E-Malt news

Argentina: Both malting and feed barley prices unchanged

Argentina: Barley crop 2025 development supported by favourable weather

Australia: Barley crop 2025 currently forecast at 15.8 mln tonnes with potential for further increase

Canada: Barley crop 2025 forecast at 9 mln tonnes still slightly above official estimates, analysts say

Vores malt

Vores humle

New Hops

Vores gær

Vores krydderier

Vores sukker

Vores kapsler

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

-

Kapsler 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/papkasse)

Tilføj kurv

Kapsler 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/papkasse)

Tilføj kurv

-

Kapsler 26mm TFS-PVC Free, Cyan Opaque col. 2616 (10000/papkasse)

Tilføj kurv

Kapsler 26mm TFS-PVC Free, Cyan Opaque col. 2616 (10000/papkasse)

Tilføj kurv

-

Kegcaps 64 mm, Blå 141 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

Kegcaps 64 mm, Blå 141 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

-

Kegcaps 74 mm, Orange 43 Flatfitting A-type (700/papkasse)

Tilføj kurv

Kegcaps 74 mm, Orange 43 Flatfitting A-type (700/papkasse)

Tilføj kurv

Certifikater

-

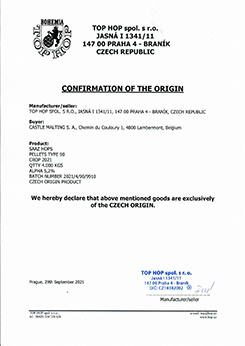

Top Hop - Confirmation of the Origin 2021

Top Hop - Confirmation of the Origin 2021

-

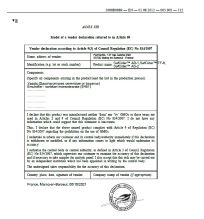

Hops Hopfenveredlung St.Johann, Certificate ISO 22000:2005 2021-2024

Hops Hopfenveredlung St.Johann, Certificate ISO 22000:2005 2021-2024

-

Fermentis Yeast- Non GMO declaration SafCider range

Fermentis Yeast- Non GMO declaration SafCider range

-

Hops Hopfenveredlung St.Johann, Certificate ISO 9001:2015 2022-2025

Hops Hopfenveredlung St.Johann, Certificate ISO 9001:2015 2022-2025

-

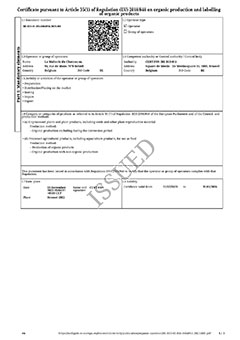

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

Forslag

Japan: Activist fund criticizes Sapporo after overseas �acquisition failures�

Japan: Activist fund criticizes Sapporo after overseas �acquisition failures�

3D Investment Partners has criticised Sapporo Holdings Ltd over its execution of overseas acquisitions, expressing concerns about the risk that the Japanese brewer may continue to “misallocate capital” leading to further “destruction of corporate value”, The Edge reported on February 18.

The Singapore-based investment fund censured the management over “impairment losses on all of its overseas alcoholic beverage acquisitions”, and questioned the responsibility of the board of directors, in a letter seen by Bloomberg.

The letter on February 18 was sent to Sapporo’s board of directors and specifically railed against the 13.9 billion (US$92 million or RM407.16 million) impairment loss that Sapporo booked in January 2025 for Stone Brewing, a US craft brewer that it acquired in 2022. The letter said the company had acquired the US brewer at a price-to-book ratio of 3.4 times, despite Stone Brewing’s declining sales and unprofitable operations.

On February 17, Sapporo announced that the board had voted against appointing former Toshiba Corp outside director Paul Brough, whose name 3D had proposed.

According to data compiled by Bloomberg, 3D is the largest shareholder, owning more than 19% of Sapporo shares.

Sapporo said last week it continues to explore “large-scale” merger and acquisition (M&A) deals to grow its alcoholic beverage business using funds raised from real estate business.

3D said that as a major shareholder it had the responsibility to ensure the board addresses the key issue of capital discipline.

Spokespeople for Sapporo and 3D weren’t immediately available to comment.

Tilbage