Il tuo carrello

Notizie Aziendali

E-Malt news

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

I nostri malti

I nostri luppoli

-

BELMA (USA) Pellets T90 (5KG)

Aggiungi al carrello

BELMA (USA) Pellets T90 (5KG)

Aggiungi al carrello

-

CASCADE BIOLOGICO (AU) Pellets T90 (5KG)

Aggiungi al carrello

CASCADE BIOLOGICO (AU) Pellets T90 (5KG)

Aggiungi al carrello

-

MILLENIUM BIOLOGICO (USA) Pellets T90 (5KG)

Aggiungi al carrello

MILLENIUM BIOLOGICO (USA) Pellets T90 (5KG)

Aggiungi al carrello

-

CASHMERE BIOLOGICO (USA) Pellets T90 (5KG)

Aggiungi al carrello

CASHMERE BIOLOGICO (USA) Pellets T90 (5KG)

Aggiungi al carrello

-

GOLDINGS BIOLOGICO (BE) Pellets T90 (5KG)

Aggiungi al carrello

GOLDINGS BIOLOGICO (BE) Pellets T90 (5KG)

Aggiungi al carrello

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

Tappi 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/box)

Aggiungi al carrello

Tappi 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/box)

Aggiungi al carrello

-

Crown Caps 26 mm TFS-PVC Free, Giallo col. 2165 (10000/box)

Aggiungi al carrello

Crown Caps 26 mm TFS-PVC Free, Giallo col. 2165 (10000/box)

Aggiungi al carrello

-

Tappi 26mm TFS-PVC Free, Red Neu col. 2151 (10000/box)

Aggiungi al carrello

Tappi 26mm TFS-PVC Free, Red Neu col. 2151 (10000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Rosso 102 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Rosso 102 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

Ricette per birra

Certificati

Suggerimento

UK: UK barley hoping for rises

UK: UK barley hoping for rises

A second 8 mln tonnes+ barley crop in two seasons, has again meant that exports are going to be key for the UK barley market. However, exporting this season is not straight forward, with a challenging global market, and strong export competition, AHDB reported on November 19.

Alongside the large barley crop, malting barley targets have been missed by many GB samples, resulting in an increase in tonnages for feed markets. Add to that, the ongoing pandemic and resulting pressure on malting and it leaves domestic prices with an uphill climb to gain value.

Ex-farm feed barley (UK, nearby) was quoted at £138.50/t in the week ending 12 November, a £46.80/t discount to feed wheat. The gap to wheat has grown since the start of the season, and gains in the value of barley have mostly been on the back of gains in wheat. There are a number of factors preventing this spread narrowing and these can be seen if we examine the end markets for domestic barley.

Barley inclusion rates in animal feed production are reportedly at their limits, with barley usage already up 28.5% year-on-year (Jul-Sept). From a brewing, malting and distilling perspective, barley usage has declined 14.7% over the same period.

Though increases to feed usage this season are seen (+14%), the domestic barley surplus for free stock or export is estimated at 2.28 mln tonnes, according to the AHDB balance sheet released last month. As a result, exports will be pivotal and UK barley prices will need to remain competitive.

Uncertainty still remains over the trading relationship the UK will have with the EU come January. With the risk of tariffs, the country could increasingly have to compete with Australian, Black Sea and French barley for non-EU export business. A no-deal scenario would result in tariffs for UK barley going into the EU although British farmers would still be able to access the EU third country tariff rate quota (TRQ’s). The EU TRQ for barley stands at 307 thousand tonnes of imports at €16/t, after which a €93/t tariff is imposed on further tonnages above this quota.

Last season, 23% of UK barley exports were to non-EU homes, the largest share since 2015/16. This season, to September, the share exports to non-EU homes stands at 11%, with exports to Algeria and Morocco totalling 28.8 thousand tonnes.

If we take the 2019/20 Oct-Dec exports as a baseline, where we saw a rush to export before the 31 October 2019 Brexit deadline, we could see a further 24% of barley exported before the revised 31 December 2020 deadline. This would theoretically leave 1.4 mln tonnes of the barley surplus available post December, for either stock or export. However, there was not the complication of a global pandemic in 2019 muddying the waters further. Equally the rate over this quarter could be affected by the Brexit deadline closing in December rather than October.

