Ваша корзина

Новости компании

E-Malt news

India: Pernod Ricard retains position as India�s largest alcoholic beverage maker by value

China: Tsingtao Brewery focusing on portfolio optimization and channel expansion

USA, MA: Wandering Star Craft Brewery�s time in the Berkshires comes to an end

USA, NY: Fifth Frame Brewing Co. announces abrupt and immediate closure

Наш солод

Наш хмель

Новый хмель

Наши дрожжи

Наши специи

Наш сахар

Наши крышки

-

Крышки для кег 64мм, Коричневые 118 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

Крышки для кег 64мм, Коричневые 118 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

-

Крышки для кег 64мм, Orange 43 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

Крышки для кег 64мм, Orange 43 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

-

Крышки для кег 69 мм, Оранжевые 43 Grundey G-тип (850/коробка)

Добавить в корзину

Крышки для кег 69 мм, Оранжевые 43 Grundey G-тип (850/коробка)

Добавить в корзину

-

Crown Caps 26mm TFS-PVC Dark Green col. 2410 Зеленые (10000/коробка)

Добавить в корзину

Crown Caps 26mm TFS-PVC Dark Green col. 2410 Зеленые (10000/коробка)

Добавить в корзину

-

Крышки для кег 64мм, Коричневые 153 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

Крышки для кег 64мм, Коричневые 153 Sankey S-тип (ЕС) (1000/коробка)

Добавить в корзину

Рецепты пива

Сертификаты

Предложения по поиску

Japan: Asahi aiming at cracking non-alcohol drinks market

Japan: Asahi aiming at cracking non-alcohol drinks market

Asahi wants to crack a market that has proved surprisingly resilient during the coronavirus pandemic: non-alcohol drinks, the Financial Times reported on May 3.

Asahi’s decision followed a $20 bln splurge on beer brands including Peroni, Pilsner Urquell to Carlton Draught in recent years. But a consumer focus on all things “wellness” has been strengthened by Covid-19. Sales of low and non-alcoholic drinks rose during the pandemic even as pub closures have led to a global decline in beer sales.

“Non-alcohol is a good all-around product,” Atsushi Katsuki, Asahi’s chief executive since March, said in an interview. “It helps to resolve social issues, it connects us with new users and it leads to our profitability.”

Low and non-alcohol beer sales have benefited as people spent more on drinks to be consumed at home during lockdowns, suiting Asahi’s broader strategy of focusing on higher-margin “premium” beverages.

The shift has also been supported by pressures in Japan, where beer volumes have fallen for more than two decades and the government has tightened its crackdown on heavy alcohol consumption.

In Europe, sales of Asahi’s non-alcohol brew grew 10 per cent in 2020 compared with the previous year, driven by the popularity of brands such as Birell and Peroni Libera — even as those of beer fell 6 per cent on a volume basis. Asahi has said it wanted to quadruple its ratio of non-alcohol drink sales in Europe by 2030, from 5.1 per cent last year.

The company, which is known in Japan for its flagship Super Dry brand, launched a low-alcohol product called Beery in March, using technology from European drinks it acquired to recreate a beer beverage with reduced alcohol content. It aims to triple its ratio of beverages with 3.5 per cent alcohol or less to 20 per cent of its product mix by 2025.

“This isn’t just about changes in consumption among the young,” said Katsuki. “Until now, we were not able to offer options for different circumstances to address people who can drink but won’t or people who want to drink but can’t.”

The volume of sales of low and no-alcohol drinks is projected to grow 10.7 per cent annually in the US, 6.6 per cent in the UK and 6.5 per cent in Japan between 2020 and 2024, according to drinks analytics group IWSR.

Rivals such as Anheuser-Busch InBev and Heineken have also been building non-alcoholic portfolios. But analysts have taken a wait-and-see stance about how much these products will contribute to earnings, with the low and no-alcohol market accounting for less than 2 per cent of that for intoxicating drinks. Asahi’s operating profit fell a third last year, as it relied heavily on sales at restaurants and pubs.

Katsuki, 61, took over the world’s seventh-largest brewer in a drastically more difficult business environment than the previous five years, when Asahi spent billions scooping up European and Australian assets from AB InBev, including Grolsch and Carlton & United Breweries.

The company has ruled out any big acquisition until 2024, by which time it hopes to have reduced its net debt to three times earnings before interest, tax, depreciation and amortisation, compared with its current level of six times.

“We are discussing internally whether our current portfolio and footprint is sufficient. There is also the question of whether it is OK to just have beer,” Katsuki said.

Обратно

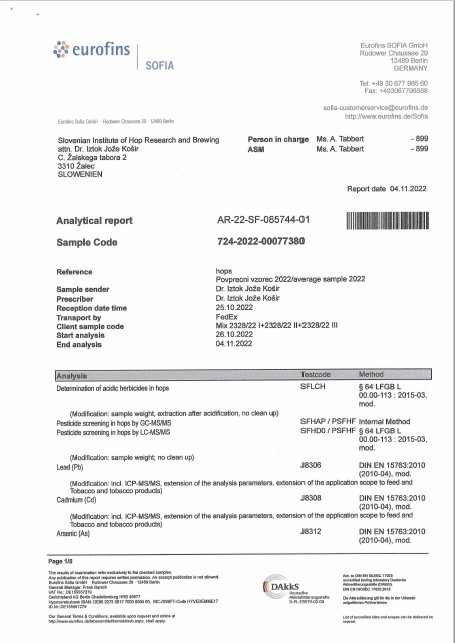

Slovenian hops Pesticide Residues Certificate (Crop 2022)

Slovenian hops Pesticide Residues Certificate (Crop 2022)

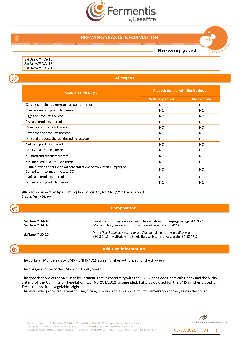

Fermentis - Brewing Yeasts Information ENG - HA-18,_DA-16, LD-20

Fermentis - Brewing Yeasts Information ENG - HA-18,_DA-16, LD-20

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

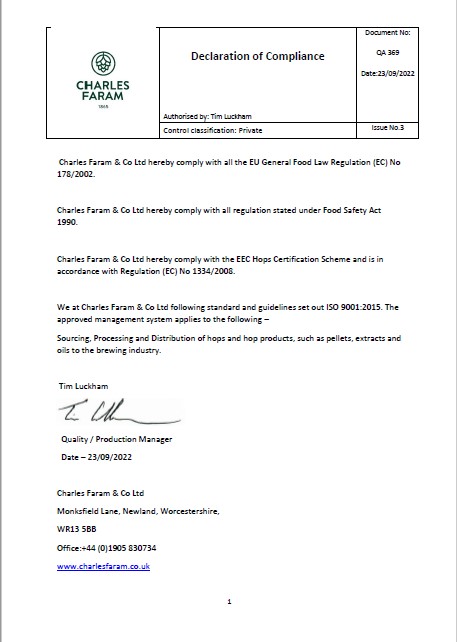

ChF Hops, Declaration of Compliance QA369, EN 2022

ChF Hops, Declaration of Compliance QA369, EN 2022

Fagron Spices, IFSFood Certificate 16089, EN 2024

Fagron Spices, IFSFood Certificate 16089, EN 2024