Noutățile companiei

Noutăți E-Malt

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Malțurile noastre

Hameiurile noastre

Hameiuri noi

Drojdiile noastre

Condimentele noastre

Zahărul nostru

Capacele noastre

-

Kegcaps 74 mm, Auriu 116 Flatfitting A-type (700/cutie)

Adaugă în coş

Kegcaps 74 mm, Auriu 116 Flatfitting A-type (700/cutie)

Adaugă în coş

-

Capace 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/cutie)

Adaugă în coş

Capace 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/cutie)

Adaugă în coş

-

Crown Caps 26mm TFS-PVC Free, Auriu col. 2311 (10000/cutie)

Adaugă în coş

Crown Caps 26mm TFS-PVC Free, Auriu col. 2311 (10000/cutie)

Adaugă în coş

-

Kegcaps 74 mm, Maro 154 Flatfitting A-type (700/cutie)

Adaugă în coş

Kegcaps 74 mm, Maro 154 Flatfitting A-type (700/cutie)

Adaugă în coş

-

Kegcaps 64 mm, Albastru 141 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

Kegcaps 64 mm, Albastru 141 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

Certificate

Sugestie

Australia: Both malting and feed barley prices settle into a sideways trend

Australia: Both malting and feed barley prices settle into a sideways trend

Since early 2022, the prices of both Australian malting and feed barley have steadily fallen before recently settling into a sideways trend. This price decline has occurred despite the ongoing high rate of barley exports, largely driven by very strong Chinese demand, RMI Analytics said in their latest report.

Following the lifting of the restrictive Chinese tariff on Australian barley in August 2023, Australian exports have surged. So far in 2025, China has imported 3.8 million tonnes of barley, which accounts for nearly 74% of all Australian barley exports. Of these shipments to China, 79% are categorized as feed barley, while 21% are classified as malting barley (noting that a proportion of the feed barley is actually put through the malting process). The export pace to China was robust in Q1 2025, but has experienced a slight slowdown during in Q2 2025.

From a statistical perspective, both malting and feed barley prices are expected to trend sideways. Malting barley prices are forecast to climb over the next three months before drifting lower. Feed barley prices are to decline into harvest, but then should bounce higher in November-December 2025, before falling back down again in early 2026.

The turnaround in Australia’s barley crop development over the past three months has been nothing short of amazing. From severe dryness concerns during May 2025, conditions are now nearly perfect, due to widespread rainfall across all major barley producing regions. While Western Australia, South Australia, and western Victoria need normal moisture in the weeks ahead to finish the crop, the northern New South Wales crop looks ideal, and with good soil moisture levels existing. This improvement in the Australian crop is evidenced in RMI Analytics’ price forecasts for both malting and feed barley over the next six months.

Înapoi

Fermentis GMO-free Declaration

Fermentis GMO-free Declaration

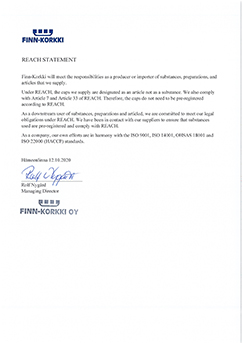

Crown Caps Finnkorkki REACH Statement

Crown Caps Finnkorkki REACH Statement

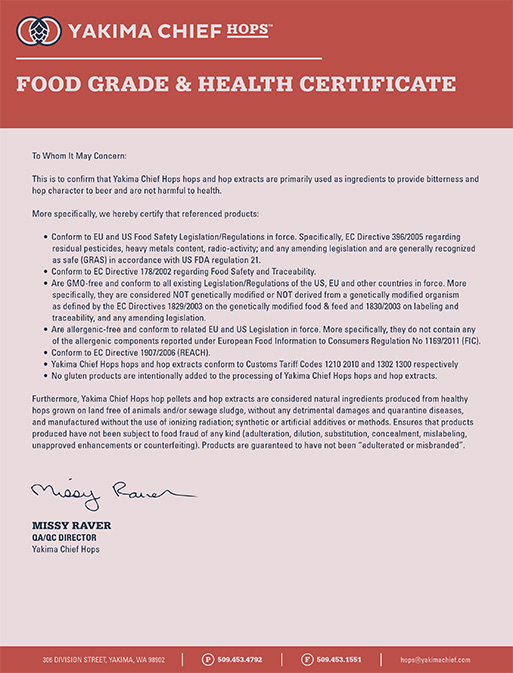

Hops Yakima Chief, Food Grade & Health Certificate

Hops Yakima Chief, Food Grade & Health Certificate

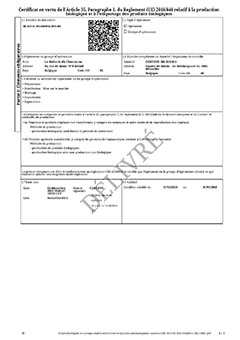

Certificat BIO FR: Malt, Houblon, Sucre - juillet 2025- mars 2028

Certificat BIO FR: Malt, Houblon, Sucre - juillet 2025- mars 2028

Fagron Spices, GMO-free Certificate 2022

Fagron Spices, GMO-free Certificate 2022