Aktualności firmowe

E-Malt news

Argentina: Both malting and feed barley prices unchanged

Argentina: Barley crop 2025 development supported by favourable weather

Australia: Barley crop 2025 currently forecast at 15.8 mln tonnes with potential for further increase

Canada: Barley crop 2025 forecast at 9 mln tonnes still slightly above official estimates, analysts say

Nasze słody

Nasze chmiele

New Hops

Nasze drożdże

Nasze przyprawy

Nasze cukry

Nasze kapsle

-

Kapsle 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/box)

Dodaj do koszyka

Kapsle 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/box)

Dodaj do koszyka

-

Kapsle 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/box)

Dodaj do koszyka

Kapsle 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/box)

Dodaj do koszyka

-

Kegcaps 64 mm, Czerwony 102 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

Kegcaps 64 mm, Czerwony 102 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

-

Kegcaps 69 mm, Błękitny 141 Grundey G-type (850/box)

Dodaj do koszyka

Kegcaps 69 mm, Błękitny 141 Grundey G-type (850/box)

Dodaj do koszyka

-

Kegcaps 64 mm, Rose 1215 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

Kegcaps 64 mm, Rose 1215 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

Certyfikaty

-

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

-

Charles Faram Hops, HACCP Plan QA38, EN 2022

Charles Faram Hops, HACCP Plan QA38, EN 2022

-

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)

-

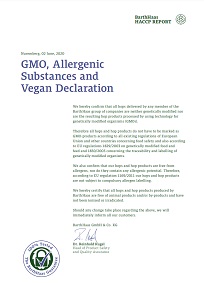

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

-

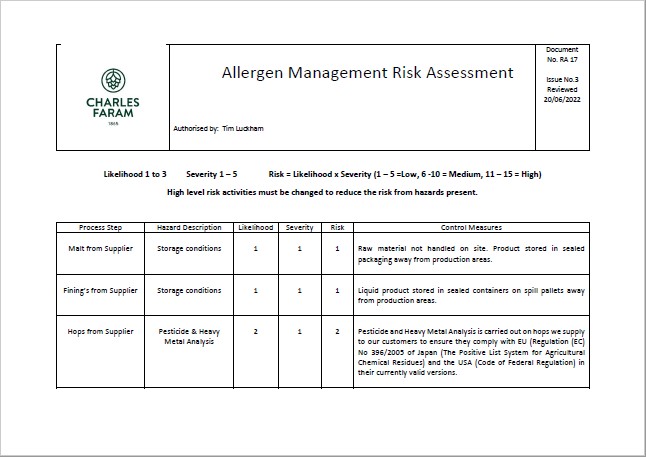

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022

Sugestia

World: Molson Coors Beverage Co enjoys better-than-expected sales and profits in Q2

World: Molson Coors Beverage Co enjoys better-than-expected sales and profits in Q2

Molson Coors Beverage Co reported on August 5 better-than-expected sales and profits for the second quarter, despite continued softness in beer volumes amid a challenging consumer environment.

The North American beermaker reported revenue of $3.2 billion for the quarter, down 1.6% year-over-year but ahead of Wall Street estimates of $3.12 billion.

Earnings per share were $2.05, up 6.8% from the year-ago period and ahead of estimates of $1.83.

The company noted that its Q2 performance, which included a 6.6% decline in volumes, was impacted by the macroeconomic environment and its impact on the beer industry and the consumer. It also experienced headwinds from the discontinuation of its contract brewing arrangements in the Americas at the end of 2024.

For the full year, the company revised its sales guidance to now expect a 3% to 4% decline, compared to earlier guidance of a low single-digit decline.

It also guided a 7% to 10% drop in adjusted EPS, up from its earlier guidance of low-single digit growth.

“As a result of the anticipated ongoing macroeconomic impacts on the industry, our lower-than-expected US share performance, and higher-than-expected indirect tariff impacts on the pricing of aluminum, in particular the Midwest Premium pricing, we have adjusted our 2025 full-year top and bottom-line guidance,” Molson Coors CEO Gavin Hattersley said in a statement.

“However, we are reaffirming our annual underlying free cash flow guidance of $1.3 billion plus or minus 10% due to expected higher cash tax benefits and favorable working capital.”

Shares of Molson Coors added 1.2% at $49 late morning on August 5.

Wstecz