Tu carrito

Noticias de Empresa

E-Malt news

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

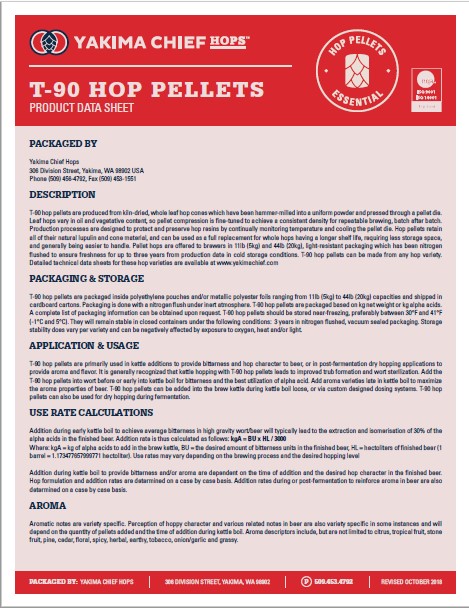

Hops Yakima Chief, T90 Hop Pellets Product data sheet

Hops Yakima Chief, T90 Hop Pellets Product data sheet

-

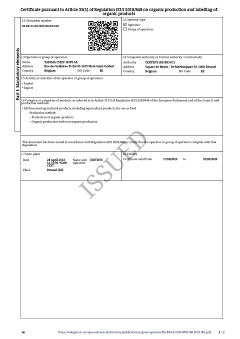

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

-

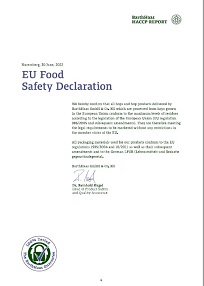

Barth Haas Hops: EU Food Safety Declaration 2022

Barth Haas Hops: EU Food Safety Declaration 2022

Sugerencia

Australia: July malting barley export up 80% versus June

Australia: July malting barley export up 80% versus June

Australia exported 94,404 tonnes of malting barley, 498,057t of feed barley and 242,400t of sorghum in July, according to the latest data from the Australian Bureau of Statistics.

The barley figures are up 80 per cent from the June total on malting and 4pc on feed, while the sorghum total represents a 4pc drop over the month.

Flexi Grain pool manager Sam Roache said July was a strong month for malting barley thanks to the return of demand from Mexico and Peru as well as Vietnam.

“The consistency of the Central and South American business is notable, and it will be interesting to watch if the Canadians can eat into this market with their improved production as we move into the Oct-Dec quarter,” Mr Roache said.

As with last year, when Canada’s drought fuelled export Feed barley shipments were strong for a period when Australian exports typically enter the key Black Sea and EU shipping window

“Our volumes are seemingly unaffected by the harvest pressure and export competition out of the Northern Hemisphere at this stage.

“We do note that the Ukrainians are shipping virtually no barley so far this season, with the majority of resources being focussed on corn to this point.”

Russian new-crop grain shipments have been slow overall and lagging expected pace, but that is expected to change from this month.

“Despite the poor Russian shipments in July-August and flare-ups in conflict, we are beginning to see some stronger export numbers in September, and this will mean more competition for Aussie grain if pace can be sustained.

“The market is comfortable that Russia has the crop and the grain is there to ship; it’s a matter of when, not if.”

Australia’s feed barley markets continued on trend in July, with the Middle East leading the way, and Japan and Vietnam holding up the Asian side.

“Feed wheat continues to block us out of The Philippines and further Asian demand on price.

“Depending on the quality profile of the coming Australian crop, along with the continuing strength in global corn markets, we can see barley winning back some demand into Asia in the new-crop timeframe.”

In Australia’s new-crop market, Mr Roache said activity has been relatively quiet.

“Saudi buyers are standing back in front of a growing Australian production.

“Jordan tenders have been some of the only new-crop business we are seeing, and they are indicating a steady market over the last month or so.”

Mr Roache said Australia’s elevation margins for barley were behind those of wheat and other grains.

“Therefore barley does risk having a lack of export capacity allocated to it as it stands today.

“The market will respond to this, with one solve being Saudi and other Middle East buyers eventually having to pay up to draw the barley out via a higher global price, especially in the face of higher corn prices.”

He said the other option was the local barley market coming under pressure via harvest selling, which will have a similar effect on margins.

“We suggest a bit of both will eventuate.

“We think harvest pressure could see some severe drops in price, especially if Saudi can manage to stay out of the market for another one or two months.

“Avoid it if you can.”

Regresar