Noticias de Empresa

E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Tapas 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/caja)

Añadir al carrito

-

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

-

Kegcaps 74 mm, Verdes 147 Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Verdes 147 Flatfitting A-type (700/caja)

Añadir al carrito

-

Kegcaps 74 mm, Doradas 116 Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Doradas 116 Flatfitting A-type (700/caja)

Añadir al carrito

-

Kegcaps 74 mm, Orange 43 Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Orange 43 Flatfitting A-type (700/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

World: Carlsberg misses half-year profit and volume forecasts

World: Carlsberg misses half-year profit and volume forecasts

Carlsberg missed half-year profit and volume forecasts on August 14 and warned it did not expect the consumer environment to improve in the rest of 2025, sending the Danish brewer's shares down almost 7% in early trading.

The latest report by the world's third-largest brewer - behind Anheuser-Busch InBev and Heineken - was received with similar pessimism to those of its rivals in recent weeks as investors sent shares declining.

While Carlsberg, which makes Kronenbourg 1664, Tuborg and Somersby, raised the bottom end of its annual profit guidance, that did not offset slower-than-expected first-half operating profit growth of 2.3%, and a 1.7% decline in volumes.

CEO Jacob Aarup-Andersen said on a media call that the brewer's performance was strong in a difficult year, and that it anticipated slightly better volume growth in the second half.

Still, he wasn't optimistic on consumer spending, which was being reined in by price increases and uncertainty, adding: "There is no indication as we move into the second half that that's going to change."

Big brewers have been battling reduced demand, the impact of U.S. tariffs and poor weather, and their weak performance or volume expectations have left investors fretting over growth prospects.

Carlsberg's shares were down 5.8%, after earlier falling as much as 6.7%, its steepest decline since July 2024.

Haider Anjum, analyst from Jyske Bank, said he was surprised by the share price reaction, given Carlsberg's relatively strong performance.

But Laurence Whyatt, analyst at Barclays, said the market had been "punishing volume misses" like Carlsberg's, which was driven by a weaker-than-expected performance in Asia.

As well as temporary challenges, brewers also face questions around longer-term shifts, such as some consumers cutting back on alcohol for health reasons.

Altogether, these issues have dampened earlier optimism around the sector.

Carlsberg had also pledged to deliver revenue growth of between 4% and 6% annually each year until 2027, but Aarup-Andersen told investors on a call that in a year like 2025, that may not be "fully realistic."

While it narrowed its expectations for annual operating profit growth to 3% to 5%, compared with 1% to 5% before, analysts said they were already expecting 4%.

Regresar

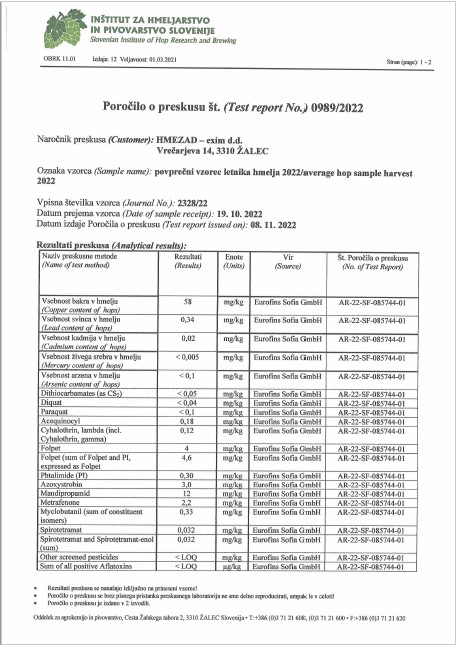

Hmezad Hops, Heavy Metals Certificate 2022

Hmezad Hops, Heavy Metals Certificate 2022

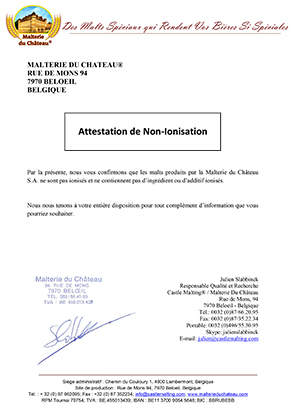

Castle Malting Malt Non Ionization Certificate FR

Castle Malting Malt Non Ionization Certificate FR

Belgosuc Sugar, Certificate, shelf_life_of_products (EN)

Belgosuc Sugar, Certificate, shelf_life_of_products (EN)

Barth Haas Hops: Organic Certificate 2024-2026

Barth Haas Hops: Organic Certificate 2024-2026

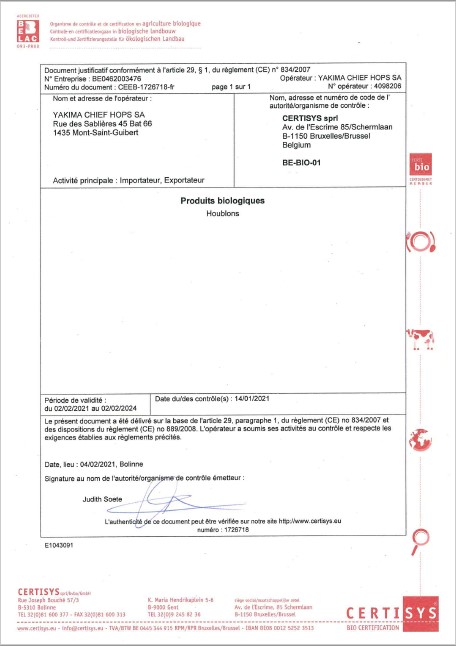

Hops Yakima Chief, Certificate Bio 2021-2024

Hops Yakima Chief, Certificate Bio 2021-2024