Notizie Aziendali

E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

I nostri malti

-

CHÂTEAU PEATED

Aggiungi al carrello

CHÂTEAU PEATED

Aggiungi al carrello

-

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

-

CHÂTEAU CARA HONEY NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

CHÂTEAU CARA HONEY NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

-

CHÂTEAU AROME NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

CHÂTEAU AROME NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

-

MALT CHÂTEAU SPELT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

MALT CHÂTEAU SPELT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

I nostri luppoli

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

-

CC29mm TFS-PVC Free, Blu without oxygen scav.(7500/box)

Aggiungi al carrello

CC29mm TFS-PVC Free, Blu without oxygen scav.(7500/box)

Aggiungi al carrello

-

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Ricette per birra

Certificati

Suggerimento

World: Molson Coors beats fourth-quarter sales and profit estimates

World: Molson Coors beats fourth-quarter sales and profit estimates

Molson Coors beat fourth-quarter sales and profit estimates on February 13, helped by recovering demand for its beer brands including Coors Light and Miller Lite in the Americas, The Globe and Mail reported on February 13.

Shares of the company were up about 5 per cent in premarket trading.

The company saw sales recover in certain regions, as consumers continued to lean on their favorite beers after cutting back on expensive wines and spirits.

Net sales in its Americas segment were down 2.6 per cent in quarter ended December 31, after falling 11 per cent in the third quarter.

The improvement in sales in the Americas, a biggest revenue generating region, was driven by a consecutive rise in brand volumes in Canada.

Molson Coors, similar to its peer Constellation Brands , has been ramping up prices to counter lingering input costs such as raw materials.

That, along with Molson Coors’ efforts to lower its marketing expenses, helped it in posting underlying earnings per share of $1.30, compared with analysts’ estimates of $1.13 per share, as per data compiled by LSEG.

Its quarterly net sales came in at $2.74-billion, compared with analysts’ estimates of $2.70-billion.

The company expects annual net sales to be up in low single-digit, compared with analysts’ estimate of a 0.55 per cent decline.

The company said that its outlook does not reflect impacts of any trade policy activities or tariffs by the U.S. and potential retaliatory actions by other countries.

President Donald Trump’s import tariffs on goods from Mexico, Canada and China have alcohol firms scrambling to take up measures to try and mitigate impact from the potential trade war.

Last month, Molson Coors bought an 8.5 per cent stake in a $88-million deal to get exclusive rights to market cocktail mixers and tonic water of British company Fevertree Drinks, as the beer maker looks to expand its non-alcoholic drinks.

Torna

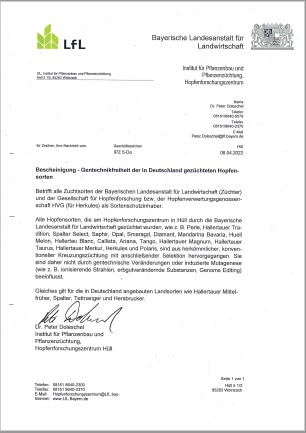

Hops, HVG, non-GMO Certificate 2022, EN

Hops, HVG, non-GMO Certificate 2022, EN

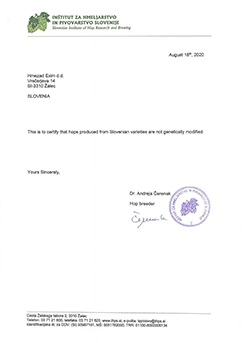

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

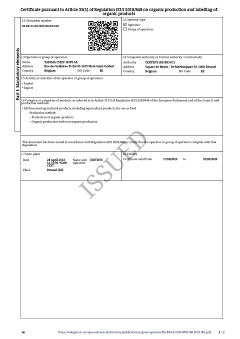

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

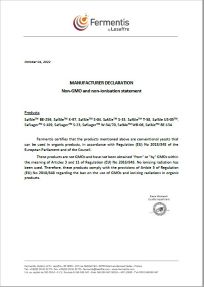

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

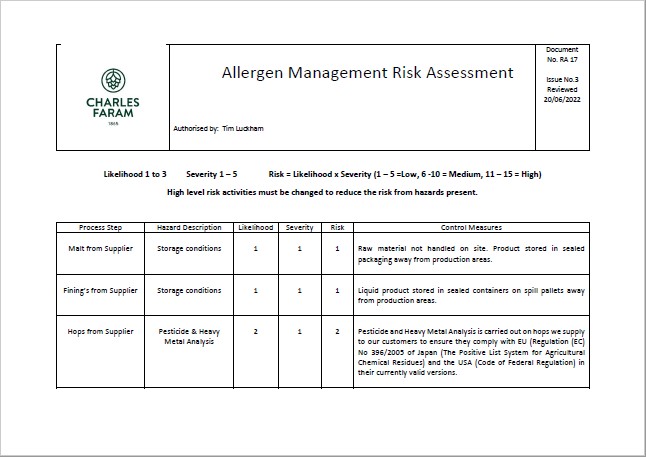

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022