E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

우리몰트

우리 홉

New Hops

우리 효모

우리 향신료

우리슈가

우리 캡(Caps)

맥주&위스키 레시피

인증서

동의

USA: US beer volumes expected to fall about 5% this year

USA: US beer volumes expected to fall about 5% this year

Barclays warned that weak beer demand and economic strain will weigh on volumes and investor sentiment on the U.S. beer sector for some time as it downgraded Constellation Brands and Molson Coors, Investing.com reported on September 12.

Analysts downgraded Corona beer maker Constellation to Equal weight from Overweight.

Molson Coors , which has Coors and Miller beer brands, was cut to Underweight from Equal weight given a lack of catalysts after another disappointing summer selling season.

“Just as consumer spend has been measured & careful, so too are we taking a more selective stance… and frankly we struggle to think of a positive catalyst for US beer trends, and investor sentiment towards the category,” analysts at Barclays added.

Barclays now expects U.S. beer volumes to fall about 5% in 2025 before moderating to a 2% annual decline in later years.

Analysts cited pressure on lower-income consumers and the Hispanic cohort, a key driver of industry sales, as a major headwind.

Constellation, which gets about 40% of its beer revenue from Hispanic consumers, faces added risk from immigration policy curbing social gatherings, Barclays said.

Surveys show Hispanic beer buyers are increasingly worried about their finances, leading to sharper declines in purchase rates compared with the broader population.

Molson Coors is seen as more vulnerable given its reliance on light beer brands, while Constellation’s high-end Mexican portfolio offers relative resilience.

Still, Barclays trimmed its growth expectations for both companies, saying industry malaise and shifting consumer habits leave little room for near-term recovery.

뒤로

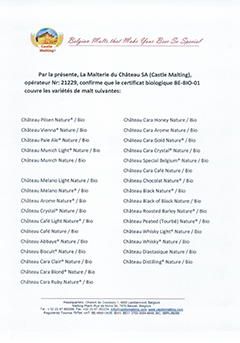

Liste produits BIO - Malterie du Château

Liste produits BIO - Malterie du Château

Belgosuc Sugar, Irradiation’ statement, 2020

Belgosuc Sugar, Irradiation’ statement, 2020

Belgosuc Sugar, Organic certificate 2024-2027

Belgosuc Sugar, Organic certificate 2024-2027

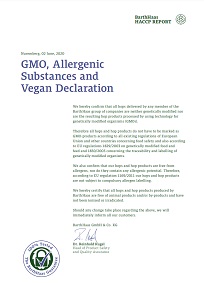

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Barth Haas Hops: GMO, Allergenic Substances and Vegan Declaration 2022

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)