But a consumer focus on all things “wellness” has been strengthened by Covid-19. Sales of low and non-alcoholic drinks rose during the pandemic even as pub closures have led to a global decline in beer sales.

“Non-alcohol is a good all-around product,” Atsushi Katsuki, Asahi’s chief executive since March, said in an interview. “It helps to resolve social issues, it connects us with new users and it leads to our profitability.”

Low and non-alcohol beer sales have benefited as people spent more on drinks to be consumed at home during lockdowns, suiting Asahi’s broader strategy of focusing on higher-margin “premium” beverages.

The shift has also been supported by pressures in Japan, where beer volumes have fallen for more than two decades and the government has tightened its crackdown on heavy alcohol consumption.

In Europe, sales of Asahi’s non-alcohol brew grew 10 per cent in 2020 compared with the previous year, driven by the popularity of brands such as Birell and Peroni Libera — even as those of beer fell 6 per cent on a volume basis. Asahi has said it wanted to quadruple its ratio of non-alcohol drink sales in Europe by 2030, from 5.1 per cent last year.

The company, which is known in Japan for its flagship Super Dry brand, launched a low-alcohol product called Beery in March, using technology from European drinks it acquired to recreate a beer beverage with reduced alcohol content. It aims to triple its ratio of beverages with 3.5 per cent alcohol or less to 20 per cent of its product mix by 2025.

“This isn’t just about changes in consumption among the young,” said Katsuki. “Until now, we were not able to offer options for different circumstances to address people who can drink but won’t or people who want to drink but can’t.”

The volume of sales of low and no-alcohol drinks is projected to grow 10.7 per cent annually in the US, 6.6 per cent in the UK and 6.5 per cent in Japan between 2020 and 2024, according to drinks analytics group IWSR.

Rivals such as Anheuser-Busch InBev and Heineken have also been building non-alcoholic portfolios. But analysts have taken a wait-and-see stance about how much these products will contribute to earnings, with the low and no-alcohol market accounting for less than 2 per cent of that for intoxicating drinks. Asahi’s operating profit fell a third last year, as it relied heavily on sales at restaurants and pubs.

Katsuki, 61, took over the world’s seventh-largest brewer in a drastically more difficult business environment than the previous five years, when Asahi spent billions scooping up European and Australian assets from AB InBev, including Grolsch and Carlton & United Breweries.

The company has ruled out any big acquisition until 2024, by which time it hopes to have reduced its net debt to three times earnings before interest, tax, depreciation and amortisation, compared with its current level of six times.

“We are discussing internally whether our current portfolio and footprint is sufficient. There is also the question of whether it is OK to just have beer,” Katsuki said.

Revenir

Malt Kosher Certificate July 2025-June 2026

Malt Kosher Certificate July 2025-June 2026

Top Hop - HACCP Certificate 2021-2024

Top Hop - HACCP Certificate 2021-2024

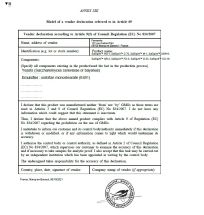

Fermentis Yeast- Non GMO declaration SafSpirit range

Fermentis Yeast- Non GMO declaration SafSpirit range

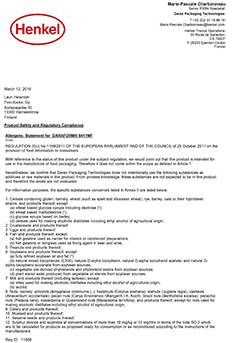

Crown Caps Finnkorkki Product Safety & Regulatory Compliance

Crown Caps Finnkorkki Product Safety & Regulatory Compliance

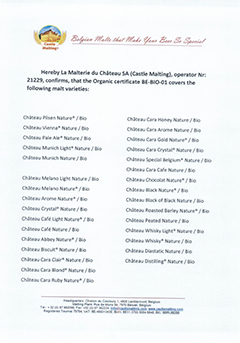

List of organic malts - Castle Malting

List of organic malts - Castle Malting