Seu carrinho

Novidades da empresa

E-Malt news

Kenya: Diageo to sell its stake in East African Breweries to Asahi Group

World: Global hop harvest lower this year, Barth Haas say

USA, NM: Two Bosque Brewing locations in Albuquerque closing their doors

World: Global hop acreage down 5% in 2025

Nossos maltes

Nossos lúpulos

New Hops

Nossos fermentos

Nossas especiarias

Nossos candy sugars

Nossas tampinhas

-

Kegcaps 64 mm, Gold 116 Sankey S-type (EU) (1000/caixa)

Adicionar

Kegcaps 64 mm, Gold 116 Sankey S-type (EU) (1000/caixa)

Adicionar

-

Kegcaps 64 mm, Vermelhas 56 Sankey S-type (EU) (1000/caixa)

Adicionar

Kegcaps 64 mm, Vermelhas 56 Sankey S-type (EU) (1000/caixa)

Adicionar

-

Tampas de garrafa 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/caixa)

Adicionar

Tampas de garrafa 26mm TFS-PVC Free, Reflex Blue col. 2203 (10000/caixa)

Adicionar

-

Kegcaps 74 mm, Azuis 141 Flatfitting A-type (700/caixa)

Adicionar

Kegcaps 74 mm, Azuis 141 Flatfitting A-type (700/caixa)

Adicionar

-

Kegcaps 69 mm, Verdes 147 Grundey G-type (850/caixa)

Adicionar

Kegcaps 69 mm, Verdes 147 Grundey G-type (850/caixa)

Adicionar

Receitas de cerveja e uísque

Certificados

Sugestão

World: Global hop acreage down 5% in 2025

World: Global hop acreage down 5% in 2025

The persistent weakness in the global hop market remained evident following the 2024 harvest. Spot market prices were well below production costs, and forward contract prices fell to levels last seen a decade ago. These unsustainable prices prompted further acreage reductions, including in Germany, Hopsteiner said in their annual Guidelines for Hop Buying report.

Global acreage for the 2025 harvest declined nearly 5% to approximately 53,000 hectares, which is 10,500 hectares (–16%) below the peak level of 2021. Because of continued declines in beer consumption, 2025 crop spot prices were very low, which in turn put downward pressure on the future market. Clearly, the acreage reductions were not enough. Additional reductions are expected ahead of the 2026 harvest.

In Germany, the reduction of acreage has gained significant momentum. For the 2025 harvest, 1,327 hectares (–6.5%) were removed from production. The varieties most affected include Hallertauer Tradition, Perle, Hallertau Magnum and, for the first time, Herkules. This decline is reminiscent of 2012, when a similarly large acreage drop occurred. Although acreage has returned to near 2016 levels, it remains around 12% above the previous low point of 2013, prior to the craft beer boom that triggered a sharp expansion.

Other European growing regions saw only minor adjustments for 2025 – in some cases despite inventories of unsold spot hops. The 2025 growing conditions in Europe were initially characterized by moderate temperatures and well below-average rainfall. Adequate precipitation did not occur until mid-July, ultimately resulting in a good harvest.

In the U.S., 1,135 hectares were removed from production in 2025 – consisting of high-alpha and aroma varieties. Water supply remained sufficient, although restrictions were imposed due to limited winter accumulation. Despite four consecutive years of acreage reductions, the overall market has not yet stabilized.

Variety-specific adjustments and the return of beer consumption to growth remain critical market factors. Acreage reduction will reduce the supply of spot hops that create inventory and have no market upside. Given that there is also a reduction of forward contract volumes, it is more important than ever to reduce market speculation and avoid spot volumes taking on a large portion of the market. Future contracts are the hedge mechanism that allows all market participants to plan ahead, invest sensibly in their infrastructure, and focus on quality and sustainability. This is a clear choice when the alternative is to face unknown risks that have proven to have a much greater likelihood of a negative rather than positive outcome. In addition, the parallel priority needs to be shipping and invoicing the backlog of contracted but undelivered inventory.

Unfortunately, beer consumption declined again in 2025, with some countries recording decreases of 5–10%. According to forecasts, global beer sales are expected to decline by 3% in 2025. Conversely, the market for non-alcoholic beer continues to grow and now accounts for around 2% of the total market. Consumption has dropped due to inflationary trends that keep consumers from returning to pre-Covid spending patterns. In addition, aging populations and health consciousness have applied pressure on overall alcohol sales. Nevertheless, beer is “the beverage of moderation” and is better positioned than competing alcohol producers to meet these challenges.

The brewing industry is responding to inflation by increasing its efficiency in hop usage and developing alternative beverages, many of which do not contain hops. In the short term, therefore, the market remains challenging for hop producers; prices for overproduced varieties remain well below the cost of production. In addition, rising costs across the value chain, stricter regulatory requirements (such as advertising bans for beer and European taxes for CO2 emissions), and geopolitical risks further constrain the potential growth of beer production. Hopsteiner’s innovation in hop varieties and hop products can help brewers on the cost side while also ensuring that some inflation is accounted for in future pricing.

Acreage reduction is expected to accelerate as pre-contract quotas fall significantly from 2026 onwards. Growing hops without a contract is not recommended in the current market.

A silver lining to this cloud is that the weak market is a good opportunity for changing out varieties that no longer produce consistently for more sustainable, weather- and disease-resilient varieties.

Voltar

Belgosuc Sugar, Certificate, shelf_life_of_products (EN)

Belgosuc Sugar, Certificate, shelf_life_of_products (EN)

ChF Hops GMO-free Certificate

ChF Hops GMO-free Certificate

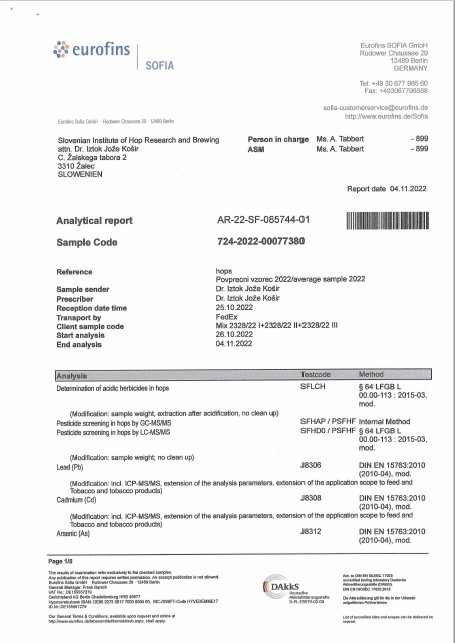

Slovenian hops Pesticide Residues Certificate (Crop 2022)

Slovenian hops Pesticide Residues Certificate (Crop 2022)

Fermentis - Spirit Dry Yeast Information 2023

Fermentis - Spirit Dry Yeast Information 2023

ChF - Hops Kosher Certificate 2022-2023

ChF - Hops Kosher Certificate 2022-2023