Bedrijfsnieuws

E-Malt news

Canada, SK: Black Bridge Brewery partnering with 9 Mile Legacy Brewing, moving production to Saskatoon

USA: Molson Coors planning to acquire more non-alcoholic beer brands

USA: Constellation Brands strategy around Modelo and Corona uraveling under mass deportation push

EU: Barley crop forecast lowered to 55.6 mln tonnes

Onze mouten

Onze hoppen

New Hops

Onze gisten

Onze kruiden

Onze suikers

Onze kroonkurken

-

Crown Caps 26 mm TFS-PVC Free, Yellow col. 2165 (10000/box)

Toevoegen aan kar

Crown Caps 26 mm TFS-PVC Free, Yellow col. 2165 (10000/box)

Toevoegen aan kar

-

Kegcaps 74 mm, Yellow 4 Flatfitting A-type (700/box)

Toevoegen aan kar

Kegcaps 74 mm, Yellow 4 Flatfitting A-type (700/box)

Toevoegen aan kar

-

Kegcaps 64 mm, Zwarten 91 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

Kegcaps 64 mm, Zwarten 91 Sankey S-type (EU) (1000/box)

Toevoegen aan kar

-

Kroonkurken 26mm TFS-PVC Free, Blue Neu col. 20120 (10000/box)

Toevoegen aan kar

Kroonkurken 26mm TFS-PVC Free, Blue Neu col. 20120 (10000/box)

Toevoegen aan kar

-

Kegcaps 74 mm, Blue 141 Flatfitting A-type (700/box)

Toevoegen aan kar

Kegcaps 74 mm, Blue 141 Flatfitting A-type (700/box)

Toevoegen aan kar

Bier Recepten

Certificaten

Suggestie

EU: UBS turns bullish on European brewers

EU: UBS turns bullish on European brewers

UBS shifted its outlook on Europe’s beverage sector, lifting its stance on brewers while turning more cautious on spirits as it reset ratings across major companies, Investing.com reported on December 4.

The brokerage said beer producers are positioned for a recovery in 2026 as volume trends stabilize, while distillers continue to face pressure from weakening demand in the United States and China.

At the center of the changes, UBS upgraded Carlsberg, the Danish brewer, to “buy” from “neutral.”

The brokerage set a price target of DKK 1,060, implying 32% upside from its reference level of DKK 802.

UBS said Carlsberg is positioned to return to sustainable volume growth, supported by its entry into the faster-growing soft-drinks category through Britvic and increased investment in China, where selling expenses rose 14% in the third quarter.

The brokerage’s free-cash-flow estimates for the company are roughly 15% above consensus as capex moderates and revenue synergies emerge.

For AB InBev, the world’s biggest beer company, the brokerage set a price target of €68 and said volumes could return to growth from the second quarter of 2026 as conditions in Brazil and China improve.

UBS expects the company can sustain 1-1.5% annual volume growth, supporting about 13% EPS CAGR, and added that AB InBev’s existing $6 billion two-year buyback could rise to $10-11 billion if excess cash were fully returned.

For Heineken, the Dutch brewer, UBS maintained a “buy” rating with a €84 target, saying volume growth could resume in the first quarter of 2026.

The brokerage cited easier retail comparisons in Europe, improving demand in Mexico and Brazil ahead of the World Cup, strong category growth in Vietnam and India, and share gains in Africa. UBS’s EPS estimates are 5-7% above consensus, helped by consolidation of the FIFCO transaction.

In contrast, the brokerage marked a clear downshift in spirits. UBS downgraded Diageo, the world’s largest distiller, to “neutral” from “buy” and set a price target of £18.5. It said U.S. spirits sell-out trends deteriorated to 9% in September and October, with the company’s Tequila portfolio down 17% as Don Julio loses share in a declining category.

UBS expects Diageo’s North America organic sales to decline to 5% in FY26, below consensus.

The French cognac maker Remy Cointreau was downgraded to “sell,” with a price target of €33.

UBS said U.S. cognac sell-out remains down at 9%, while China faces intensified promotional pressure and potential post-holiday destocking.

The brokerage expects a transition year with muted profit growth and noted the company’s 3x net-debt-to-EBITDA ratio.

UBS kept Pernod Ricard and Campari at “neutral.” For Pernod, the brokerage projected FY26 organic revenue down at 2.6% and noted leverage rising to 3.6x.

For Campari, UBS highlighted weaker U.S. and European trends and the impact of Jamaica’s recent hurricane, though margins should benefit from lower agave costs. Campari’s price target was set at €6.2, while Pernod’s was €75.

In soft drinks, UBS reaffirmed “buy” on Coca-Cola Europacific Partners, citing strong energy-drink growth and consistent execution. It set a $105 target and pointed to combined dividends and buybacks exceeding 6% of market cap.

UBS said the sector trades at a wide valuation discount, with brewers positioned to benefit first as cyclical pressures ease, while structural challenges continue to weigh on spirits.

Back

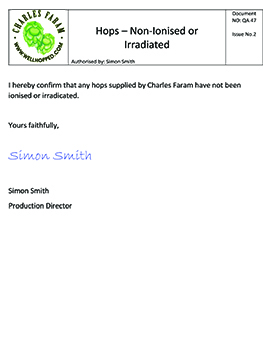

ChF Hops Non-Ionization and Non-Irradiation Certificate

ChF Hops Non-Ionization and Non-Irradiation Certificate

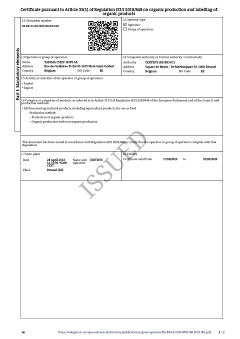

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

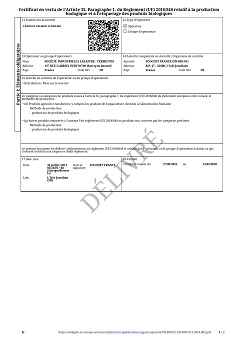

Fermentis - Certificate ECOCERT Bio production et produits 2022-2026

Fermentis - Certificate ECOCERT Bio production et produits 2022-2026

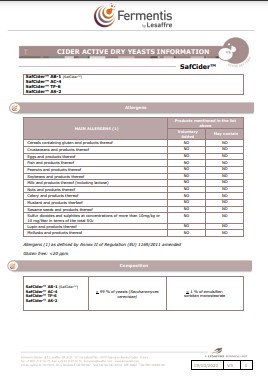

Fermentis - Cider Dry Yeast Information 2023

Fermentis - Cider Dry Yeast Information 2023

Crown Caps Finnkorkki REACH Statement

Crown Caps Finnkorkki REACH Statement