Tu carrito

Noticias de Empresa

E-Malt news

India: Pernod Ricard retains position as India�s largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Black 91 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

Kegcaps 69 mm, Azules 141 Grundey G-type (850/caja)

Añadir al carrito

-

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

Kegcaps 64 mm, Rojas 150 Sankey S-type (EU) (1000/caja)

Añadir al carrito

-

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

CC29mm TFS-PVC Free, Azules without oxygen scav.(7500/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

-

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

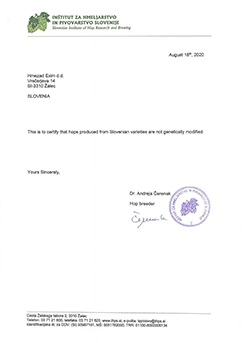

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

-

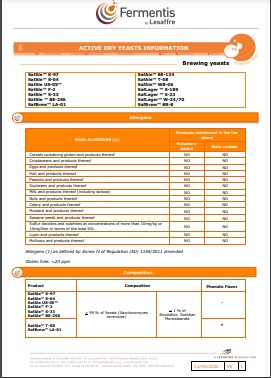

Fermentis - Brewing Yeasts Information 2023

Fermentis - Brewing Yeasts Information 2023

-

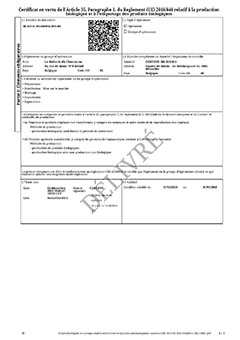

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Certificat BIO FR: Malt, Houblon, Sucre - décembre 2023- mars 2026

Sugerencia

South Korea: Beer and liquor companies perform poorly in 2020 because of pandemic

South Korea: Beer and liquor companies perform poorly in 2020 because of pandemic

Liquor companies in South Korea performed poorly in 2020 as people consumed less alcohol due to the coronavirus outbreak, the Yonhap News reported on April 14.

Lotte Chilsung Beverage Co., a major maker of beer and soju, a Korean distilled liquor, saw its sales shrink 7.7 percent on-year to 2.16 trillion won (US$1.92 billion) last year, according to the data from the Financial Supervisory Service.

Lotte Chilsung, also the country's leading beverage manufacturer, reported an operating income of 97.2 billion won in 2020, down 10.8 percent from the previous year.

Sales of Oriental Brewery (OB) Co., South Korea's largest brewer, sank 12.3 percent on-year to 1.35 trillion won last year, with its operating profit plunging 28 percent to 294.5 billion won.

Whisky companies took a bigger hit from the coronavirus pandemic that forced bars to cut operating hours and suspend operations frequently.

Homegrown whisky maker Golden Blue saw sales tumbling 24.8 percent on-year to 127 billion won last year, with its operating income falling 5.2 percent to 20.2 billion won.

Sales of Diageo Korea Co., the South Korean unit of British alcoholic beverage company Diageo Plc, plummeted 32.6 percent on-year to some 200 billion won, with its operating income nose-diving about 60 percent to 20 billion won.

Pernod Ricard Korea also saw its turnover fall 11.7 percent on-year to 91.5 billion won, but it swung to an operating profit of 16.1 billion won.

Makers of soju were no exception with their sales declining at a double-digit rate last year.

Major liquor maker Hite Jinro Co. was the only industry player that shined thanks to the popularity of new products. Hite Jinro's sales jumped 12 percent on-year to 2.05 trillion won last year, with its operating income spiking 125.2 percent to 180.8 billion won.

Regresar