Unternehmensnachrichten

Branchennachrichten

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Unsere Malze

Unsere Hopfen

New Hops

Unsere Hefen

Unsere Gewürze

Unsere Kandiszucker

Unsere Kronkorken

-

Kegcaps 64 mm, Weiß 86 Sankey S-type (EU) (1000/Karton)

in den Warenkorb

Kegcaps 64 mm, Weiß 86 Sankey S-type (EU) (1000/Karton)

in den Warenkorb

-

CC29mm TFS-PVC Free, Rot with oxygen scav.(7000/Karton)

in den Warenkorb

CC29mm TFS-PVC Free, Rot with oxygen scav.(7000/Karton)

in den Warenkorb

-

Kegcaps 74 mm, Blau 141 Flatfitting A-type (700/Karton)

in den Warenkorb

Kegcaps 74 mm, Blau 141 Flatfitting A-type (700/Karton)

in den Warenkorb

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/Karton)

in den Warenkorb

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/Karton)

in den Warenkorb

-

Crown Caps 26 mm TFS-PVC Free, Dunkelbraun col. 2844 (10000/Karton)

in den Warenkorb

Crown Caps 26 mm TFS-PVC Free, Dunkelbraun col. 2844 (10000/Karton)

in den Warenkorb

Bierrezepte

Zertifikate

Vorschlag

USA, MA: Boston Beer�s third quarter earnings beat analyst estimates

USA, MA: Boston Beer�s third quarter earnings beat analyst estimates

The Boston Beer Company, Inc. reported third quarter earnings that beat analyst estimates, but posted full-year guidance below estimates, sending shares down slightly by 0.6% in after-hours trading, Investing.com reported on October 24.

The maker of Samuel Adams beer and Truly Hard Seltzer posted adjusted earnings per share of $5.35, topping the consensus estimate of $5.03. Revenue rose 0.6% year-over-year to $605.5 million, just above analyst expectations of $605.14 million.

However, Boston Beer provided full-year 2024 earnings guidance for a range of $8.00 to $10.00 per share, below the consensus estimate of $9.58. The company cited "somewhat softer near-term category trends."

"We continue to believe that there is significant growth opportunity in Beyond Beer categories despite some near-term variability in alcoholic beverage demand," said Chairman and Founder Jim Koch.

Depletions, a key industry metric measuring sales to retailers, decreased 3% in the quarter. Shipment volume fell 1.9% to approximately 2.24 million barrels.

The company's gross margin improved to 46.3%, up 60 basis points year-over-year, benefiting from price increases and procurement savings.

Boston Beer repurchased $191 million worth of shares year-to-date through October 18. The company also increased its share repurchase authorization by $400 million.

Zurück

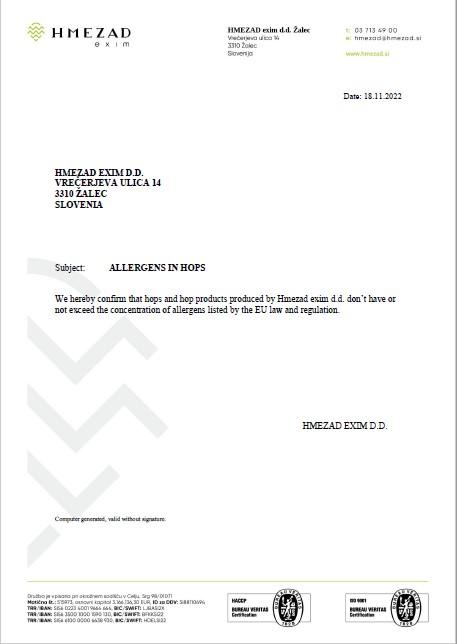

HMEZAD Hops - Certificate allergens in hops 2022

HMEZAD Hops - Certificate allergens in hops 2022

Belgosuc, Sugar Certification Allergens 2022 - Belgosuc(English)

Belgosuc, Sugar Certification Allergens 2022 - Belgosuc(English)

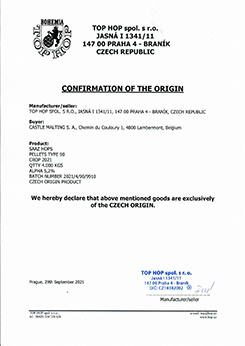

Top Hop - Confirmation of the Origin 2021

Top Hop - Confirmation of the Origin 2021

Belgosuc sugar, Management System Certificate 2022 (English)

Belgosuc sugar, Management System Certificate 2022 (English)

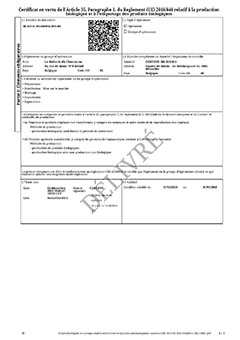

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026