Though this figure is an estimate, it gives a rough idea as to the situation facing barley markets for the second half of the season.

There has been plenty of activity in global barley tenders this week. The latest Saudi Arabian (SAGO) tender for 730 thousand tonnes of feed barley was met with accepted Cost, Insurance & Freight (CIF) offers ranging between $229.83/t and $237.82/t. Though origins are yet to be disclosed, the majority are thought to be from Australia and Black Sea regions. This week, Jordan too has bought 60 thousand tonnes of feed barley for delivery next year, with the accepted CIF price at $238.99/t.

The ability for feed barley to rise looks to be subject to a trade deal with the EU. The large surplus this season that is weighing on markets is cleared most efficiently through exports to the EU. In the last five years, the trade bloc has accounted for an average of 85% of UK barley exports; having this route subject to a €93/t tariff, after the TRQ of 307 thousand tonnes had been filled, would effectively cease fresh purchases. At the moment, the uncertainty and risk of losing this market has acted as a cap on large price gains in barley.

Torna

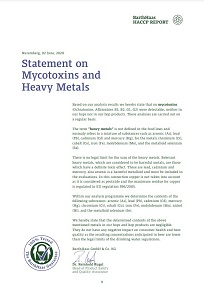

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

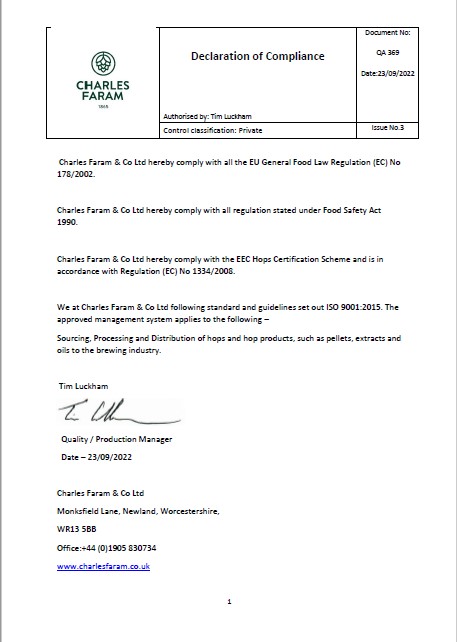

ChF Hops, Declaration of Compliance QA369, EN 2022

ChF Hops, Declaration of Compliance QA369, EN 2022

Malt Attestation GMP & HACCP 2024 (ENG) (FR)

Malt Attestation GMP & HACCP 2024 (ENG) (FR)

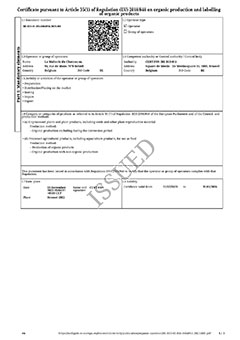

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

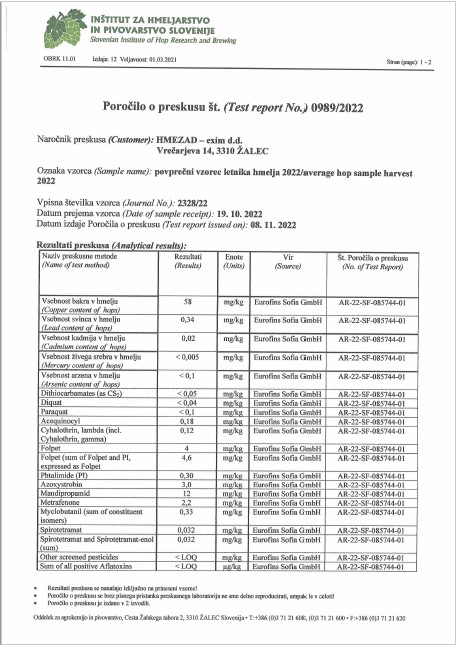

Hmezad Hops, Heavy Metals Certificate 2022

Hmezad Hops, Heavy Metals Certificate 2022