Unternehmensnachrichten

Branchennachrichten

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Unsere Malze

Unsere Hopfen

New Hops

Unsere Hefen

Unsere Gewürze

Unsere Kandiszucker

Unsere Kronkorken

-

Kegcaps 64 mm, Weiß 86 Sankey S-type (EU) (1000/Karton)

in den Warenkorb

Kegcaps 64 mm, Weiß 86 Sankey S-type (EU) (1000/Karton)

in den Warenkorb

-

CC29mm TFS-PVC Free, Rot with oxygen scav.(7000/Karton)

in den Warenkorb

CC29mm TFS-PVC Free, Rot with oxygen scav.(7000/Karton)

in den Warenkorb

-

Kegcaps 74 mm, Blau 141 Flatfitting A-type (700/Karton)

in den Warenkorb

Kegcaps 74 mm, Blau 141 Flatfitting A-type (700/Karton)

in den Warenkorb

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/Karton)

in den Warenkorb

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/Karton)

in den Warenkorb

-

Crown Caps 26 mm TFS-PVC Free, Dunkelbraun col. 2844 (10000/Karton)

in den Warenkorb

Crown Caps 26 mm TFS-PVC Free, Dunkelbraun col. 2844 (10000/Karton)

in den Warenkorb

Bierrezepte

Zertifikate

Vorschlag

World: Alcohol spending under pressure but premium beer outperforms wine and spirits

World: Alcohol spending under pressure but premium beer outperforms wine and spirits

New research from IWSR reveals that while global alcohol spending is under pressure, Gen Z is engaging with drinking – and premium beer is outperforming wine and spirits, The Drinks Business reported on June 27.

Alcohol spending is falling across key global markets, according to new data from IWSR’s Bevtrac consumer tracker, as consumers grapple with inflation and continue to moderate their intake. However, younger legal-drinking-age (LDA+) consumers – especially Gen Z – are beginning to show signs of re-engagement with alcohol.

IWSR’s March 2025 survey of 15 leading global markets shows a mixed picture: sentiment remains strong in India and China, with some recovery in Europe, but the outlook is more negative in North America and parts of Asia-Pacific.

“Consumer sentiment [is] neutral to negative, and spend even more subdued,” said Richard Halstead, COO Consumer Insights at IWSR. “The US and China are seeing some of the biggest falls, and sentiment has weakened across Asia-Pacific, with other markets maintaining the same levels as a year ago.”

Ongoing cost-of-living concerns have seen consumers in developed markets prioritise essentials over alcohol, with on-trade spending in particular continuing to lag.

While older drinkers pull back, Gen Z is pushing forward. The Bevtrac data shows alcohol participation among LDA+ Gen Z adults has climbed to 73%, up from 66% in April 2023. The rebound is most pronounced in Australia, where participation jumped from 61% to 83%, and the US, up from 46% to 70%.

“The propensity to go out and spend more is recovering among this group – challenging the received wisdom that this generation is ‘abandoning’ alcohol,” said Halstead.

Alongside increased consumption, Gen Z is maintaining a broad repertoire of drinks and showing strong engagement with spirits and the on-trade. Their approach to moderation also appears more relaxed than that of older generations.

India remains the only market where all three key indicators – consumer sentiment, recalled volume, and recalled spend – are in positive territory. Affluent Indian Millennials and Gen Zs are leading both consumption and experimentation.

“Affluent Indian Millennials continue to feel financially secure and upbeat about the future,” said Halstead. “Gen Zs closely follow in their footsteps.”

Brazil also shows strong growth, particularly in premium beer, driven by confident, higher-income Millennials. Halstead noted increased participation across vodka, gin, cream liqueurs, and no-alcohol beer among this group.

While premium and super-premium wine and spirits continue to decline, premium-and-above beer is showing resilience. Brazil saw a 14% volume increase in premium beer last year, with rising spend among high- and medium-income earners.

Similar trends are emerging in Europe. “In France, premium and super-premium beer volumes are showing green shoots of recovery,” Halstead said. “Meanwhile, more affluent Spanish drinkers appear to be reshaping the prospects for premium beer in Spain.”

Despite a challenging macroeconomic environment, the data suggests that category and demographic nuances – particularly the resurgence of Gen Z and premium beer – are reshaping the global alcohol landscape.

Zurück

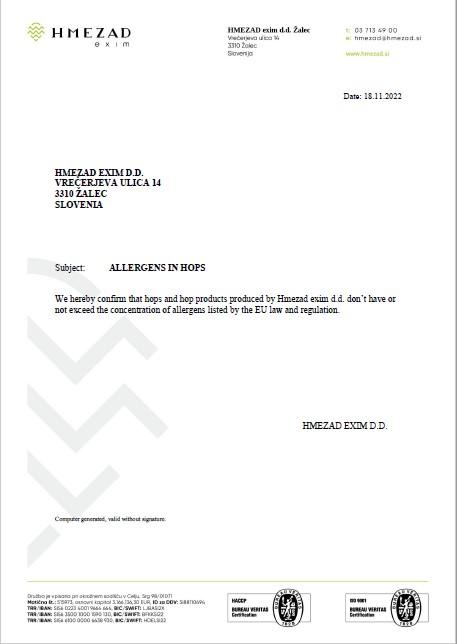

HMEZAD Hops - Certificate allergens in hops 2022

HMEZAD Hops - Certificate allergens in hops 2022

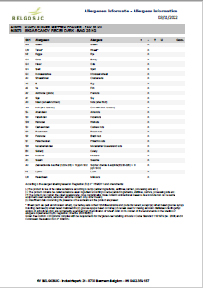

Belgosuc, Sugar Certification Allergens 2022 - Belgosuc(English)

Belgosuc, Sugar Certification Allergens 2022 - Belgosuc(English)

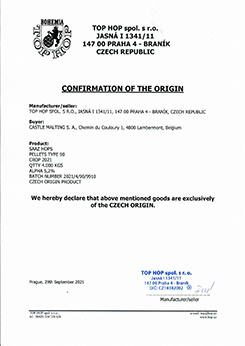

Top Hop - Confirmation of the Origin 2021

Top Hop - Confirmation of the Origin 2021

Belgosuc sugar, Management System Certificate 2022 (English)

Belgosuc sugar, Management System Certificate 2022 (English)

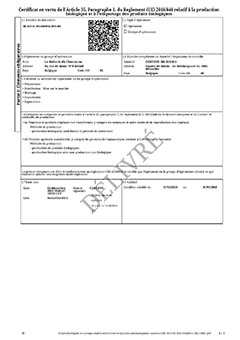

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026