Noticias de Empresa

E-Malt news

Argentina: Both malting and feed barley prices unchanged

Argentina: Barley crop 2025 development supported by favourable weather

Australia: Barley crop 2025 currently forecast at 15.8 mln tonnes with potential for further increase

Canada: Barley crop 2025 forecast at 9 mln tonnes still slightly above official estimates, analysts say

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Kegcaps 64 mm, Azules 141 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Azules 141 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Orange 43 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Orange 43 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Marron 153 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Marron 153 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Black 91 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Black 91 Grundey G-type (850/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

Malaysia: Carlsberg Brewery Malaysia reports 3.2% rise in Q2 net profit

Malaysia: Carlsberg Brewery Malaysia reports 3.2% rise in Q2 net profit

Carlsberg Brewery Malaysia Bhd posted a 3.2% year-on-year rise in net profit to RM81.9 million for the second quarter ended June 30, 2025 (2Q25), from RM79.4 million a year earlier, despite revenue easing 3.4% to RM490.2 million from RM507.5 million, The Malaysian Reserve reported on August 12.

The improvement was mainly due to lower tax expenses and higher contributions from its Sri Lankan associate.

The group’s earnings per share for the quarter stood at 26.80 sen, up from 25.97 sen in 2Q24.

The board declared a second interim dividend of 20 sen per share, bringing year-to-date payouts to 43 sen per share, compared with 42 sen in the same period last year.

Malaysia operations saw revenue grow 1.5% to RM369.4 million, with profit from operations rising 4.6% to RM80.7 million, partly due to a lower base in the same quarter last year when trade purchases had surged ahead of a price hike.

Singapore operations, however, recorded a 15.9% decline in revenue to RM120.8 million and a 28.5% drop in profit from operations to RM14.6 million, weighed down by softer on-trade performance and intensified pricing competition amid subdued consumer sentiment.

The group’s associate, Lion Brewery (Ceylon) PLC, contributed RM9.1 million in profit, up from RM8.3 million a year earlier, on improved revenue in Sri Lanka.

For the first half of FY2025, Carlsberg’s net profit rose 5.4% to RM176.5 million from RM167.3 million, while revenue declined 6.5% to RM1.15 billion from RM1.23 billion, partly due to the shorter Chinese New Year period, with some festive sales captured in December 2024.

Its MD Stefano Clini said the group’s focus on disciplined discount management and operational efficiency had supported its performance despite lower sales.

He added that the group remains cautious on the macroeconomic outlook, but will continue to invest in brand premiumisation, product innovation and digital transformation while optimising costs.

Regresar

Belgosuc sugar, Management System Certificate 2022 (English)

Belgosuc sugar, Management System Certificate 2022 (English)

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

Belgosuc, Sugar Certification Allergens 2022 - Belgosuc(English)

Belgosuc, Sugar Certification Allergens 2022 - Belgosuc(English)

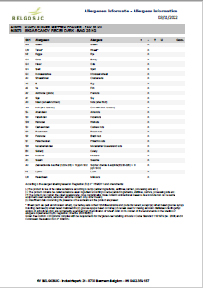

Fermentis - Brewing Yeasts Information ENG - SpringFerm BR-2

Fermentis - Brewing Yeasts Information ENG - SpringFerm BR-2

Fagron Spices, GMO-free Certificate 2022

Fagron Spices, GMO-free Certificate 2022