Tu carrito

Noticias de Empresa

E-Malt news

UK: Britons drinking less alcohol than before

The Netherlands: Heineken fined for distributing beer cans without mandatory deposit

Argentina: Barley crop forecast maintained at 5.4 mln tonnes

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Red Neu col. 2151 (10000/caja)

Añadir al carrito

-

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 56 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Orange 43 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

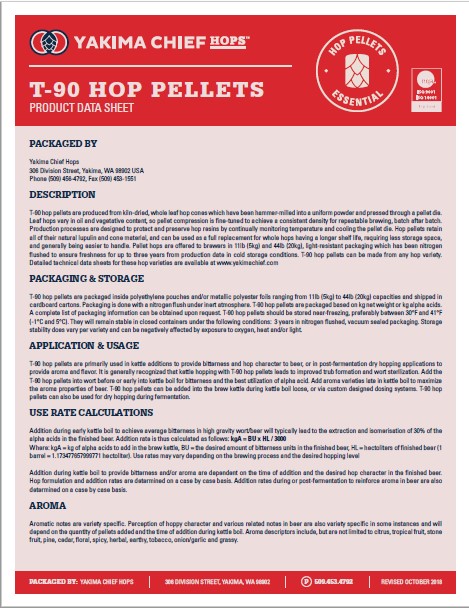

Hops Yakima Chief, T90 Hop Pellets Product data sheet

Hops Yakima Chief, T90 Hop Pellets Product data sheet

-

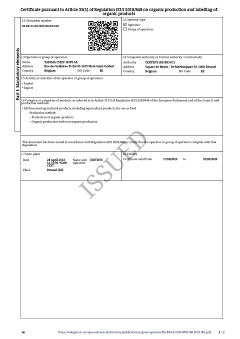

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

-

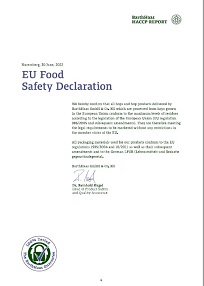

Barth Haas Hops: EU Food Safety Declaration 2022

Barth Haas Hops: EU Food Safety Declaration 2022

Sugerencia

Germany: Craft beer popularity increasing as consumers become more experimental

Germany: Craft beer popularity increasing as consumers become more experimental

Germany’s traditional beer industry is being ‘threatened’ by craft beer as consumers are becoming more experimental with products, claimed GlobalData, a data and analytics company.

“Since 1516, German breweries have maintained focus on the German Purity Law; however, this is set to change with the entrance of the craft beer segment,” said Holly Inglis, Beverages Analyst at GlobalData. She furthered commented on how COVID-19 restrictions affected the hospitality and trade industry, with a reduction in tourism and on-premise closures hindering consumption opportunities.

According to GlobalData, from 2015-2020 Germany’s beer market recorded a compound annual growth rate (CAGR) loss of 1.3 percent, in line with consumers who are both monitoring and reducing their intake of alcoholic beverages.

Germany’s craft market growth has been slow, as research suggests consumers opt for class German beer. Inglis described the craft market as “unique” and “trendy”, and claimed that, “craft beer types have started to gain a stronger presence since 2019, with larger breweries such as Riedenburger and Glaabsbrau innovating in craft production lines, as well as developments from more niche breweries like Brlo.”

According to GlobalData’s latest survey, 19 percent of German consumers sometimes try varieties of alcoholic beverages, refocusing demand for novel products. It must also be outlined that beers with 0.0 percent ABV content are on the rise, presenting an opportunity for manufacturers to capitalise on 0.0 percent ABV craft beer.

In the same survey, 30 percent stated curiosity motivates them to try new beers, while 10 percent highlighted brand trust and transparency. This perhaps suggests that German consumers are experimental, highlighting potential growth for new, craft beer producers.

Inglis claimed that younger generations were more likely to consume craft beer at festivals and bars, rather than traditional beers, which could remain popular in the older community. “Nonetheless, if local brands are able to combine both traditional production processes with craft beers that adopt novel and innovative flavour and packaging solutions, we may see synergy between the two sub-categories.”

Regresar