Tu carrito

Noticias de Empresa

E-Malt news

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

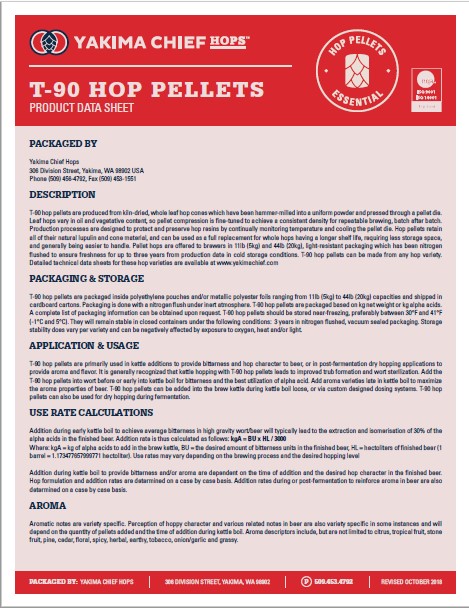

Hops Yakima Chief, T90 Hop Pellets Product data sheet

Hops Yakima Chief, T90 Hop Pellets Product data sheet

-

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

-

Barth Haas Hops: EU Food Safety Declaration 2022

Barth Haas Hops: EU Food Safety Declaration 2022

Sugerencia

China & Australia: China�s import tariff on Australian barley a �lose-lose situation� for both nations - analysts

China & Australia: China�s import tariff on Australian barley a �lose-lose situation� for both nations - analysts

Last year, China slapped an 80 per cent tariff on Australian barley, which effectively ended the trade.

Since then, Australia has managed to find alternative markets such as Saudi Arabia and Mexico.

But new data by AgFlow and Thomas Elder Markets shows the true cost of losing China, which was Australia's biggest customer for barley.

"What we're finding is that even though we're getting good prices [for barley], because the entire tide has lifted for grain prices, in reality it's not as good as it could be," analyst Andrew Whitelaw said.

"Australia is very cheap compared to other barley-producing nations.

"France is almost another world away in terms of shipping freight, but it's passing our boats as we go to Saudi Arabia and it's going to China."

Mr Whitelaw estimates Australian grain growers are getting A$30 to A$40 dollars a tonne less than what they should be for feed barley, and the discount is even higher for malt.

He said China was not winning either.

"Chinese consumers are paying a higher price for the barley; whether they're a consumer for feed or a consumer for malt, they are paying more," he said.

"It's a kind of lose-lose situation that China has enacted this tariff. It costs us, but it also costs them."

On Twitter, WA farmer Scott Bowman said highlighting the discount was important.

"When barley gets to A$280 [a tonne] we say that's decent. If it brushes A$300 we think it's great, but if it could be A$320 we should be vocally upset about [losing] that A$20.

"The next drought might have already begun," he said.

Mr Whitelaw said globally high grain prices were masking the true price penalty of China's barley tariff.

"If Canada had a huge crop and China wasn't importing as much, those two factors alone would probably have meant that we'd be looking more like a barley price with a one in front of it [under A$200 a tonne]. "

"We just have to be aware that losing China is a big thing and it's impacting our prices already."

In its 2021-22 winter crop forecast for Australia, Rabobank is expecting barley production to be down 10 per cent on last year to 11.7 million tonnes, which it says is still up on the five-year average by 7 per cent.

Rabobank said it "did not expect China to return as a market to a material degree even in the mid-term, [but] the tight global corn market is set to support [feed] barley demand over the coming year".

"Malt barley demand is also improving, with recovering beer demand globally as the world opens after COVID-19," Rabobank's Kalisch Gordon said.

According to Grain Research and Development Corporation (GRDC), China's 80 per cent tariff on Australian barley exports has stopped an annual trade flow worth A$1.2 billion.

Regresar