Twój koszyk

Aktualności firmowe

E-Malt news

Ireland: Drinks Ireland research shows sector is vital to local economies

USA, AL: Red Clay Brewing Co. to end operations in March

USA, MO: Minglewood Brewery to close for good on January 18

Brazil: Brazil becomes second-largest market for Johnie Walker whiskey

Nasze słody

Nasze chmiele

-

WILLAMETTE EKOLOGICZNY (ES) Pellets T90 (5KG)

Dodaj do koszyka

WILLAMETTE EKOLOGICZNY (ES) Pellets T90 (5KG)

Dodaj do koszyka

-

CASHMERE EKOLOGICZNY (USA) Pellets T90 (5KG)

Dodaj do koszyka

CASHMERE EKOLOGICZNY (USA) Pellets T90 (5KG)

Dodaj do koszyka

-

HALLERTAU SMARAGD EKOLOGICZNY (DE) Pellets T90 (5KG)

Dodaj do koszyka

HALLERTAU SMARAGD EKOLOGICZNY (DE) Pellets T90 (5KG)

Dodaj do koszyka

-

HALLERTAU TRADITION EKOLOGICZNY (DE) Pellets T90 (5KG)

Dodaj do koszyka

HALLERTAU TRADITION EKOLOGICZNY (DE) Pellets T90 (5KG)

Dodaj do koszyka

-

CASCADE (FR) Pellets T90 (5kg)

Dodaj do koszyka

CASCADE (FR) Pellets T90 (5kg)

Dodaj do koszyka

New Hops

Nasze drożdże

Nasze przyprawy

Nasze cukry

Nasze kapsle

-

Kegcaps 64 mm, White 86 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

Kegcaps 64 mm, White 86 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

-

Crown Caps 26mm TFS-PVC Dark Green col. 2410 Zielony (10000/box)

Dodaj do koszyka

Crown Caps 26mm TFS-PVC Dark Green col. 2410 Zielony (10000/box)

Dodaj do koszyka

-

CC29mm TFS-PVC Free, Zielony with oxygen scav.(6500/box)

Dodaj do koszyka

CC29mm TFS-PVC Free, Zielony with oxygen scav.(6500/box)

Dodaj do koszyka

-

Kegcaps 64 mm, Czerwony 102 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

Kegcaps 64 mm, Czerwony 102 Sankey S-type (EU) (1000/box)

Dodaj do koszyka

-

Kapsle 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/box)

Dodaj do koszyka

Kapsle 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/box)

Dodaj do koszyka

Certyfikaty

Sugestia

USA, MA: Boston Beer�s third quarter earnings beat analyst estimates

USA, MA: Boston Beer�s third quarter earnings beat analyst estimates

The Boston Beer Company, Inc. reported third quarter earnings that beat analyst estimates, but posted full-year guidance below estimates, sending shares down slightly by 0.6% in after-hours trading, Investing.com reported on October 24.

The maker of Samuel Adams beer and Truly Hard Seltzer posted adjusted earnings per share of $5.35, topping the consensus estimate of $5.03. Revenue rose 0.6% year-over-year to $605.5 million, just above analyst expectations of $605.14 million.

However, Boston Beer provided full-year 2024 earnings guidance for a range of $8.00 to $10.00 per share, below the consensus estimate of $9.58. The company cited "somewhat softer near-term category trends."

"We continue to believe that there is significant growth opportunity in Beyond Beer categories despite some near-term variability in alcoholic beverage demand," said Chairman and Founder Jim Koch.

Depletions, a key industry metric measuring sales to retailers, decreased 3% in the quarter. Shipment volume fell 1.9% to approximately 2.24 million barrels.

The company's gross margin improved to 46.3%, up 60 basis points year-over-year, benefiting from price increases and procurement savings.

Boston Beer repurchased $191 million worth of shares year-to-date through October 18. The company also increased its share repurchase authorization by $400 million.

Wstecz

Hops Hopfenveredlung St.Johann, Certificate ISO 9001:2015 2022-2025

Hops Hopfenveredlung St.Johann, Certificate ISO 9001:2015 2022-2025

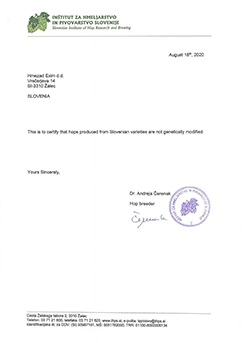

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

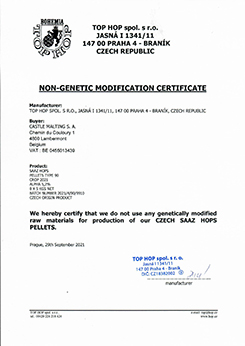

Top Hop - Non GMO Certificate 2021

Top Hop - Non GMO Certificate 2021

Malt Attestation of Conformity for Mycotoxins and Heavy Metals 2024 (ENG)

Malt Attestation of Conformity for Mycotoxins and Heavy Metals 2024 (ENG)

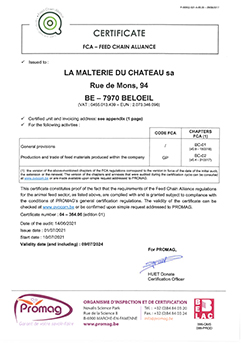

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)