Uw winkelwagen

Bedrijfsnieuws

E-Malt news

India: Pernod Ricard retains position as India�s largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Onze mouten

Onze hoppen

New Hops

Onze gisten

Onze kruiden

Onze suikers

Onze kroonkurken

-

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

-

Crown Caps 26mm TFS-PVC Free, Gold col. 2311 (10000/box)

Toevoegen aan kar

Crown Caps 26mm TFS-PVC Free, Gold col. 2311 (10000/box)

Toevoegen aan kar

-

Kegcaps 64 mm, Brown 153 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

Kegcaps 64 mm, Brown 153 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

-

Kegcaps 64 mm, Brown 118 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

Kegcaps 64 mm, Brown 118 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

-

Kegcaps 64 mm, Goud 116 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

Kegcaps 64 mm, Goud 116 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

Bier Recepten

Certificaten

Suggestie

Ghana: Alcoholic drinks sector generates approximately 2.24 billion US dollars in revenue in 2025

Ghana: Alcoholic drinks sector generates approximately 2.24 billion US dollars in revenue in 2025

Ghana’s alcoholic drinks sector generated approximately 2.24 billion US dollars in combined revenue during 2025, establishing itself as a crucial component of the nation’s beverage industry. At-home consumption accounted for roughly 2.01 billion dollars, while out-of-home sales contributed about 223 million dollars, according to Statista market outlook data.

The figures reflect a strengthening domestic market driven by a rising middle class, steady economic growth, and enduring cultural drinking traditions. Consumer interest in premium offerings and craft beverages continues to expand, alongside a notable shift toward healthier low-alcohol and non-alcohol alternatives.

However, this domestic resilience stands in stark contrast to global trends affecting the alcohol industry worldwide. Recent market data reveals that shares of the world’s leading beer, wine, and spirits makers have lost a combined 830 billion US dollars in market value over just four years, Bloomberg reported in November 2025. The unprecedented downturn reflects profound shifts in consumer habits, rising health awareness, and evolving lifestyle priorities among younger generations who increasingly choose moderation or abstention.

The global beverage alcohol market faced additional pressure in 2025. IWSR (International Wine and Spirits Record), a leading analytics firm, revised its forecast in November to project a 0.4 percent volume decline globally for the year, down from an earlier estimate of 0.2 percent. Value terms showed an even steeper drop of 0.7 percent year-on-year, primarily linked to the beer category, which fell 0.2 percent globally after previously being forecast for modest growth.

Global spirits volumes were expected to fall 1.3 percent in 2025, while wine was projected to decline 2.4 percent. Ready-to-drink beverages remained the bright spot, with global volumes forecast to grow 1.3 percent, having posted a three percent increase in the first half of 2025 across 20 key markets.

Ghana’s alcohol market faces both risks and opportunities amid these global shifts. While domestic demand remains resilient, younger Ghanaian consumers are increasingly influenced by global trends toward moderation and health-conscious lifestyles. Research published in BMC Public Health in May 2025 found that substance use among adolescents in Ghana showed distinct patterns linked to social and familial influences, with alcohol being the most commonly used substance among students surveyed.

A growing preference for reduced alcohol consumption among youth could slow volume growth, particularly in categories such as beer and spirits that are highly sensitive to generational changes. Industry analysts note that health consciousness, once a fringe trend, is now reshaping global demand fundamentally.

The global pivot toward low-alcohol and non-alcoholic beverages offers a blueprint for innovation within Ghana. Local firms can capitalize on this trend by introducing healthier drink options, investing in craft and premium lines, and leveraging the country’s rich heritage of indigenous beverages. Palm wine, a traditional alcoholic beverage obtained through natural fermentation of palm sap, has been consumed for generations in Ghanaian communities and could be marketed alongside modern craft alternatives.

Ghana’s alcoholic drinks industry experienced significant developments in 2024, according to a Euromonitor report. Despite macroeconomic challenges including 20 percent average inflation and Ghanaian cedi depreciation exceeding 20 percent against the US dollar, the industry continued to grow in both volume and value terms. These currency fluctuations contributed to price increases between 25 and 30 percent for many alcoholic products during the year.

