Aktualności firmowe

E-Malt news

Argentina: Both malting and feed barley prices unchanged

Argentina: Barley crop 2025 development supported by favourable weather

Australia: Barley crop 2025 currently forecast at 15.8 mln tonnes with potential for further increase

Canada: Barley crop 2025 forecast at 9 mln tonnes still slightly above official estimates, analysts say

Nasze słody

Nasze chmiele

New Hops

Nasze drożdże

Nasze przyprawy

Nasze cukry

Nasze kapsle

-

Kapsle 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/box)

Dodaj do koszyka

Kapsle 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/box)

Dodaj do koszyka

-

Kapsle 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/box)

Dodaj do koszyka

Kapsle 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/box)

Dodaj do koszyka

-

Kegcaps 64 mm, Czerwony 102 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

Kegcaps 64 mm, Czerwony 102 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

-

Kegcaps 69 mm, Błękitny 141 Grundey G-type (850/box)

Dodaj do koszyka

Kegcaps 69 mm, Błękitny 141 Grundey G-type (850/box)

Dodaj do koszyka

-

Kegcaps 64 mm, Rose 1215 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

Kegcaps 64 mm, Rose 1215 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

Certyfikaty

-

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

-

Charles Faram Hops, HACCP Plan QA38, EN 2022

Charles Faram Hops, HACCP Plan QA38, EN 2022

-

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)

-

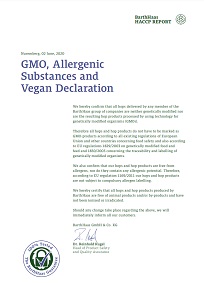

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

-

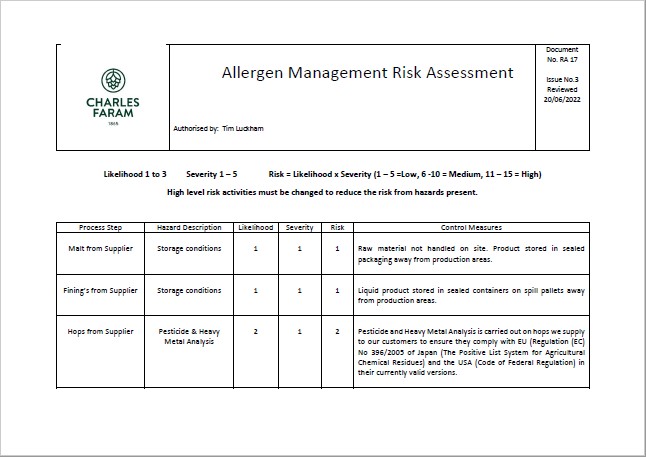

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022

Sugestia

USA: Michelob Ultra overtakes Modelo Especial as the best-selling beer in the US

USA: Michelob Ultra overtakes Modelo Especial as the best-selling beer in the US

Michelob Ultra has overtaken Constellation Brands’ Modelo Especial as the best-selling beer in the United States, CNBC reported on September 22.

Michelob Ultra claimed the top spot as the best-selling beer in retail channels in the 52 weeks ended Sept. 14, parent company Anheuser-Busch announced on September 22, citing data from Circana. The light lager is also the top seller in bars and restaurants, according to Nielsen IQ data for the 52 weeks ended July 12.

For brewer AB InBev, Michelob Ultra’s triumph reverses the company’s struggles from two years ago. Modelo Especial unseated Bud Light in the wake of conservative backlash over the flagship beer’s partnership with transgender social media influencer Dylan Mulvaney. Bud Light had previously held the title as the top-selling beer in the U.S. for more than two decades.

Modelo’s declining popularity comes as Constellation faces key challenges to its business, including tariffs on aluminum and Mexican imports and weaker demand from Hispanic consumers.

Historically, Hispanic beer drinkers have accounted for roughly half of Constellation’s customer base, although growing demand from non-Hispanic consumers helped fuel Modelo’s rise. Executives have said that President Donald Trump’s immigration policies and related job losses have weighed on Hispanic consumers’ spending.

Earlier this month, Constellation cut its forecast for the fiscal year, citing a “challenging” economy. The company expects net beer sales will fall 2% to 4% due to lower volumes and additional tariff impacts. It previously anticipated sales would range from flat to up 3%.

So far this year, AB InBev’s stock has climbed more than 16%, while shares of Constellation have tumbled 39%.

Wstecz