Новини компанії

E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Наш солод

Наш хміль

New Hops

Наші дріжджі

Наші спеції

Наш цукор

Наші кришки

-

Кришки для кег 64мм, Коричневі 118 Sankey S-тип (ЄС) (1000/Коробка)

Додати до кошика

Кришки для кег 64мм, Коричневі 118 Sankey S-тип (ЄС) (1000/Коробка)

Додати до кошика

-

Кришки для кег 64мм, Сині 141 Sankey S-тип (ЄС) (1000/Коробка)

Додати до кошика

Кришки для кег 64мм, Сині 141 Sankey S-тип (ЄС) (1000/Коробка)

Додати до кошика

-

Кришки для кег 74 мм, Золотисті 116 Flatfitting A-тип (700/Коробка)

Додати до кошика

Кришки для кег 74 мм, Золотисті 116 Flatfitting A-тип (700/Коробка)

Додати до кошика

-

Кришки для кег 64мм, Червоні 56 Sankey S-тип (ЄС) (1000/Коробка)

Додати до кошика

Кришки для кег 64мм, Червоні 56 Sankey S-тип (ЄС) (1000/Коробка)

Додати до кошика

-

Кришки для кег 64мм, Червоні 1485 Sankey S-тип (ЄС) (1000/Коробка)

Додати до кошика

Кришки для кег 64мм, Червоні 1485 Sankey S-тип (ЄС) (1000/Коробка)

Додати до кошика

Рецепти пива

Сертифікати

Suggestion

Hungary: Beer consumption shows significant decline in H1 2025

Hungary: Beer consumption shows significant decline in H1 2025

After nearly three percent growth last year, Hungary’s beer consumption significantly declined in the first half of this year. While the overall beer market shows a modest dynamic, certain product categories are advancing rapidly, gradually reshaping the structure of domestic beer production, Trade Magazin reported on July 31.

According to data from the five most significant breweries operating in the country, 5.55 million hectolitres of beer were sold in Hungary last year, representing a 2.8 percent increase.

“In the first half of this year, brewery sales dropped by more than 18 percent, but this figure is primarily due to stockpiling by retailers in early 2024 in preparation for the introduction of the mandatory deposit return system, which inflated the base period figures. The actual decline in consumption may be closer to 8 percent,” Dr. Sándor Kántor, Director of the Hungarian Brewers’ Association, told Agroinform.hu. “As weather is a decisive factor in beer consumption, the temperatures in the remaining summer months will determine the final extent of the annual decline.”

Domestic beer consumption has not shown steady growth over the past five years: there were two years of roughly 10% decline and three years of moderate, around 3% growth. As a result, the five leading domestic breweries’ 2024 sales are still 11 percent below 2019 levels.

Meanwhile, the super-premium segment grew by 43 percent, while budget and private label products dropped by the same margin. Notably, demand for flavored and unflavored alcohol-free beers grew by 40 percent, whereas the market for low-alcohol flavored beers shrank by a staggering 70 percent. In the hospitality segment, beer sales volume has essentially been halved.

Lager beers (Bavarian, Vienna, and Pilsner types) still dominate the market with over 80 percent share, but last year, flavored alcohol-free beers moved into second place, overtaking ales. The fourth spot is held by special beers—such as abbey, porter, and stout varieties—which cater to a niche audience but enjoy a highly dedicated consumer base.

The shift toward higher-quality beers continues to be evident: the premium and super-premium segments now account for more than one-third of the total market—up from just 25 percent five years ago. This is partly thanks to significant technological advancements and creative initiatives by brewers to stimulate and shape consumer demand. New products such as beer cocktails, hydrating alcohol-free beers, and refreshing malt beverages have emerged through continuous product development.

Hungarian beer production is increasingly relying on locally sourced agricultural ingredients, which points to improving quality and tighter supply chains. The biggest challenge remains hops, as current domestic cultivation cannot meet industry demand—representing a major opportunity for future agricultural development. There are visible efforts to cover full production needs with local ingredients, which could yield results in the near future, not to mention the export opportunities enabled by international breweries operating in Hungary.

Today, domestic beer production is primarily conducted by large-scale breweries, with 95 percent of output coming from plants employing at least 50 people. The remaining 5 percent is produced by around 80 small-scale breweries, including several that produce so-called “craft” beers.

The momentum of small-scale breweries peaked in the mid-2010s, but the pandemic radically reshaped the market. Temporary shutdowns, followed by labor shortages and substantial increases in energy and raw material costs in recent years, have posed serious challenges to the industry—especially for smaller producers with limited capital. As a result, the sector has undergone significant consolidation in recent years.

“Today’s long-term competitive players—both large-scale and professionally run small-scale breweries—are well-positioned on a sustainable growth path. In stable periods, annual growth of 3 percent is realistically achievable, but only for those who lead in product and technology innovation,” emphasized Dr. Sándor Kántor.

Назад

Hops, HVG, Organic Certificate 2024

Hops, HVG, Organic Certificate 2024

Certificate Bio Cambie Hop VOF 2024-2025

Certificate Bio Cambie Hop VOF 2024-2025

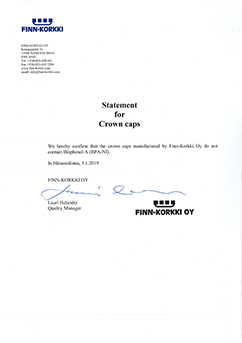

Crown Caps Finnkorkki Statement

Crown Caps Finnkorkki Statement

Belgosuc sugar, Management System Certificate 2022 (English)

Belgosuc sugar, Management System Certificate 2022 (English)

Fermentis Yeast- Non GMO declaration SafCider range

Fermentis Yeast- Non GMO declaration SafCider range