Uw winkelwagen

Bedrijfsnieuws

E-Malt news

UK & South Korea: New UK-South Korea deal to benefit exports of Guinness, cars, Scottish salmon

UK: UK brewers facing �heavy headwinds� from increased taxation, other issues

Japan: Kirin set to ramp up beer development via proprietary AI

Norway & Sweden: Olvi Group acquires majority share in Brewery International group

Onze mouten

Onze hoppen

New Hops

Onze gisten

Onze kruiden

Onze suikers

Onze kroonkurken

-

CC26 mm, Rose with silver edge (10500/box)

Toevoegen aan kar

CC26 mm, Rose with silver edge (10500/box)

Toevoegen aan kar

-

Kegcaps 64 mm, Red 1485 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

Kegcaps 64 mm, Red 1485 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

-

Kroonkurken 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/box)

Toevoegen aan kar

Kroonkurken 26mm TFS-PVC Free, Gold Neu Matt col. 2981 (10000/box)

Toevoegen aan kar

-

Kegcaps 69 mm, Zwarten 91 Grundey G-type (850/box)

Toevoegen aan kar

Kegcaps 69 mm, Zwarten 91 Grundey G-type (850/box)

Toevoegen aan kar

-

Kegcaps 64 mm, Brown 118 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

Kegcaps 64 mm, Brown 118 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

Bier Recepten

Certificaten

Suggestie

UK: UK brewers facing �heavy headwinds� from increased taxation, other issues

UK: UK brewers facing �heavy headwinds� from increased taxation, other issues

According to the Society of Independent Brewers & Associates (SIBA) Independent Beer Report 2025, demand for independent beer remains strong, however UK brewers are facing “heavy headwinds” from increased taxation, market access restrictions and reduced alcohol consumption. Despite average production climbing 10% last year, the report found that “nearly half (46%) of independent brewers say their main priority is survival and almost a third (29%) expect turnover to fall”, Drinks International reported on December 16.

Polling from Survation for the UK Spirits Alliance, reported by LBC, revealed that nearly three in 10 pubs “fear they may not survive another year if costs increase – equivalent to around 11,000 venues across the UK”. With independent breweries relying heavily on pubs to survive, this mass closure could be detrimental to independent brewing in the UK.

“The fall of 100 brewers in 2024 highlights that, while demand might be strong, making sustainable profit is a challenge,” says the SIBA report. “As well as running over 2,000 pubs, bars and taprooms, around 80% of indie brewer sales are to the on-trade, so we await the impact of the budgeted tax hikes and note that most brewers are not looking to invest in their brewery in 2025.”

Amélie Tassin, founder of Women in Beer, adds that the current climate for beer in the UK is “quite tricky”, saying: “Craft breweries don’t have a lot of money, it’s a very difficult time financially. They are having to be mindful about what they release and about their consumer’s needs. More people are also being mindful about consumption, partly due to financial difficulties, so it’s more difficult for them to spend money on leisure and that includes going to the pub.

“The brewing industry in the UK is a fantastic culture that should be protected and not massively taxed. It’s a shame to see that because more and more breweries and pubs will close if they keep taxing the industry as much as they do. It would be devastating if the UK were to lose one of its strengths and something they should promote widely abroad. I’m from France where people are proud of the wine industry and the government is protecting that and protecting the producers. Hopefully we’ll have the support of the government on protecting small breweries that shape the identity of the UK,” Tassin continues.

While potential rises in taxation threaten the beer industry, breweries are forced to bear the brunt of the additional costs. Based in Hebden Bridge, West Yorkshire, Vocation Brewery produces over 10 million pints a year, selling in the UK and abroad at a range of retailers. Gail Lumsden, chair and chief executive of Vocation Group, notes the overall tax and labour cost burden remains “significant”, particularly for smaller producers. “As a result, many are exiting the market, while others are cutting costs, driving efficiencies, raising prices where possible and putting investment plans on hold. Ultimately, it’s those with strong balance sheets who are able to keep investing and building their brands that will be best placed to survive.”

Based in Beckenham, London, Br3wery director & founder Cadú Gomes, adds: “The most challenging thing for us is the cost of going out. In our case, we produce and sell directly to consumers, then offset costs in other areas so we don’t put our prices up. But those relying on different revenue streams, such as selling to big supermarkets, will be contracted into pricing so they’re stuck absorbing the extra costs.

“It’s a bit harsh to say, but I believe craft beer is dead because everybody says they are craft now. It’s beer with a community focus, that’s what it should be. There are some brands that started small but then they grew too much and couldn’t cope with the costs of everything. Because our model is selling directly to consumers, we want to open a third bar so we can produce more. Yes we will pay more overall but then we’ll sell more, all without increasing our prices and trying to offset it in operational costs. We send our beers to our bars and it’s sold pretty much straight away, it’s a healthy model for this type of business and industry,” Gomes continues.

Over in Finchampstead, Berkshire, Andy Parker, managing director of Elusive Brewing, adds: “We know that people do want to drink independent beer, and I think we’ve seen that was an emergence from the pandemic, that people really supported local business and wanted to be drinking local products.”

Brewing around a quarter of a million pints a year, Elusive is partly reliant on local pubs to reach consumers, which comes with its own set of challenges.

