Notizie Aziendali

E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

I nostri malti

-

CHÂTEAU PEATED

Aggiungi al carrello

CHÂTEAU PEATED

Aggiungi al carrello

-

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

-

CHÂTEAU CARA HONEY NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

CHÂTEAU CARA HONEY NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

-

CHÂTEAU AROME NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

CHÂTEAU AROME NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

-

MALT CHÂTEAU SPELT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

MALT CHÂTEAU SPELT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

I nostri luppoli

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

-

CC29mm TFS-PVC Free, Blu without oxygen scav.(7500/box)

Aggiungi al carrello

CC29mm TFS-PVC Free, Blu without oxygen scav.(7500/box)

Aggiungi al carrello

-

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Ricette per birra

Certificati

Suggerimento

USA: Constellation Brands navigating a tough beer market this year

USA: Constellation Brands navigating a tough beer market this year

Constellation Brands is navigating a tough beer market as multiple pressures weigh on consumption, Yahoo! Finance reported on October 8.

"The overall industry is a bit suppressed because of the lack of engagement and the lack of consumers going out and drinking and consuming in the way that they normally would," CEO Bill Newlands told Yahoo Finance's Opening Bid.

The company's stock is down nearly 36% year to date. Over the same period, shares of Coors Light maker Molson Coors (TAP) are down 20%, while Bud Light maker Anheuser-Busch's (BUD) stock is up 19%.

Headwinds like consumer caution are major factors. According to a Constellation Brands survey, 80% of consumers are worried about socioeconomic issues, and 70% are concerned about personal finances. Newlands cited healthcare and rent as areas of concern.

"The way that has generally played out, particularly with the Hispanic consumer, is they're going out less," Newlands said. "They're going to bars and restaurants less, and they're having less occasions at home when they would consume our products."

Regional trends compound the challenge. California, Constellation's largest market, has seen subdued construction jobs — traditionally, those workers' high-intensity days often end with a beer.

"When the construction industry is soft, the impact to us is there's less consumption," Newlands said.

During the company's Oct. 7 earnings call, he described the state as "the single biggest problem."

Rebuilding efforts after last year's fires in Los Angeles have been slower than expected due to insurance delays, although activity is expected to pick up over time, he added.

Macro policy pressures are also adding to the strain. Newlands noted that President Trump's immigration policies are affecting demand among Hispanic consumers. Meanwhile, tariffs are increasing production costs.

"We'll have roughly $90 million in annualized cost this year around tariffs," Newlands said. "So, certainly, that's a financial challenge."

Broader demographic and cultural trends aren't helping. US alcohol consumption hit a near-90-year low, with only 54% of adults reporting drinking, according to Gallup. Younger adults are drinking less, a trend influenced by health-conscious lifestyles and changing social habits.

Constellation's second quarter results showed a 15% year-over-year drop in sales. Beer volumes slipped across some of its core brands: Modelo Especial sales fell more than 4%, Corona Extra dropped over 7%, and Modelo Chelada declined roughly 3%. Those losses were partially offset by Pacifico (+14%) and Victoria (+19%).

In wine and spirits, sales plunged 65% year over year, compared to a 12% decline a year ago.

The Rochester, New York-based company also lowered its fiscal 2026 outlook, now expecting net sales to decline 4% to 6%, compared to previous guidance of a 1% increase to a 2% decline.

Evercore ISI analyst Robert Ottenstein noted that, while muted, results were largely in line with expectations. He highlighted that fiscal 2027-2028 guidance does not assume an improvement in Hispanic consumer demand, leaving potential upside if economic conditions ease.

Despite these headwinds, Constellation is doubling down on its core brands. Newlands said the company is returning to the "essence" of Corona's "beach mentality," rather than relying heavily on celebrity endorsements.

"It's difficult to predict when we get back to a sense of normality," he said. "But ... we continue to invest behind our brands."

Torna

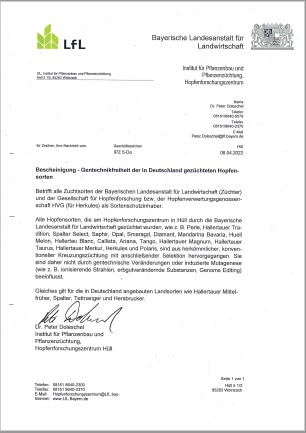

Hops, HVG, non-GMO Certificate 2022, EN

Hops, HVG, non-GMO Certificate 2022, EN

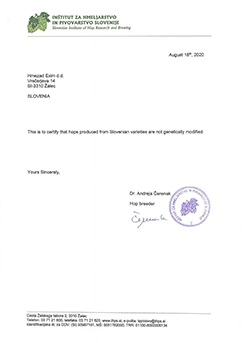

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

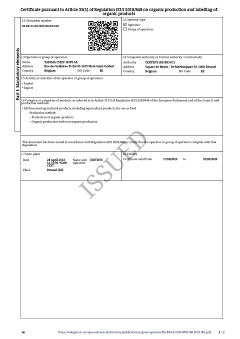

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

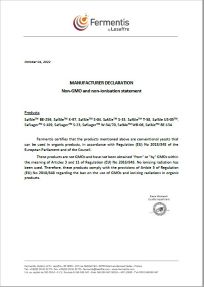

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

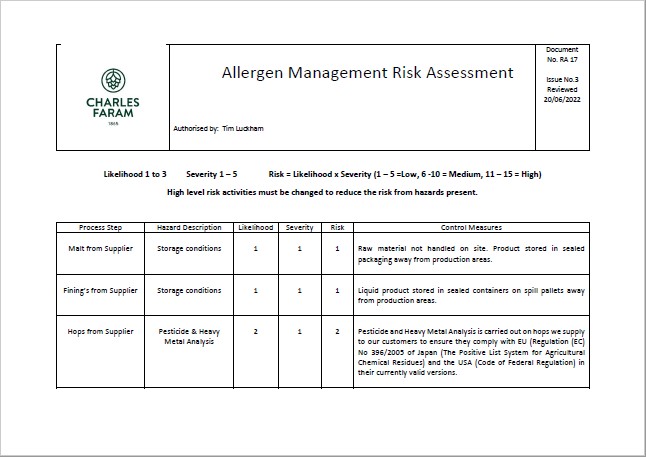

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022