Notizie Aziendali

E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

I nostri malti

-

CHÂTEAU PEATED

Aggiungi al carrello

CHÂTEAU PEATED

Aggiungi al carrello

-

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

-

CHÂTEAU CARA HONEY NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

CHÂTEAU CARA HONEY NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

-

CHÂTEAU AROME NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

CHÂTEAU AROME NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

-

MALT CHÂTEAU SPELT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

MALT CHÂTEAU SPELT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

I nostri luppoli

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

-

CC29mm TFS-PVC Free, Blu without oxygen scav.(7500/box)

Aggiungi al carrello

CC29mm TFS-PVC Free, Blu without oxygen scav.(7500/box)

Aggiungi al carrello

-

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Ricette per birra

Certificati

Suggerimento

Austria: Stiegl Brewery admits difficult financial situation

Austria: Stiegl Brewery admits difficult financial situation

Herbert Bauer, who took over as managing director of Stiegl Brewery in Salzburg in April after joining from Coca-Cola HBC, has announced a comprehensive restructuring program and hinted at possible job cuts. Speaking to ORF and other media, Bauer admitted that Austria’s largest privately owned brewery is in a difficult financial situation, Inside.Beer reported on October 23.

The brewery, producing nearly 1 million hl annually, has now recorded its third consecutive year of losses, –1.4 million EUR in 2022, –5 million EUR in 2023 and –5.3 million EUR in 2024, despite increasing its turnover from 88.1 million EUR (2023) to 95.4 million EUR (2024). According to ORF, the company accumulated more than 9 million EUR in losses over the past two years alone.

Bauer attributed the ongoing decline mainly to a shift in sales channels: most beer is now sold through retail outlets, where intense price pressure from supermarket chains prevents the same profitability as in gastronomy. The on-trade business, already hit hard by the pandemic, has not yet recovered. Additionally, stagnating demand and overcapacity continue to burden the Austrian beer market.

While the company currently covers losses with reserves from earlier profitable years, Bauer emphasized that Stiegl must adapt structurally. “There will be areas where we may need fewer people than today, but also new fields where we’ll require additional expertise,” he said.

The brewery’s real estate division recently generated liquidity by selling properties — the so-called “Stiegl-Gründe” — for over 75 million EUR, but the core brewing operations remain under pressure. Stiegl, a member of the Freie Brauer association, now plans to focus on efficiency and long-term sustainability to return to profitability.

Torna

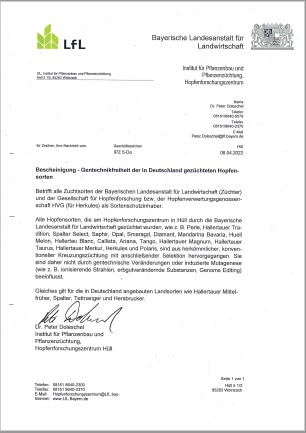

Hops, HVG, non-GMO Certificate 2022, EN

Hops, HVG, non-GMO Certificate 2022, EN

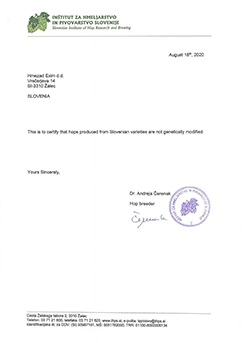

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

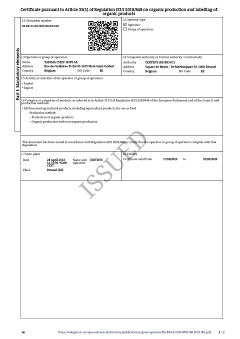

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

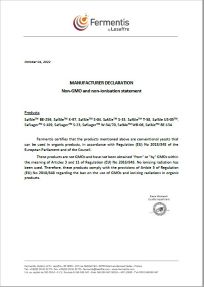

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

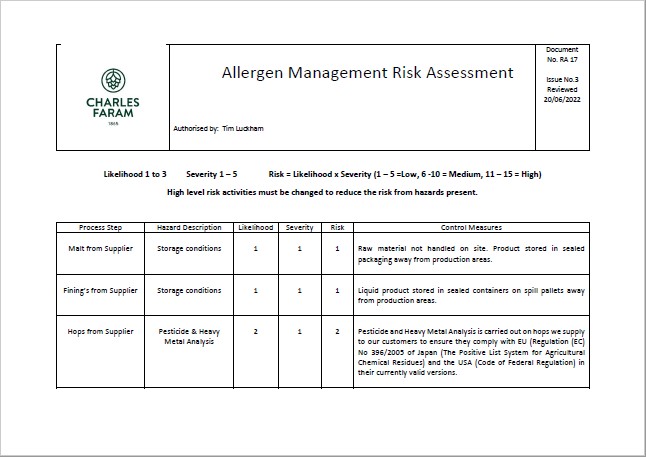

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022