Ваша корзина

Новости компании

E-Malt news

Australia: Barley harvest almost complete and likely to reach 15.8 mln tonnes

Canada: Barley exports see a slight slowdown

EU: Barley production forecast to decline by 8.3% in 2026/27

USA, IA: 515 Brewing Co. to shut down for good after 12 years in business

Наш солод

Наш хмель

Новый хмель

Наши дрожжи

Наши специи

Наш сахар

Наши крышки

-

Крышки 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/коробка)

Добавить в корзину

Крышки 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/коробка)

Добавить в корзину

-

Crown Caps 26 mm TFS-PVC Free, Черные col. 2217 Beer Season (10000/коробка)*

Добавить в корзину

Crown Caps 26 mm TFS-PVC Free, Черные col. 2217 Beer Season (10000/коробка)*

Добавить в корзину

-

Крышки для кег 64мм, Коричневые 153 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

Крышки для кег 64мм, Коричневые 153 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

-

Крышки для кег 64мм, Красные 102 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

Крышки для кег 64мм, Красные 102 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

-

Крышки для кег 64мм, Черные 91 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

Крышки для кег 64мм, Черные 91 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

Рецепты пива

Сертификаты

Предложения по поиску

World: AB InBev reports surprise rise in sales but earnings decline in Q3

World: AB InBev reports surprise rise in sales but earnings decline in Q3

Anheuser-Busch InBev, the world's largest brewer, scrapped its interim dividend and said quarterly profits dipped as the shift to drinking at home pushed up its costs.

The maker of Budweiser, Stella Artois and Corona lagers enjoyed a surprise rise in sales but earnings declined slightly after the pandemic forced consumers to shift from drinking out to buying more of their beer in stores.

This pushes up costs because AB InBev needs to produce and ship more packaging and single-use cans and bottles and fewer of the cheaper kegs and returnable glass bottles used in bars and restaurants.

The world's second largest brewer Heineken AS said on October 28 it faced a similar cost issue.

AB InBev gave no specific financial guidance for 2020, but expects the second half of the year to be better than the first, albeit with considerable uncertainty due to the pandemic.

Overall beer and soft drink volumes rose by 1.9% in the June-September quarter after a 17% slide in the second quarter to drive revenue up 4.0%, against consensus expectations of a 4% decline.

AB InBev shares were trading up 1.6% at 0925 GMT, with its largest markets recovering and showing no imminent signs of lockdowns.

Unlike rival Heineken, only a small percentage of the company’s business is in Europe, where COVID-19 restrictions are tightening most.

AB InBev’s clear outperformer was Brazil, the company’s second biggest market, where beer sales shot up 25% from a year earlier with government subsidies propping up consumer demand for its premium and new beers.

Volumes and profits also grew in its largest market, the United States, as its Michelob Ultra lager and hard seltzers offset a decline of mainstream brands to increase its share of national beer sales.

The Belgium-based company also reported growth in Mexico, Europe and China, but suffered declines in Colombia, where stay-at-home restrictions only eased in August, and South Africa, where alcohol sales were banned for a month.

Still, earnings before interest, tax, depreciation and amortisation only dipped by 0.8%, a far milder decline than the average forecast of a 9.3% drop in a company-compiled poll. EBITDA fell by a third in the second quarter.

The company said uncertainty and market volatility meant it would not pay an interim dividend this year after a payout of 0.80 euros per share in 2019.

Earlier this year, it also halved its final dividend for 2019 to 0.50 euros.

Обратно

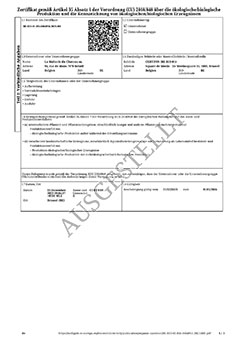

Bio-Zertifikat DE - Dezember 2023-März 2026

Bio-Zertifikat DE - Dezember 2023-März 2026

Malt GMO-Free Certificate 2025

Malt GMO-Free Certificate 2025

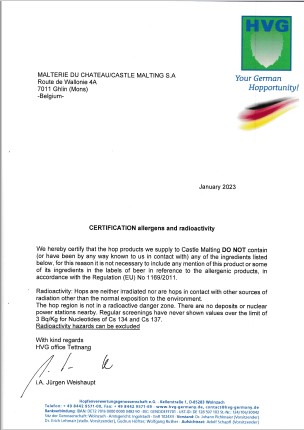

HVG Hops Certification allergens and radioactivity 2022

HVG Hops Certification allergens and radioactivity 2022

Certificate Bio Cambie Hop VOF 2024-2025

Certificate Bio Cambie Hop VOF 2024-2025