Tu carrito

Noticias de Empresa

E-Malt news

India: Pernod Ricard retains position as India�s largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

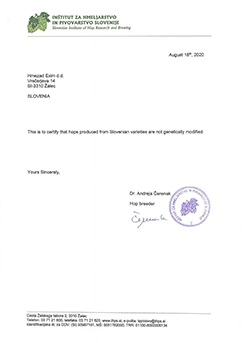

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

-

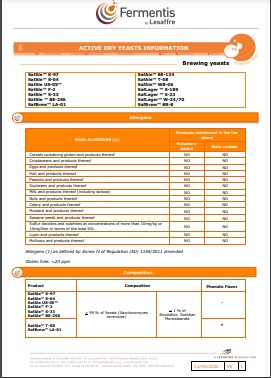

Fermentis - Brewing Yeasts Information 2023

Fermentis - Brewing Yeasts Information 2023

-

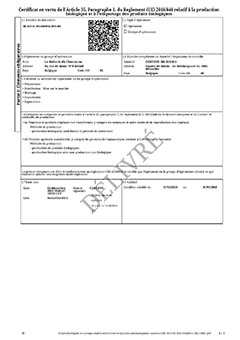

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Sugerencia

UK: Malting barley premiums dwindled since harvest, grain merchants say

UK: Malting barley premiums dwindled since harvest, grain merchants say

UK barley markets have struggled to get much traction in recent months, with large stocks weighing on the market, Farmers Weekly reported on January 15.

Feed barley ranged from £155/t ex-farm in the east of England to £166/t in Scotland in the past week.

Malting barley has also been under pressure with usage by brewers, maltsters and distillers back notably last autumn compared with the previous year.

Malting barley premiums have dwindled since harvest, according to grain merchants, as a result of the high volumes and quality of barley produced last year.

This has reportedly resulted in some growers, eager to sell, having to take a hit on the price and selling malting quality barley for animal feed rations.

Traders at Frontier said: “With demand for malting barley lacking, premiums are still small going into the new year and this sentiment is expected to last for the remainder of the crop year.”

However, some short-term support has been added to the global grain markets after the US Department of Agriculture (USDA) released its latest World Agricultural Supply and Demand Estimates report.

The USDA cut its estimate for global maize stocks, which led to higher maize prices and in turn some temporary support for barley markets.

The UK spring barley area is forecast to be down by 13% year-on-year, predominantly due to an improved autumn planting window with more winter wheat being planted than during the 2023-24 crop year.

AHDB’s Early Bird Survey forecasts a 2025 harvest area for spring barley of 702,000ha and a winter barley area of 381,000ha.

Global market research company Imarc Group estimated the European barley market at 50.4m tonnes in 2024 and expects it to grow to 68.8m tonnes by 2033.

However, the EU agricultural outlook projects barley production within the EU to only rise marginally from 50m tonnes to 51m tonnes by 2035, which would leave a greater reliance on imports.

The EU Commission expects that a marginal improvement in barley yields during the next decade will more than compensate for a slight reduction in the total area.

Regresar