Tu carrito

Noticias de Empresa

E-Malt news

Kenya: Diageo to sell its stake in East African Breweries to Asahi Group

World: Global hop harvest lower this year, Barth Haas say

USA, NM: Two Bosque Brewing locations in Albuquerque closing their doors

World: Global hop acreage down 5% in 2025

Nuestras maltas

-

CHÂTEAU CARA GOLD NATURE® (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU CARA GOLD NATURE® (MALTA ORGÁNICA)

Añadir al carrito

-

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTA ORGÁNICA)

Añadir al carrito

-

CHÂTEAU CARA HONEY NATURE (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU CARA HONEY NATURE (MALTA ORGÁNICA)

Añadir al carrito

-

MALT CHÂTEAU OAT NATURE® (MALTA ORGANICA DE AVENA)

Añadir al carrito

MALT CHÂTEAU OAT NATURE® (MALTA ORGANICA DE AVENA)

Añadir al carrito

-

CHÂTEAU CARA BLOND NATURE (MALTA ORGÁNICA)

Añadir al carrito

CHÂTEAU CARA BLOND NATURE (MALTA ORGÁNICA)

Añadir al carrito

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

CC26 mm, Rose with silver edge (10500/caja)

Añadir al carrito

CC26 mm, Rose with silver edge (10500/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 1485 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 1485 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

-

Kegcaps 69 mm, Blancas 86 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Blancas 86 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Rojas 102 Grundey G-type (850/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

World: China�s demand leads to increased world barley trade forecast

World: China�s demand leads to increased world barley trade forecast

China import demand for coarse grains is not limited to corn and sorghum. This month, barley imports are forecast higher, reflecting trade to date. For the first 7 months in 2020/21 (Oct-Sep), imports totalled 7.0 million tonnes, well above previous years’ levels, USDA said in their June report.

Imported barley, mainly from Canada, the European Union, and Ukraine, has been used in the domestic beer industry and as a substitute for corn in feed rations, particularly in the southern region. Barley imports are not subject to a tariff-rate quota and are therefore administratively less burdensome.

With greater demand from China, global barley imports are forecast higher for both 2020/21 and 2021/22 from last month. While the antidumping and countervailing duties on barley from Australia remain in place, China has been successful in securing alternative sources for barley. Meanwhile, barley from Australia has found new markets around the world, primarily in Southeast Asia, the Middle East, and Mexico. In the Red Sea, ships carrying barley from the European Union and Ukraine to China are crossing paths with ships loaded with Australian barley destined for the Middle East. These trade dynamics are likely to be in place for a few more years due to China’s 5-year action on barley from Australia.

Regresar

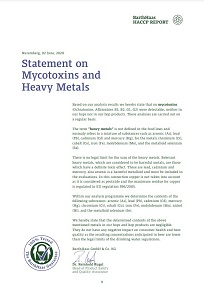

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

Barth Haas Hops: Statement on Mycotoxins and Heavy metals 2022

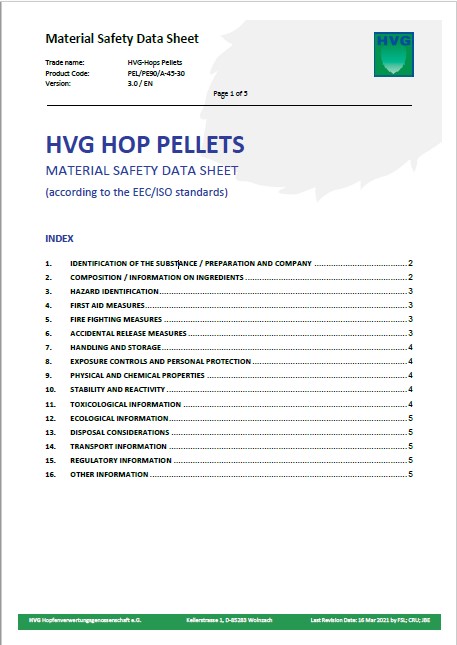

Hops, HVG, Material Safety Data Sheet 2023

Hops, HVG, Material Safety Data Sheet 2023

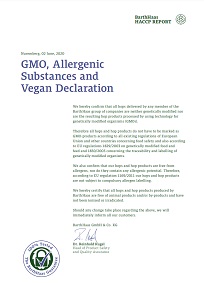

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Malt GMO-Free Certificate 2025

Malt GMO-Free Certificate 2025

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027