Beer remained the dominant category within Ghana’s alcoholic drinks sector in 2024, with its popularity stemming largely from affordability compared to wine and whiskey. Widespread consumption in informal bars, local pubs, and restaurants underscores the category’s embedded role in Ghanaian social life.

Industry projections remain optimistic for Ghana despite global headwinds. Alcoholic beverages revenues are expected to increase at 13 percent annually through 2026, according to Research and Markets data. This growth rate significantly outpaces the global market, which faces flat or negative growth in most developed economies.

Domestic production holds a significant share of Ghana’s beverage sector, with notable players including Guinness Ghana Breweries, Kasapreko Company, Accra Breweries, and GIHOC Distilleries. Further investment in brand development, quality improvements, and supportive regulatory frameworks could strengthen competitiveness.

Collaboration with tourism and hospitality sectors to showcase Ghana’s indigenous drinks may help fortify the industry against global headwinds. The juxtaposition of Ghana’s growing market with worldwide struggles illustrates a sector in transition. To mitigate risks associated with declining traditional alcohol consumption globally, Ghanaian companies must proactively diversify offerings, strengthen consumer engagement across demographics, and align product development with evolving tastes and health preferences.

The Liquor Licensing Act of 1970 establishes an age limit of 18 or older for alcohol consumption in Ghana. The government has also established the National Alcohol Policy and the Narcotics Control Board to regulate alcohol usage and fight underage drinking nationwide. Enforcement challenges persist, particularly in rural areas where studies have documented that neighborhood bars often allow children to enter freely and purchase alcohol without restrictions.

As Ghana’s alcohol sector navigates these complex dynamics, strategic adaptation will prove essential. The ability to balance traditional market strengths with innovative responses to changing consumer preferences will likely determine whether domestic producers can sustain growth trajectories that diverge from troubled global patterns.

Back

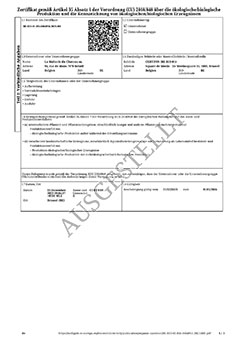

Bio-Zertifikat DE - Dezember 2023-März 2026

Bio-Zertifikat DE - Dezember 2023-März 2026

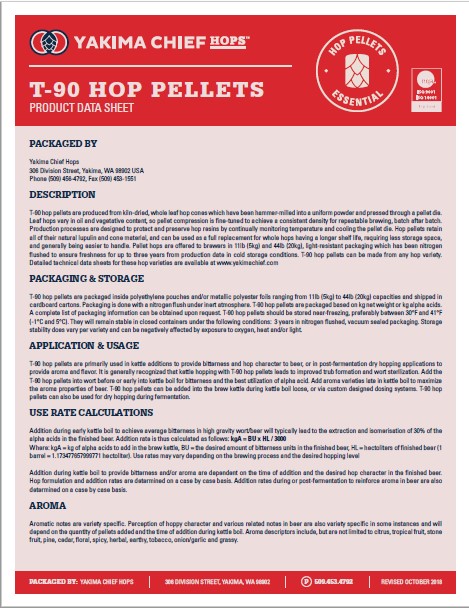

Hops Yakima Chief, T90 Hop Pellets Product data sheet

Hops Yakima Chief, T90 Hop Pellets Product data sheet

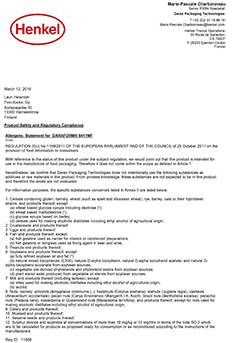

Crown Caps Finnkorkki Product Safety & Regulatory Compliance

Crown Caps Finnkorkki Product Safety & Regulatory Compliance

Malt GMO-Free Certificate 2025

Malt GMO-Free Certificate 2025

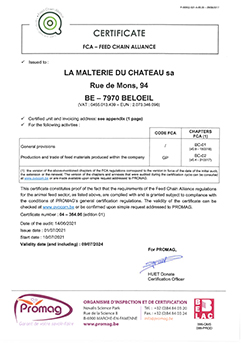

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)

La Malterie du Chateau| FCA Malt Certificate 2022 (English) (2021-2024)