Новости компании

E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Наш солод

Наш хмель

Новый хмель

Наши дрожжи

Наши специи

Наш сахар

Наши крышки

-

Крышки для кег 64мм, Черные 91 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

Крышки для кег 64мм, Черные 91 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

-

Крышки для кег 74 мм, Коричневые 154 Flatfitting A-тип (850/коробка)

Добавить в корзину

Крышки для кег 74 мм, Коричневые 154 Flatfitting A-тип (850/коробка)

Добавить в корзину

-

CC26 mm, розовые с серебряной каемкой (10500/коробка)

Добавить в корзину

CC26 mm, розовые с серебряной каемкой (10500/коробка)

Добавить в корзину

-

CC29mm TFS-PVC Free, Белые with oxygen scav.(7000/коробка)

Добавить в корзину

CC29mm TFS-PVC Free, Белые with oxygen scav.(7000/коробка)

Добавить в корзину

-

Крышки для кег 74 мм, Оранжевые 43 Flatfitting A-тип (700/коробка)

Добавить в корзину

Крышки для кег 74 мм, Оранжевые 43 Flatfitting A-тип (700/коробка)

Добавить в корзину

Рецепты пива

Сертификаты

Предложения по поиску

UK: Malting barley premiums remain under pressure in the UK

UK: Malting barley premiums remain under pressure in the UK

The premium of malting barley over the feed barley price in the UK remains under pressure. Corn Returns data in the month of December (the latest available premium price), shows that the spot ex-farm malting barley premium over feed averaged £19.20/t. This is down from November, when the premium averaged £24.60/t, and November last year when it reached £66.70/t. Ample supply of UK malting barley, and relatively weaker demand, are both key factors weighing on the premium this marketing year, AHDB reported on February 27.

Barley usage by the brewing, malting and distilling (BMD) sector totalled 892.7 Kt from July to December 2024 this season, back 7.6 % on the same period last year. Total cereals usage by the BMD sector is forecast to decline this season on year earlier levels. This decline is due to a downturn in demand, and is partly driven by the increase in the cost of living, as well as the longer-term trend of fewer younger people choosing to consume alcohol.

Retail volume sales of beer and lager remained flat during 2024 following challenging declines during 2023 (Kantar 52 w/e 29 December 2024). Higher prices have meant volume growth has been hard in the backdrop of consumers watching their finances. There has also been 4.6% volume growth for non-alcoholic beer during 2024 on the back of rises in 2023.

Mintel reported that moderation of alcohol consumption has grown since 2022 and is set to further increase in the near future.

Spirits volumes sales also continue to dip, with affordability a key consideration for consumers for which finances may remain tight.

Another bearish factor is sluggish export demand. Full season barley exports are forecast by AHDB at 500 Kt, down by 36% from last season. Exports from July to December totalled 257.2 Kt, a 37% drop from last year (HMRC).

For 2025, AHDB’s Early Bird Survey (EBS) of planting intentions, carried out in November, suggested the winter and spring barley areas could fall by 1% and 13% respectively on the year. This could mean that we head into the next marketing year with a smaller domestic crop. However, currently, 2024/25 ending stocks are expected to be well above average, and as such, it’s unlikely supplies will be particularly tight next season. As a result, if demand also remains steady as expected, it’s unlikely we will see much support in premiums over the coming months.

On the other hand, while the barley export pace remains slow, AHDB note a slight uptick in exports recently, and with the majority of the UK barley crop yet to go in the ground, there could be significant change for the harvest 2025 outlook – something to watch out for over the coming months.

Обратно

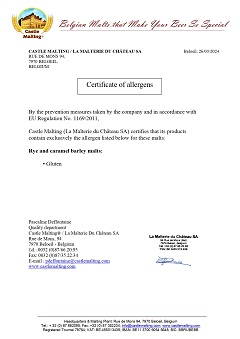

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)

Belgosuc, Sugar, Kosher Certificates 2022-2023 - Belgosuc (English)

Belgosuc, Sugar, Kosher Certificates 2022-2023 - Belgosuc (English)

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

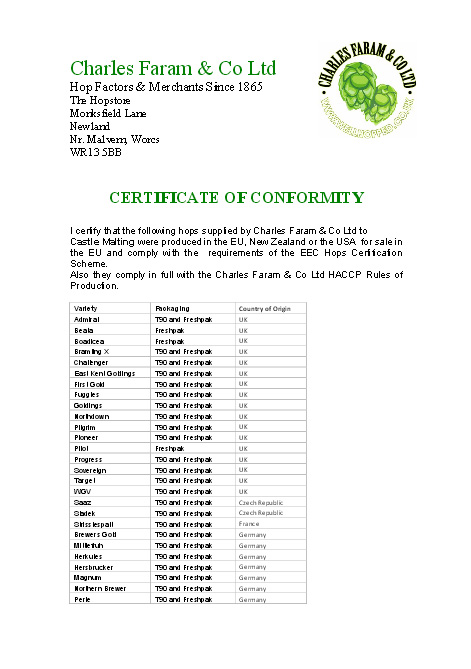

ChF Hops Conformity Certificate

ChF Hops Conformity Certificate

ChF Hops, ISO 14001 Certificate, EN 2023 (oct)

ChF Hops, ISO 14001 Certificate, EN 2023 (oct)