Noticias de Empresa

E-Malt news

UK: Syngenta agrees to sell its malting barley seeds business

Germany & South Korea: Paulaner switches South Korea distribution to Heineken

Thailand: ThaiBev reports 7% fall in annual profit

USA, TX: Revolver Brewing to leave Granbury and move to Dallas-Fort Worth area

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Kegcaps 69 mm, Orange 43 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Orange 43 Grundey G-type (850/caja)

Añadir al carrito

-

CC29mm TFS-PVC Free, Verdes with oxygen scav.(6500/caja)

Añadir al carrito

CC29mm TFS-PVC Free, Verdes with oxygen scav.(6500/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Champagne Opaque col. 2713 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Champagne Opaque col. 2713 (10000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Blancas 86 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Blancas 86 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 74 mm, Rojas 102 Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Rojas 102 Flatfitting A-type (700/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

World: Barley prices slightly lower in early 2025

World: Barley prices slightly lower in early 2025

From a price perspective, 2025 is starting with a drifting lower of barley prices, for all regions, with malting prices under a bit more pressure than feed barley prices which are steadier (even up a little in Argentina), RMI Analytics said in their first report in 2025.

In terms of maintaining planted area in 2025, it will be important to follow malting barley premiums which are quite varied globally - from USD25/tonne in Australia to over USD50 in Argentina. The French USD60/tonne premium should help maintain spring barley area, the analysts said.

Australia continues to firmly hold the most competitive global origin for malting barley, and also on a delivered basis for feed barley to China. This explains the price movement from other origins (Chart left), where the decline in prices is gradually closing the gap to Australian prices. The RMI Predictive Barley Price Model forecasts a continuation of this narrowing trend in the months ahead.

Regresar

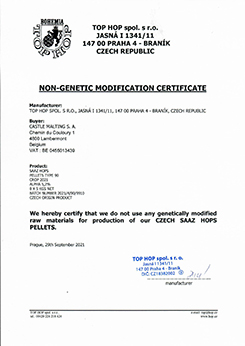

Top Hop - Non GMO Certificate 2021

Top Hop - Non GMO Certificate 2021

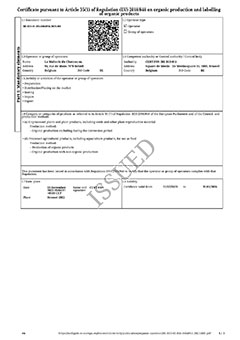

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Dec 2023-Mar 2026

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Dec 2023-Mar 2026

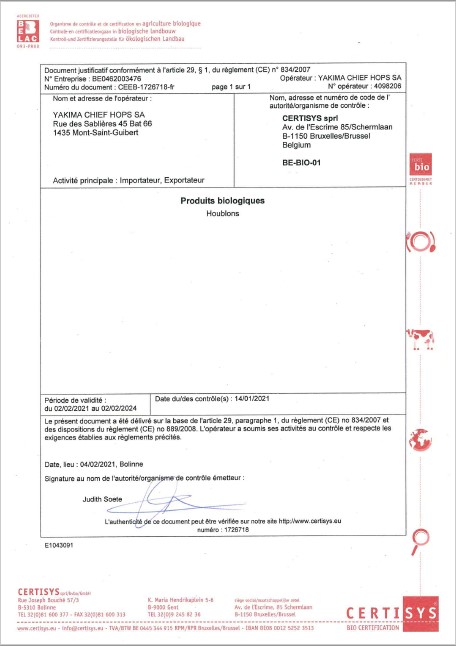

Hops Yakima Chief, Certificate Bio 2021-2024

Hops Yakima Chief, Certificate Bio 2021-2024

Fermentis - Yeast Kosher Certificates 2023

Fermentis - Yeast Kosher Certificates 2023

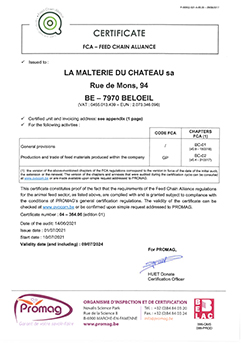

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)