Noutățile companiei

Noutăți E-Malt

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Malțurile noastre

Hameiurile noastre

Hameiuri noi

Drojdiile noastre

Condimentele noastre

Zahărul nostru

Capacele noastre

-

Kegcaps 74 mm, Auriu 116 Flatfitting A-type (700/cutie)

Adaugă în coş

Kegcaps 74 mm, Auriu 116 Flatfitting A-type (700/cutie)

Adaugă în coş

-

Capace 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/cutie)

Adaugă în coş

Capace 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/cutie)

Adaugă în coş

-

Crown Caps 26mm TFS-PVC Free, Auriu col. 2311 (10000/cutie)

Adaugă în coş

Crown Caps 26mm TFS-PVC Free, Auriu col. 2311 (10000/cutie)

Adaugă în coş

-

Kegcaps 74 mm, Maro 154 Flatfitting A-type (700/cutie)

Adaugă în coş

Kegcaps 74 mm, Maro 154 Flatfitting A-type (700/cutie)

Adaugă în coş

-

Kegcaps 64 mm, Albastru 141 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

Kegcaps 64 mm, Albastru 141 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

Certificate

Sugestie

Malaysia: Brewing industry calling on government to maintain current excise duty rates

Malaysia: Brewing industry calling on government to maintain current excise duty rates

Malaysia’s brewing industry is calling on the government to maintain the current excise duty rates on beer, stressing its significant contribution to the economy and warning against the risks of fuelling illicit trade should tax rates rise, The Malaysian Reserve reported on October 8.

The Confederation of Malaysian Brewers Bhd (CMBB) comprising Carlsberg Brewery Malaysia Bhd and Heineken Malaysia Bhd had last week released the Economic Impact Assessment of the Brewing Industry in Malaysia.

The independent study, conducted by the South-East Asia Public Policy Institute in collaboration with the University of Nottingham Malaysia, highlighted the sector’s role in GDP, job creation and tax revenue.

Between 2022 and 2023, CMBB contributed an average RM7.1 billion annually to economic growth, supported 52,400 jobs, and generated RM3.3 billion in annual tax revenue.

The brewing industry accounts for 0.4% of Malaysia’s GDP and 1.5% of the nation’s total tax revenue, underscoring its strong multiplier effect across manufacturing, logistics, retail and hospitality.

“Brewers are significant contributors to Malaysia’s economy — not only through taxes but also by driving employment and industrial activity across manufacturing, logistics, retail and hospitality sectors,” said Carlsberg Brewery Malaysia MD Stefano Clini and Heineken Malaysia MD Martijn van Keulen, in a joint statement as members of CMBB’s governing council.

CMBB stressed that retaining existing excise duty rates, alongside robust enforcement, is critical in curbing illicit trade, which threatens government revenue.

With Malaysia already ranking among the countries with the highest beer tax rates globally, any further increase could widen the price gap and make illicit beer more attractive to consumers, the confederation cautioned.

“We commend the ongoing efforts of the Multi-Agency Task Force led by the Ministry of Finance (MOF) in combating illicit trade. Our sincere appreciation goes to Royal Malaysia Customs Department (JKDM) and the Royal Malaysia Police (PDRM) for their stepped-up enforcement against smuggling and illicit beers. We look forward to further collaboration with the government to reinforce the brewers’ economic contribution, strengthen enforcement, and support Malaysia’s broader policy aspirations,” CMBB said.

The confederation reaffirmed its commitment to supporting Malaysia’s long-term development priorities, including the 13th Malaysia Plan (13MP), the New Industrial Master Plan 2030 (NIMP 2030), and the Circular Economy Blueprint, by working with government agencies and stakeholders to advance sustainable growth and competitiveness.

Înapoi

Fermentis GMO-free Declaration

Fermentis GMO-free Declaration

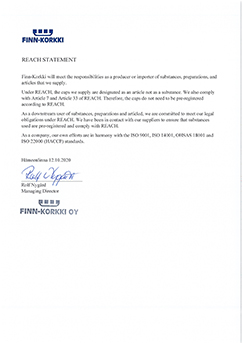

Crown Caps Finnkorkki REACH Statement

Crown Caps Finnkorkki REACH Statement

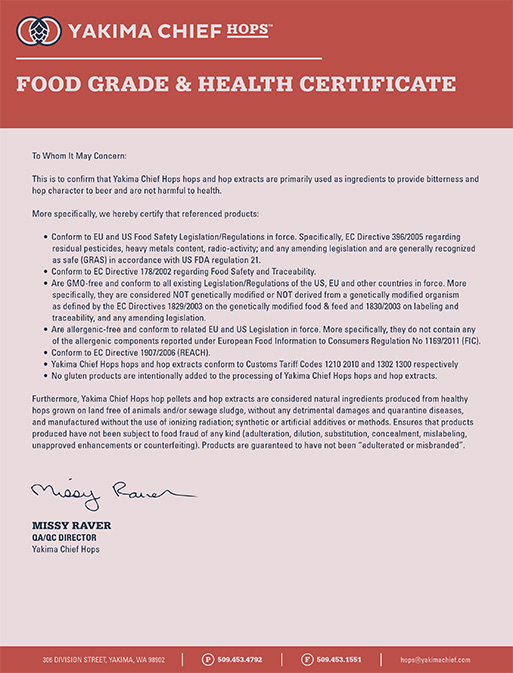

Hops Yakima Chief, Food Grade & Health Certificate

Hops Yakima Chief, Food Grade & Health Certificate

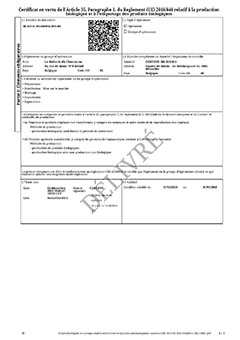

Certificat BIO FR: Malt, Houblon, Sucre - juillet 2025- mars 2028

Certificat BIO FR: Malt, Houblon, Sucre - juillet 2025- mars 2028

Fagron Spices, GMO-free Certificate 2022

Fagron Spices, GMO-free Certificate 2022