Notizie Aziendali

E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

I nostri malti

-

CHÂTEAU PEATED

Aggiungi al carrello

CHÂTEAU PEATED

Aggiungi al carrello

-

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

-

CHÂTEAU CARA HONEY NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

CHÂTEAU CARA HONEY NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

-

CHÂTEAU AROME NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

CHÂTEAU AROME NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

-

MALT CHÂTEAU SPELT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

MALT CHÂTEAU SPELT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

I nostri luppoli

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

-

CC29mm TFS-PVC Free, Blu without oxygen scav.(7500/box)

Aggiungi al carrello

CC29mm TFS-PVC Free, Blu without oxygen scav.(7500/box)

Aggiungi al carrello

-

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Ricette per birra

Certificati

Suggerimento

India: Craft beer maker Bira in talks to raise around $132 million in its largest-ever funding round

India: Craft beer maker Bira in talks to raise around $132 million in its largest-ever funding round

Indian beer maker Bira is reportedly in advanced talks to raise around $132 million in its largest-ever funding round, with New York-based Global Emerging Markets (GEM) among the potential investors, Menafn.com reported on October 8.

The proposed deal includes $50 million in equity and $82 million in structured credit, though the size of GEM's stake has not been disclosed, according to a report by Reuters.

Bira CEO Ankur Jain confirmed receiving term sheets for substantial investments through both debt and equity, but declined to reveal investor details, the report added.

The funds are expected to be used for working capital requirements, settling pending dues, and supporting business recovery and supply chain restructuring.

Founded in 2015, Bira rapidly emerged as one of India's fastest-growing beer brands, fueled by the country's evolving social drinking culture. Despite its less than 5% market share, the brand carved out a niche in a market dominated by global players such as AB InBev, Carlsberg, and Heineken.

However, regulatory hurdles have posed challenges, particularly in 2023 - 24, when a name change from B9 Beverages Pvt. Ltd. to B9 Beverages Ltd. caused significant disruptions, leading to losses of about ₹80 crore.

Bira has raised $210 million to date and was last valued at $450 million, with investors including Kirin Holdings and Peak XV Partners (formerly Sequoia Capital India).

Last year, the company announced listing plans for 2026.

Torna

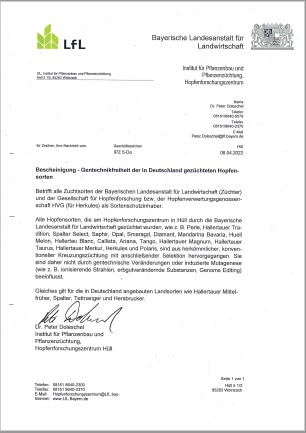

Hops, HVG, non-GMO Certificate 2022, EN

Hops, HVG, non-GMO Certificate 2022, EN

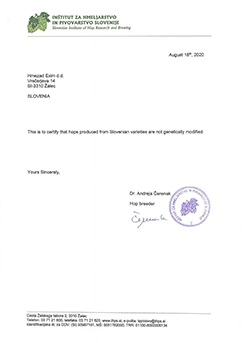

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

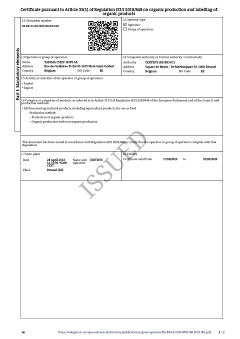

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

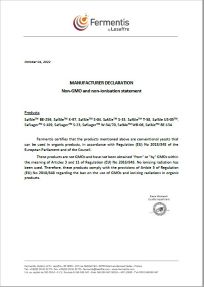

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

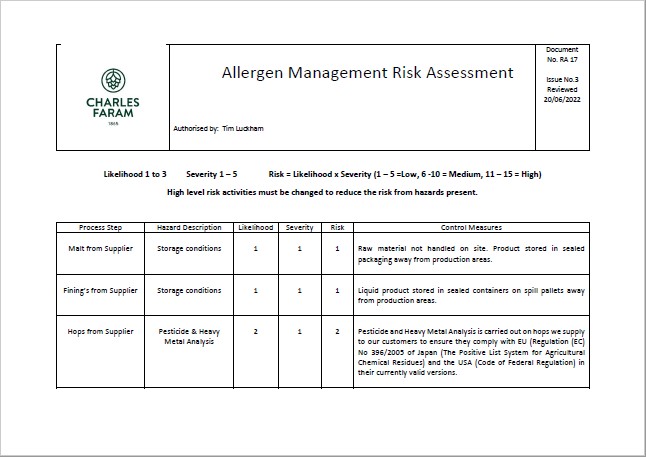

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022