Noticias de Empresa

E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Tapas 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/caja)

Añadir al carrito

-

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

-

Kegcaps 74 mm, Verdes 147 Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Verdes 147 Flatfitting A-type (700/caja)

Añadir al carrito

-

Kegcaps 74 mm, Doradas 116 Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Doradas 116 Flatfitting A-type (700/caja)

Añadir al carrito

-

Kegcaps 74 mm, Orange 43 Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Orange 43 Flatfitting A-type (700/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

Nigeria: Beer industry asks government to jettison introduction of tax stamp

Nigeria: Beer industry asks government to jettison introduction of tax stamp

Nigeria’s beer industry has requested the Federal Government to jettison the introduction of tax stamp because of its negative consequences for the economy, The Nation Newspaper reported on October 8.

It announced support for the Manufacturers Association of Nigeria (MAN)’s call for the government to rescind the proposal to introduce tax stamps.

The industry called on the Federal Government to sustain existing home-grown digital systems that deliver full visibility of excise operations.

Executive Director, Beer Sectoral Group of MAN, Abiola Laseinde said the tax stamps (digital identifiers also referred to as tack and trace systems) will be counterproductive.

She warned that the system presents operational challenges and financial risks that could undermine the fragile recovery of the manufacturing industry and the Nigerian economy.

She added in a statement that “the tax stamps system is largely inefficient, causing production slowdowns, distribution delays, product stock-outs, and high compliance costs.”

She explained that the industry is concerned that this proposal is coming at a time when operators are already “grappling with rising excise rates, foreign exchange volatility, and high inflation—making the additional burden of implementing tax stamps a serious threat to business sustainability”.

“Tax stamps are often positioned as a solution to illicit trade, would have no benefit to beer as there is zero illicit in the sector. The brewing process is complex, the product is bulky, and resale value is low—making counterfeiting unprofitable. It is also pertinent to note that the beer industry already maintains strict compliance, with digital counters, on-site Customs officers, and auditable records in place.”

The Federal Government has already invested in digital systems that deliver full visibility of excise operations. Most recently, the Nigeria Customs Service (NCS) successfully launched and piloted the B’Odogwu automated Excise Reporting System (ERS), a modern platform that digitizes excise administration. ERS replaces manual registers with an automated process that:

– Tracks production volumes and excise computation in real time

– Enhances compliance monitoring through full transparency

– Creates an auditable digital trail that reduces leakages and inefficiency

Giving alternatives to the government, the beer industry, Laseinde said: “Accordingly, we urge the government to consider the following actions in the national interest:

- Rescind the proposed rollout of tax stamps to avert disruption to production, jobs, and revenues.

- Consolidate and strengthen existing systems like Customs’ ERS and FIRS e-Invoicing, which are effective, transparent, and locally driven.

Regresar

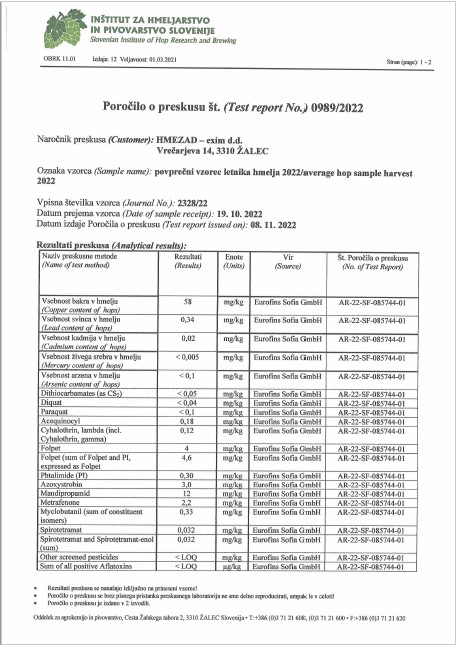

Hmezad Hops, Heavy Metals Certificate 2022

Hmezad Hops, Heavy Metals Certificate 2022

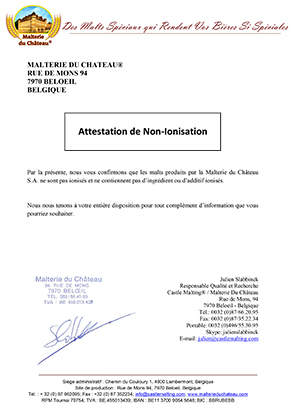

Castle Malting Malt Non Ionization Certificate FR

Castle Malting Malt Non Ionization Certificate FR

Belgosuc Sugar, Certificate, shelf_life_of_products (EN)

Belgosuc Sugar, Certificate, shelf_life_of_products (EN)

Barth Haas Hops: Organic Certificate 2024-2026

Barth Haas Hops: Organic Certificate 2024-2026

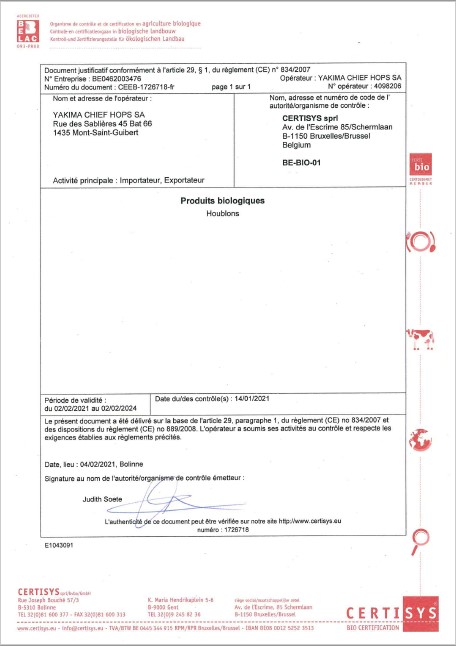

Hops Yakima Chief, Certificate Bio 2021-2024

Hops Yakima Chief, Certificate Bio 2021-2024