Votre panier

Nouvelles de la société

Actualités de l'industrie

France: Beer and wine conglomerate Castel Group facing internal turmoil

UK: Spring barley area forecast to drop by 15% in 2026

Australia: Barley prices beginning to stabilize after four years of declines

EU: Early barley crop 2026 picture remains good, forecast for 2025 boosted by 0.2 mln tonnes

Nos malts

Nos houblons

Nouveaux houblons

Nos levures

Nos épices

Nos sucres

Nos capsules

-

Capsules 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/boîte)

Ajouter au panier

Capsules 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/boîte)

Ajouter au panier

-

Kegcaps 69 mm, Blanc 86 Grundey G-type (850/boîte)

Ajouter au panier

Kegcaps 69 mm, Blanc 86 Grundey G-type (850/boîte)

Ajouter au panier

-

Capsules 26mm TFS-PVC Free, Blue Neu col. 20120 (10000/boîte)

Ajouter au panier

Capsules 26mm TFS-PVC Free, Blue Neu col. 20120 (10000/boîte)

Ajouter au panier

-

Crown Caps 26 mm TFS-PVC Free, Noir col. 2439 (10000/boîte)

Ajouter au panier

Crown Caps 26 mm TFS-PVC Free, Noir col. 2439 (10000/boîte)

Ajouter au panier

-

CC29mm TFS-PVC Free, Rouge,avec j.abs.oxygene (7000/boîte)

Ajouter au panier

CC29mm TFS-PVC Free, Rouge,avec j.abs.oxygene (7000/boîte)

Ajouter au panier

Recettes de Bière

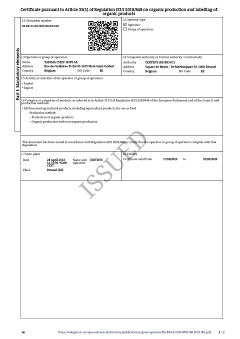

Certificats

Suggestion

USA: Large brewers beat market expectations in most recent quarters

USA: Large brewers beat market expectations in most recent quarters

Large brewers beat market expectations in their most recent quarters as they sold more drinks to homebound consumers amid the pandemic and found success with newer product categories, like hard seltzer, S&P Global reported on November 24.

Anheuser-Busch InBev SA, Constellation Brands Inc., Boston Beer Co. Inc. and Molson Coors Beverage Co. all posted stronger-than-expected quarterly earnings and adapted their businesses in light of ongoing coronavirus restrictions and lockdowns that have closed down major points of sale like restaurants, bars and other hospitality venues. IWSR, an alcoholic beverage market data company, forecasts that the global wine and beer categories are both expected to be down 9% in 2020 and are unlikely to regain volumes for several years.

AB InBev's newer products, like the lager Brahma Duplo Malte in Brazil and Bud Light Seltzer in the U.S., helped boost its third-quarter results. Constellation's stronger business through grocery stores and other retail outlets helped offset a near-50% reduction in on-premise channels like restaurants in its fiscal second quarter. Boston Beer saw third-quarter growth with its Truly Hard Seltzer and Twisted Tea brands.

"I think you saw beats across the board as the breweries kind of work their way through the issues," Jamil Soriano, a vice president and research analyst at Ariel Investments, said in an interview.

Boston Beer reported that third-quarter net revenue grew 30.2% from a year ago. Its much larger competitors are still lagging where they were a year ago, registering declines ranging from 2.7% to 4% in their most recently reported quarters. Net incomes for three of the four big beer companies actually rose in their most recent quarters, while AB InBev saw a large drop as it prioritized deleveraging commitments.

On-premise beer sales fell precipitously with the onset of the pandemic but have improved over the year, Celia Rodgers, a senior research analyst at Brandywine Global, said in an interview. Whether or not on-premise sales can get back to their pre-coronavirus levels depends on what the restaurant industry looks like coming out of the pandemic, Rodgers said.

More on-premise businesses are opting for faster-moving beer products so they do not get stuck with too much beer in the event they have to shut down again, and some restaurants are cutting back on the number of beers they have on tap, Rodgers said. It is unclear if these trends will last beyond the context of the pandemic, she said.

As sales in the on-premise channel dropped and sales in the off-premise channel surged, brewers have faced challenges supplying cans and packaging and managing supply chains, Soriano of Ariel Investments said. The on-premise channel is going to continue to be a challenge for the beer industry after European countries added lockdowns and U.S. cities and states tighten COVID-19 restrictions, Soriano said.

"While it seems as though these companies were able to get their arms around dealing with these supply issues last quarter, maybe you see a reversion because of the re-shutting down," Soriano said.

While the volume of U.S. beer has not changed that much this year there has been a huge shift from people drinking from pint glasses in bars and restaurants to drinking at home, Bart Watson, chief economist for the Brewers Association, said in an interview. It remains to be seen how long-term this shift will be, he said.

"We really don't know how much of that's going to shift back over the next year or two and how much of the share shift is going to be permanent," Watson said.

With people unable to drink in restaurants and bars, brewers are finding ways to make their products more accessible to consumers. AB InBev expanded its direct-to-consumer proprietary platforms and its third-party partnerships over the past several months. In Brazil, AB InBev uses a delivery app called Zé Delivery to deliver cold beer to consumers and has seen month-to-month growth in orders. Online sales for Molson Coors in the U.S. have grown about 200% during the pandemic, and the company is developing new e-commerce and direct-to-consumer channels for its business in Canada.

One area that continues to grow is hard seltzer. The global ready-to-drink category, which includes hard seltzer, will see volume growth of 43% in 2020, mainly due to a strong performance in the U.S., which is the largest ready-to-drink market in the world by volume, according to IWSR. Ready-to-drink products are expected to post volume gains of 21.8% compound annual growth rate from 2019 to 2024 and steal market share mainly from the beer category, the IWSR report said. The U.S. ready-to-drink category will be bigger by volume than the spirits category by the end of 2020, according to IWSR.

Large brewers are increasing their focus on hard seltzer as they look to grow and defend their share of the fast-growing market. Molson Coors, which owns Vizzy Hard Seltzer, plans to expand its hard seltzer production capacity by over 400% by the end of 2020. Boston Beer, which offers Truly Hard Seltzer, plans to continue investing to increase its capacity to meet the needs of its business and take advantage of the hard seltzer category.

"The category does have legs," Soriano said. "It's demonstrated an ability to generate demand."

Revenir

Malt Kosher Certificate July 2024-June 2025

Malt Kosher Certificate July 2024-June 2025

Certificate Bio Cambie Hop VOF 2024-2025

Certificate Bio Cambie Hop VOF 2024-2025

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

Fermentis - Brewing Yeasts Information ENG - SafSour LP-652, LB-1

Fermentis - Brewing Yeasts Information ENG - SafSour LP-652, LB-1

Fermentis Yeast Manufacturing Statement 2023

Fermentis Yeast Manufacturing Statement 2023