Nouvelles de la société

Actualités de l'industrie

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Nos malts

Nos houblons

Nouveaux houblons

Nos levures

Nos épices

Nos sucres

Nos capsules

-

Kegcaps 74 mm, Marron 154 Flatfitting A-type (700/boîte)

Ajouter au panier

Kegcaps 74 mm, Marron 154 Flatfitting A-type (700/boîte)

Ajouter au panier

-

Kegcaps 74 mm, Rouge 102 Flatfitting A-type (700/boîte)

Ajouter au panier

Kegcaps 74 mm, Rouge 102 Flatfitting A-type (700/boîte)

Ajouter au panier

-

Kegcaps 64 mm, Rouge 102 Sankey S-type (EU) (1000/boîte)

Ajouter au panier

Kegcaps 64 mm, Rouge 102 Sankey S-type (EU) (1000/boîte)

Ajouter au panier

-

Capsules 26mm TFS-PVC Free, Cyan Transparent col. 2892 (10000/boîte)

Ajouter au panier

Capsules 26mm TFS-PVC Free, Cyan Transparent col. 2892 (10000/boîte)

Ajouter au panier

-

Crown Caps 26mm TFS-PVC Dark Green col. 2410 (10000/box)

Ajouter au panier

Crown Caps 26mm TFS-PVC Dark Green col. 2410 (10000/box)

Ajouter au panier

Recettes de Bière

Certificats

Suggestion

Brazil: Heineken adapts to market pressures, strengthens position in Brazil

Brazil: Heineken adapts to market pressures, strengthens position in Brazil

The weakening of mass-market beer portfolios in Brazil, a trend affecting the entire industry, has led Heineken to adjust its inventory and product mix in the country. These strategic changes were outlined by the company’s global executives during a conference call with analysts on July 28, as they presented second-quarter results, Valor International reported.

As part of this strategy, the group delayed its price adjustment for around three months. This helped Heineken reach a 25.4% share of beer volume in Brazil in the first half, up from 23.8% a year earlier, according to data from consultancy firm Nielsen. Ambev remains the market leader with about 60%.

“Brazil is showing more volatility in sell-in [sales to retailers]. In particular, the Brazilian market is growing less than we had anticipated,” said Dolf van den Brink, CEO of Heineken Group.

In response, the company moved forward with inventory and product mix adjustments in the first quarter. These changes ended up putting pressure on margins and volume.

The good news, according to the executives, is that the Brazilian market began responding positively in retail sales in the second quarter, following those adjustments.

The decline in the “economy” segment is a reality across Brazil’s beer industry. Even Ambev has acknowledged challenges with brands like Skol. According to sources, the drop is tied to a complex economic environment and brewers shifting more focus to premium brands.

Despite a more challenging macroeconomic backdrop, Heineken reported gains in the premium segment in Brazil. The Heineken brand maintained its leadership in this category, posting low single-digit growth in the country.

Another highlight in the period was the revival of the Eisenbahn brand, which saw high single-digit growth. Eisenbahn recently signed on as a sponsor of The Town music festival, which will be held in São Paulo in September.

When asked by analysts about consumer behavior in Brazil and what influences beer-buying decisions, the CEO said that underlying beer demand remains strong in the country, but economic uncertainty continues to erode purchasing power—a situation not unique to Brazil.

“It reflects everything happening both in the markets and beyond,” he said, citing factors such as unemployment in some regions and inflation. “The fundamentals remain optimistic in the medium and long term. We’re trying to be cautious in the short term so as not to be caught off guard,” he added.

Globally, Heineken reported a 1.2% organic decline in beer volume in the first half, to 116.4 million hectolitres. However, the Heineken brand alone grew 4.5%.

In the Americas, total volume dropped 1.2% to 42.2 million hectoliters.

The company closed the second quarter with €7.64 billion in revenue, down 4.1% year over year. On an organic basis—excluding exchange rate and M&A effects—revenue fell 3.3%.

In Brazil, beyond inventory adjustments, the group also postponed its price increases, which were only implemented between May and June. Ambev, by contrast, had made its price adjustments earlier, between April and May, according to sources.

Analysts at Itaú BBA believe this lag in price hikes relative to competitors may have helped limit Ambev’s volume growth in Q2. The bank projects a 2.5% year-over-year decline in Ambev’s beer volume in Brazil for the quarter—the company is set to release its results on Thursday (31).

Heineken’s last price hike had occurred in mid-April 2024. This time, the increase matched inflation for the period, though specific percentages vary by brand. Sources say the group has no plans for additional price adjustments in 2025.

Behind the scenes, the industry no longer expects a repeat of the price war seen last year, largely driven by Grupo Petrópolis, owner of the Itaipava brand.

According to insiders, Heineken has been prioritizing premium brand production over lower-end products—a strategy reflecting limited capacity to increase output at current plants.

This situation prompted the company to invest in a new plant in Passos (Minas Gerais), its largest-ever investment in Brazil at R$2.5 billion. Operations are expected to begin soon, with a projected annual output of 5 million hectolitres.

One area of concern for the group is Europe, where sales volume fell 4.7% in the first half. “The third quarter will be important for us in Europe. The weather is helping,” said the CEO. In the region, Heineken has been locked in price negotiations with retailers.

Overall, Heineken executives expressed a more optimistic outlook for global volumes in the second half of the year compared to the first.

Regarding U.S. operations, the company told investors it expects a negative impact in the second half due to Donald Trump’s tariff policy. Although the U.S. and European Union agreed to reduce tariffs on European imports from 30% to 15%, the reduction will still weigh on the Amsterdam-based company’s earnings.

Revenir

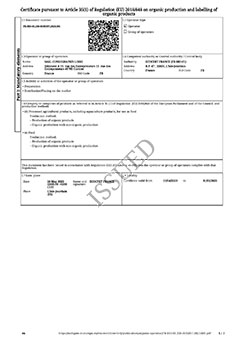

Top Hop - HACCP Certificate 2021-2024

Top Hop - HACCP Certificate 2021-2024

Organic Rice Husk Certificate ENG - 2023 - 2025

Organic Rice Husk Certificate ENG - 2023 - 2025

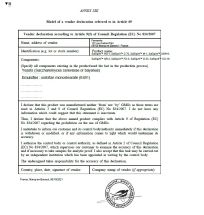

Fermentis Yeast- Non GMO declaration SafSpirit range

Fermentis Yeast- Non GMO declaration SafSpirit range

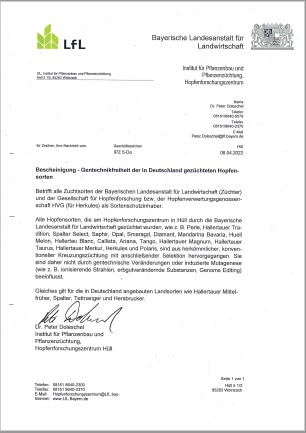

Hops, HVG, non-GMO Certificate 2022, EN

Hops, HVG, non-GMO Certificate 2022, EN

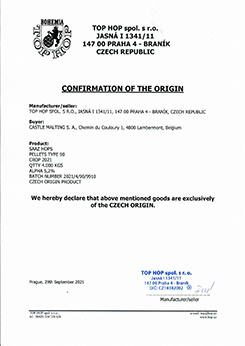

Top Hop - Confirmation of the Origin 2021

Top Hop - Confirmation of the Origin 2021