“Of 30 pubs in the local area, we can only access three or four of them. Business rates and VAT are a massive challenge, and the NOA increase, we’re a small business and we felt an impact from that,” Parker continues. “We’re at capacity as a small business, we produce what we can sell effectively. So anything that’s going to continue to pile on to pubs and hurt them will hurt us because we won’t produce beer if we can’t sell it. It’s a short shelf-life product that needs to move out, so we’re waiting and hoping the budget is favourable for us.”

For Elusive, Parker notes for the future of independent breweries, it’s up to them to differentiate themselves from ʻcraft ’ brands that are now produced on a large scale. “We need to carve out our own niche again.” The SIBA report also found that consumers' perception of indie beer is that it has a roughly “30% share of the UK beer market, roughly the same share of sales when global and independent beers freely coexist on the bar. Independent beers currently have less than a 10% share of the UK beer market”. Therefore changing consumer perception is crucial to the success of the sector, making sure those who want to drink local, are truly drinking local.

While breweries hope the UK government will provide them with some relief when it comes to increased costs, breweries are finding ways to mitigate the expenses. Tassin adds: “We’re seeing a growth in the production of no and low alcohol beer, which is a response to the trends of drinking less and being more mindful, but also because breweries will be taxed less on beer under 3.4% abv. But it's a short term solution, the bigger breweries like Heineken will have no problem producing this kind of beer but it’s more expensive for small breweries.”

As predicted, Heineken UK has recently announced it will be cutting the strength of Foster’s from 3.7% abv to 3.4%. According to a BBC report, the move would make the lager “eligible for lower rates of alcohol duty” and is set to come into effect in February 2026.

According to the SIBA report, 15% of brewers are producing non-alcoholic beer, an increase from 8%. Also noticing the shift, Br3wery saw its alcohol free beers rise by 25%. “There is a pattern of drinking less but a higher rotation, so people having one pint then leaving, with more customers coming in, rather than people staying for a while and having a few beers. We can also see that before people were buying rounds, and now they’re individually paying. The beer duty is less than half for non-alc compared to regular beers, which is considered 3.5-8%. So I think as a business strategy, selling low abv is a way to pay less tax, but our best sellers are still around 4% and we don’t want to change that,” says Gomes.

Elusive Brewery agrees, noticing a “definite shift towards more low and no”, says Parker. “That’s a huge growth area as people are mindful of what they're drinking. We’ve seen the multinationals move away from real ale in casks, so there’s an opportunity there for us, as small producers, to fill that gap. Overall, we know the number of outlets for our products is decreasing with the closure of pubs, so I think we’ll see more potential direct to consumer type sales and we’re planning to increase our canned beer output.”

What was once a thriving scene in the UK, the craft beer movement is very much slowing. But there’s still potential for salvation, especially with rising demand for lower-abv beers.

Back

La Malterie du Château | FCA Malt Certificate 2022 (Français) (2021-2024)

La Malterie du Château | FCA Malt Certificate 2022 (Français) (2021-2024)

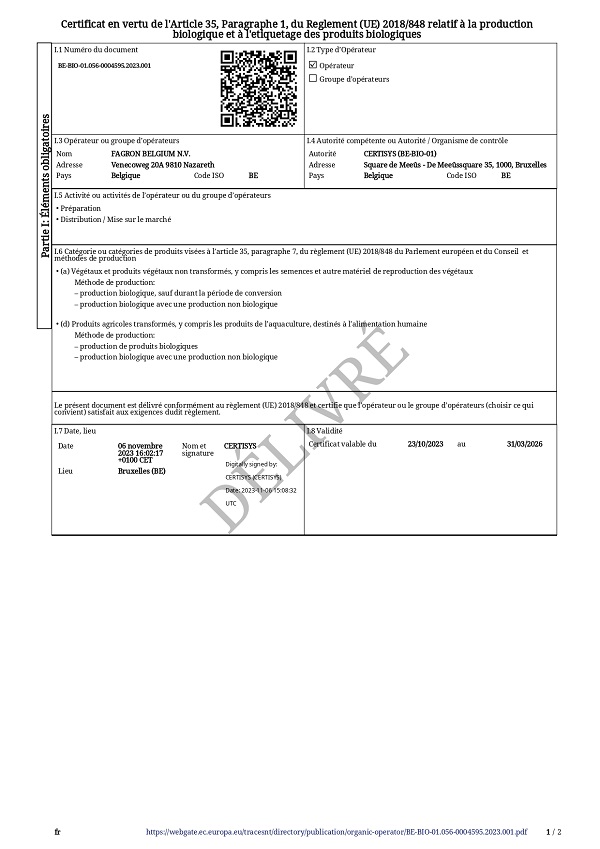

Fagron Spices, Organic Certificate 2023 - 2026

Fagron Spices, Organic Certificate 2023 - 2026

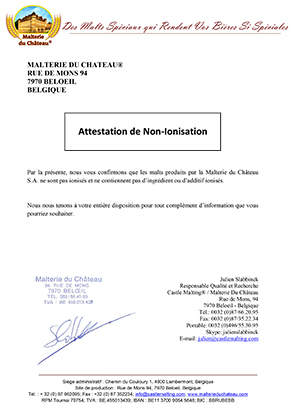

Castle Malting Malt Non Ionization Certificate FR

Castle Malting Malt Non Ionization Certificate FR

Fermentis Yeast Manufacturing Statement 2023

Fermentis Yeast Manufacturing Statement 2023

SAS Biohop Organic certificate 2023-2025

SAS Biohop Organic certificate 2023-2025