您的购物车

E-Malt news

UK & South Korea: New UK-South Korea deal to benefit exports of Guinness, cars, Scottish salmon

UK: UK brewers facing �heavy headwinds� from increased taxation, other issues

Japan: Kirin set to ramp up beer development via proprietary AI

Norway & Sweden: Olvi Group acquires majority share in Brewery International group

我们的麦芽

Our Hops

New Hops

Our Yeasts

Our Spices

Our Sugars

Our Caps

证书

建议

UK: Government under pressure to cut tax on draught beer

UK: Government under pressure to cut tax on draught beer

The UK government is under pressure to cut tax on draught beer to “help pubs thrive” once COVID-19 restrictions end, Yahoo! Finance reported on January 21.

The Campaign for Real Ale (CAMRA) is calling for the March budget to lower the rate of duty on beer served on tap, in order to help pubs and restaurants compete with supermarket booze.

Reducing the tax on beer depending on how it is served is an option the government can take to support the industry now the UK has left the European Union.

CAMRA research suggests that even a “modest reduction” in beer tax could result in £26.6 mln ($36.4 mln) of additional expenditure on draught beer in public venues.

This would help many to rebuild their businesses, as well as “bringing alcohol consumption back to social settings – creating jobs and boosting the economy in the process”, the consumer body said.

This is just one of many measures CAMRA is urging the government to take to help pubs and restaurants in 2021.

The organisation has written to chancellor Rishi Sunak to ask him to consider a package of measures ahead of the March budget. These include:

• Ongoing, regular grant payments to help pubs and social clubs cover costs when they are forced to close or operate at a reduced capacity.

• Continuing the furlough scheme as long as pubs and clubs are subject to trading restrictions.

• Making sure that brewers and cider producers are eligible for support schemes.

• Announcing another business rates holiday for 2021/22.

• Extending the VAT reduction to beer to support wet-led pubs.

后退

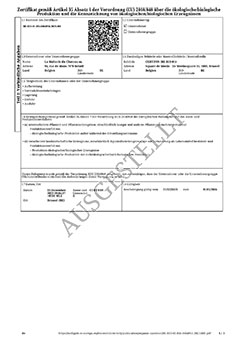

Bio-Zertifikat DE - Dezember 2023-März 2026

Bio-Zertifikat DE - Dezember 2023-März 2026

Hops Charles Faram: non-use of manufactured nanomaterials 2022

Hops Charles Faram: non-use of manufactured nanomaterials 2022

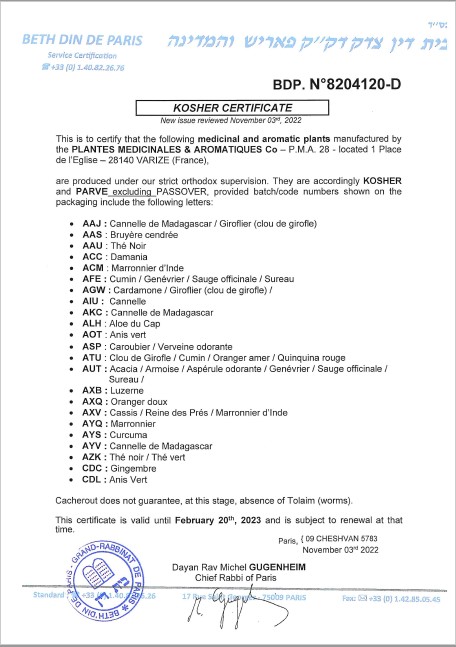

Fagron Spices, Kosher Certificate 2023

Fagron Spices, Kosher Certificate 2023

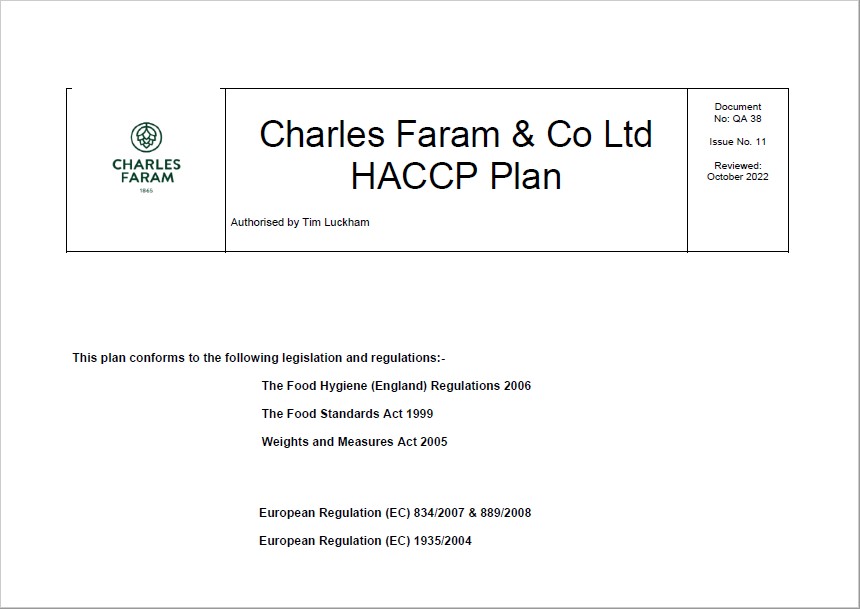

Charles Faram Hops, HACCP Plan QA38, EN 2022

Charles Faram Hops, HACCP Plan QA38, EN 2022

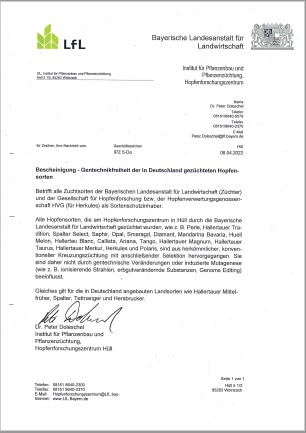

Hops, HVG, non-GMO Certificate 2022, EN

Hops, HVG, non-GMO Certificate 2022, EN