E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Vores malt

Vores humle

New Hops

Vores gær

Vores krydderier

Vores sukker

Vores kapsler

-

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

-

CC29mm TFS-PVC Free, White with oxygen scav.(7000/papkasse)

Tilføj kurv

CC29mm TFS-PVC Free, White with oxygen scav.(7000/papkasse)

Tilføj kurv

-

Kegcaps 64 mm, Gold 116 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

Kegcaps 64 mm, Gold 116 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

-

Kegcaps 64 mm, White 86 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

Kegcaps 64 mm, White 86 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

-

Kegcaps 69 mm, Grøn 147 Grundey G-type (850/papkasse)

Tilføj kurv

Kegcaps 69 mm, Grøn 147 Grundey G-type (850/papkasse)

Tilføj kurv

Certifikater

-

Fagron Spices, IFSFood Certificate 16089, EN 2024

Fagron Spices, IFSFood Certificate 16089, EN 2024

-

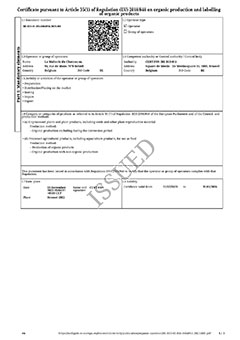

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

-

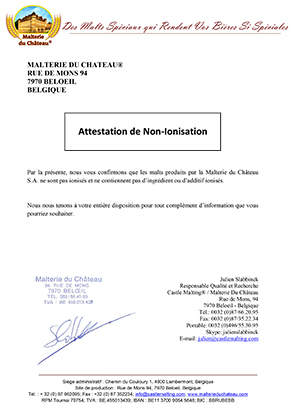

Castle Malting Malt Non Ionization Certificate FR

Castle Malting Malt Non Ionization Certificate FR

-

Hops Hopfenveredlung St.Johann, Certificate ISO 22000:2005 2021-2024

Hops Hopfenveredlung St.Johann, Certificate ISO 22000:2005 2021-2024

-

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Forslag

EU: Barley, soft wheat output forecasts increased by 0.2 and 0.3 mln tonnes, respectively

EU: Barley, soft wheat output forecasts increased by 0.2 and 0.3 mln tonnes, respectively

Expana has raised its monthly grain production forecast for European Union crops for the 2025/26 season, projecting soft wheat output will hit a record high and barley a 17-year high, Reuters reported on October 9.

In its latest cereal forecasts, Expana increased its estimate for EU soft wheat production this season by 0.3 million metric tons from last month's forecast to 136.4 million tons, up 22.8 million tons from the rain-affected 2024/25 crop.

Barley output was also revised 0.2 million tons higher to 56.4 million tons, up 6.2 million tons year-on-year.

For maize, Expana raised its crop estimate by 0.8 million tons to 56.5 million tons, after the harvest turned out slightly better than previously expected, though the crop remains 2.5 million tons below last season and the second lowest since 2007.

As of early October, maize harvesting was well advanced in most European production zones except Poland, where crop development is around a month behind schedule.

"The contrast between a good maize harvest in the northern half of the EU and disastrous results in the southern half looks set to become even more pronounced than it was in 2024/25," Expana said.

Expana continues to expect that EU soft wheat exports will rebound sharply this season, but said the increase looks set to be held in check by fierce competition on international markets, especially from U.S., Australian and Argentinian origins.

"European exports, especially French exports, made a slow start to the new campaign. However, French exports have gained some momentum in recent weeks thanks to the better competitiveness of French wheat," it said.

Tilbage