Новости компании

E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Наш солод

Наш хмель

Новый хмель

Наши дрожжи

Наши специи

Наш сахар

Наши крышки

-

Крышки для кег 64мм, Черные 91 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

Крышки для кег 64мм, Черные 91 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

-

Крышки для кег 74 мм, Коричневые 154 Flatfitting A-тип (850/коробка)

Добавить в корзину

Крышки для кег 74 мм, Коричневые 154 Flatfitting A-тип (850/коробка)

Добавить в корзину

-

CC26 mm, розовые с серебряной каемкой (10500/коробка)

Добавить в корзину

CC26 mm, розовые с серебряной каемкой (10500/коробка)

Добавить в корзину

-

CC29mm TFS-PVC Free, Белые with oxygen scav.(7000/коробка)

Добавить в корзину

CC29mm TFS-PVC Free, Белые with oxygen scav.(7000/коробка)

Добавить в корзину

-

Крышки для кег 74 мм, Оранжевые 43 Flatfitting A-тип (700/коробка)

Добавить в корзину

Крышки для кег 74 мм, Оранжевые 43 Flatfitting A-тип (700/коробка)

Добавить в корзину

Рецепты пива

Сертификаты

Предложения по поиску

USA: Bank of America reiterates Buy rating on AB InBev

USA: Bank of America reiterates Buy rating on AB InBev

Bank of America reiterated its Buy rating on Anheuser-Busch InBev ahead of the earnings season, MSN reported on January 14.

The firm pointed to attractive low double-digit midterm EPS growth that is seen being supported by volume growth in emerging markets. The beer giant is also expected to benefit from margin expansion, which could lead to potentially accelerating cash returns going forward.

"This attractive midterm outlook has been overshadowed by recent volume softness in a few markets (China, Argentina, Mexico), which is well understood, in consensus numbers and should improve in 2025," previewed analyst Andrea Pistacci.

In terms of valuation, Anheuser-Busch InBev (BUD) was noted to be trading at a discount to staples peers. The share price decline of BUD due to investor concerns on potential legislation mandating warnings labels on alcoholic drinks was called overdone.

In the U.S., the company's Michelob Ultra label jumped to being the top-selling draft beer over a December tracking period.

Anheuser-Busch InBev has a consensus Buy rating from both Wall Street analysts and Seeking Alpha analysts.

Обратно

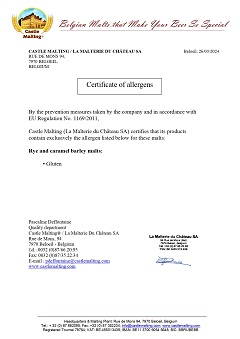

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)

Malt Allergen Certificate for Rye and Caramel Barley Malt (ENG)

Belgosuc, Sugar, Kosher Certificates 2022-2023 - Belgosuc (English)

Belgosuc, Sugar, Kosher Certificates 2022-2023 - Belgosuc (English)

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

La Malterie du Château | FCA Malt Certificate (Français) (2024-2027)

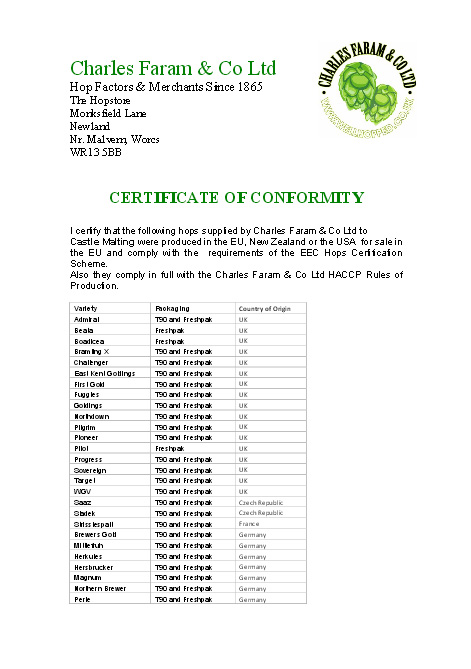

ChF Hops Conformity Certificate

ChF Hops Conformity Certificate

ChF Hops, ISO 14001 Certificate, EN 2023 (oct)

ChF Hops, ISO 14001 Certificate, EN 2023 (oct)