Il tuo carrello

Notizie Aziendali

E-Malt news

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Canada: Barley exports see a slight slowdown

EU: Barley production forecast to decline by 8.3% in 2026/27

USA, IA: 515 Brewing Co. to shut down for good after 12 years in business

I nostri malti

I nostri luppoli

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

Tappi 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/box)

Aggiungi al carrello

Tappi 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/box)

Aggiungi al carrello

-

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

Crown Caps 26mm TFS-PVC Free, Oro col. 2311 (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Free, Oro col. 2311 (10000/box)

Aggiungi al carrello

-

Crown Caps 26 mm TFS-PVC Free, Nero col. 2217 Beer Season (10000/box)*

Aggiungi al carrello

Crown Caps 26 mm TFS-PVC Free, Nero col. 2217 Beer Season (10000/box)*

Aggiungi al carrello

Ricette per birra

Certificati

-

Malt Kosher Certificate July 2025-June 2026

Malt Kosher Certificate July 2025-June 2026

-

Hops Hopfenveredlung St.Johann, HAACP Certificate 2021-2024

Hops Hopfenveredlung St.Johann, HAACP Certificate 2021-2024

-

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

-

Malt Attestation of Conformity for Mycotoxins and Heavy Metals 2024 (ENG)

Malt Attestation of Conformity for Mycotoxins and Heavy Metals 2024 (ENG)

-

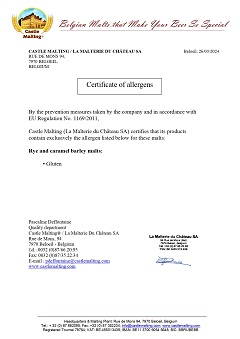

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)

Suggerimento

EU & UK: Malting barley prices weaker under the influence of weaker wheat futures

EU & UK: Malting barley prices weaker under the influence of weaker wheat futures

EU and UK malting barley prices are weaker, influenced to a large degree by weakness in wheat futures, and the ongoing weak demand picture, RMI Analytics said in their latest report.

Barley exports from the EU-27 are down around 39% versus a year ago, leaving a sizeable residual stock, and despite the disappointing winter barley crop result. From the RMI Predictive Barley Price Model, Fair Value for French 2-row malting barley prices is sideways to higher, but with some volatility over the next 3-4 months. This aligns with the tighter barley S&D, and a view of a seasonal bottom forming.

Both UK and Denmark malting barley prices are following French prices downward, as ample inventories of malting and feed barley persist. Domestic maltsters remain by all appearances well covered, and feed demand is limited as buyers are in a ‘just in time’ purchasing mode, and this could ultimately trigger feed barley being exported. In Denmark and Sweden, the crop-changeover to the highly anticipated (and needed) crop’24 has now advanced to a conclusion with good results reported.

Torna