E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Vores malt

Vores humle

New Hops

Vores gær

Vores krydderier

Vores sukker

Vores kapsler

-

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

-

CC29mm TFS-PVC Free, White with oxygen scav.(7000/papkasse)

Tilføj kurv

CC29mm TFS-PVC Free, White with oxygen scav.(7000/papkasse)

Tilføj kurv

-

Kegcaps 64 mm, Gold 116 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

Kegcaps 64 mm, Gold 116 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

-

Kegcaps 64 mm, White 86 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

Kegcaps 64 mm, White 86 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

-

Kegcaps 69 mm, Grøn 147 Grundey G-type (850/papkasse)

Tilføj kurv

Kegcaps 69 mm, Grøn 147 Grundey G-type (850/papkasse)

Tilføj kurv

Certifikater

-

Fagron Spices, IFSFood Certificate 16089, EN 2024

Fagron Spices, IFSFood Certificate 16089, EN 2024

-

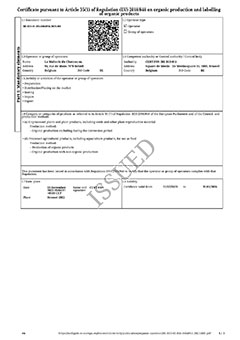

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

-

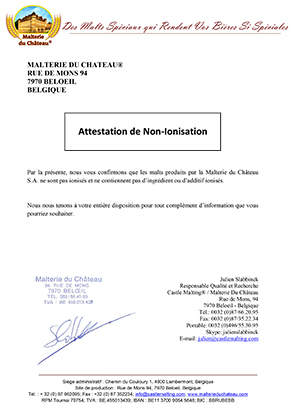

Castle Malting Malt Non Ionization Certificate FR

Castle Malting Malt Non Ionization Certificate FR

-

Hops Hopfenveredlung St.Johann, Certificate ISO 22000:2005 2021-2024

Hops Hopfenveredlung St.Johann, Certificate ISO 22000:2005 2021-2024

-

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Forslag

India: Craft beer maker Bira in talks to raise around $132 million in its largest-ever funding round

India: Craft beer maker Bira in talks to raise around $132 million in its largest-ever funding round

Indian beer maker Bira is reportedly in advanced talks to raise around $132 million in its largest-ever funding round, with New York-based Global Emerging Markets (GEM) among the potential investors, Menafn.com reported on October 8.

The proposed deal includes $50 million in equity and $82 million in structured credit, though the size of GEM's stake has not been disclosed, according to a report by Reuters.

Bira CEO Ankur Jain confirmed receiving term sheets for substantial investments through both debt and equity, but declined to reveal investor details, the report added.

The funds are expected to be used for working capital requirements, settling pending dues, and supporting business recovery and supply chain restructuring.

Founded in 2015, Bira rapidly emerged as one of India's fastest-growing beer brands, fueled by the country's evolving social drinking culture. Despite its less than 5% market share, the brand carved out a niche in a market dominated by global players such as AB InBev, Carlsberg, and Heineken.

However, regulatory hurdles have posed challenges, particularly in 2023 - 24, when a name change from B9 Beverages Pvt. Ltd. to B9 Beverages Ltd. caused significant disruptions, leading to losses of about ₹80 crore.

Bira has raised $210 million to date and was last valued at $450 million, with investors including Kirin Holdings and Peak XV Partners (formerly Sequoia Capital India).

Last year, the company announced listing plans for 2026.

Tilbage