E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Vores malt

Vores humle

New Hops

Vores gær

Vores krydderier

Vores sukker

Vores kapsler

-

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

-

CC29mm TFS-PVC Free, White with oxygen scav.(7000/papkasse)

Tilføj kurv

CC29mm TFS-PVC Free, White with oxygen scav.(7000/papkasse)

Tilføj kurv

-

Kegcaps 64 mm, Gold 116 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

Kegcaps 64 mm, Gold 116 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

-

Kegcaps 64 mm, White 86 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

Kegcaps 64 mm, White 86 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

-

Kegcaps 69 mm, Grøn 147 Grundey G-type (850/papkasse)

Tilføj kurv

Kegcaps 69 mm, Grøn 147 Grundey G-type (850/papkasse)

Tilføj kurv

Certifikater

-

Fagron Spices, IFSFood Certificate 16089, EN 2024

Fagron Spices, IFSFood Certificate 16089, EN 2024

-

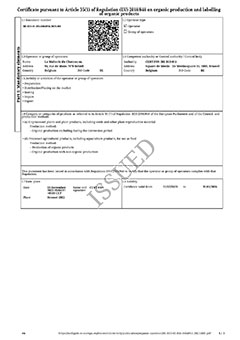

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

-

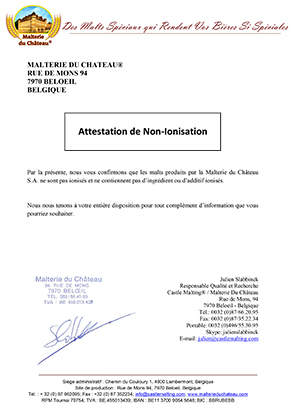

Castle Malting Malt Non Ionization Certificate FR

Castle Malting Malt Non Ionization Certificate FR

-

Hops Hopfenveredlung St.Johann, Certificate ISO 22000:2005 2021-2024

Hops Hopfenveredlung St.Johann, Certificate ISO 22000:2005 2021-2024

-

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Forslag

Malaysia: Heineken Malaysia�s net profit for Q2 falls 8.93%

Malaysia: Heineken Malaysia�s net profit for Q2 falls 8.93%

Heineken Malaysia Bhd saw its net profit for the second quarter ended June 30, 2025 (2QFY2025) fall 8.93%, weighed down by slower sales and higher costs from ongoing investments, The Edge Malaysia reported on August 15.

Its bourse filing showed that quarterly net profit came in at RM83 million, down from RM91.13 million a year earlier, while revenue slipped 5% to RM539.73 million from RM565.5 million.

Heineken Malaysia declared a single tier interim dividend of 40 sen per share, with an entitlement date of Oct 9, to be paid on Oct 30.

For the first half of FY2025, the group’s net profit eased 3.96% to RM205.15 million from RM213.61 million, while revenue fell 3.79% to RM1.3 billion from RM1.35 billion.

Heineken Malaysia said it continues to invest in commercial initiatives and digital infrastructure through the implementation of HEINEKEN’s Digital Backbone, a digital transformation programme designed to unlock the power of data, streamline processes and boost innovation to support long-term growth.

The Digital Backbone initiative is part of the group’s EverGreen strategy to future-proof its business.

In a statement, Heineken Malaysia managing director Martijn van Keulen said the group remains agile despite a challenging macroeconomic environment, leveraging digital solutions and data-driven decision-making to stay relevant in a dynamic market.

“The group continues to prioritise its EverGreen strategy, which drives superior and balanced growth by aligning topline expansion, profitability, and capital efficiency with sustainable and responsible business practices,” he said.

“This integrated approach enables the group to create long-term value for both shareholders and stakeholders, while contributing meaningfully to Malaysia’s broader socio-economic progress.

He noted that illicit alcohol remains a significant challenge for the industry, warning that higher taxes could unintentionally boost demand for illicit products. Heineken Malaysia, he said, will continue working closely with the Royal Malaysian Customs to combat illicit trade through enforcement support and consumer education.

At market close on Friday, August 15, shares of Heineken Malaysia dropped 10 sen or 0.43% at RM23.20. This gives the group a market capitalisation of RM7.01 billion.

Tilbage