Noutățile companiei

Noutăți E-Malt

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Malțurile noastre

Hameiurile noastre

Hameiuri noi

Drojdiile noastre

Condimentele noastre

Zahărul nostru

Capacele noastre

-

Kegcaps 74 mm, Auriu 116 Flatfitting A-type (700/cutie)

Adaugă în coş

Kegcaps 74 mm, Auriu 116 Flatfitting A-type (700/cutie)

Adaugă în coş

-

Capace 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/cutie)

Adaugă în coş

Capace 26mm TFS-PVC Free, Blue Neu col. 2832 (10000/cutie)

Adaugă în coş

-

Crown Caps 26mm TFS-PVC Free, Auriu col. 2311 (10000/cutie)

Adaugă în coş

Crown Caps 26mm TFS-PVC Free, Auriu col. 2311 (10000/cutie)

Adaugă în coş

-

Kegcaps 74 mm, Maro 154 Flatfitting A-type (700/cutie)

Adaugă în coş

Kegcaps 74 mm, Maro 154 Flatfitting A-type (700/cutie)

Adaugă în coş

-

Kegcaps 64 mm, Albastru 141 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

Kegcaps 64 mm, Albastru 141 Sankey S-type (EU) (1000/cutie)

Adaugă în coş

Certificate

Sugestie

USA: Boston Beer�s Q2 earnings significantly exceed analyst expectations

USA: Boston Beer�s Q2 earnings significantly exceed analyst expectations

Boston Beer Company Inc reported second-quarter earnings that significantly exceeded analyst expectations, driving shares up 8% despite a challenging industry environment marked by declining beer consumption, Investing.com reported on July 25.

The maker of Samuel Adams beer and Truly Hard Seltzer posted adjusted earnings of $5.45 per share for the second quarter, surpassing the analyst estimate of $3.92 by $1.53. Revenue came in at $587.9 million, slightly below the consensus estimate of $588.75 million but representing a 1.5% increase YoY. The company’s gross margin expanded to 49.8%, up 380 basis points from the same period last year.

"Despite a weaker volume environment, we have raised our gross margin guidance as we continue to see positive impacts from our multi-year margin enhancement initiatives," said Chairman and Founder Jim Koch in a statement.

The earnings beat came despite a 5% decrease in depletions and a 0.8% decrease in shipments during the quarter. The company attributed the volume decline to economic uncertainty affecting consumer behavior and poor weather during key selling weeks.

"We are encouraged by our strong gross margin and earnings performance in the first half of 2025 and the positive consumer response to our Sun Cruiser innovation," said President and CEO Michael Spillane.

Boston Beer updated its full-year guidance, now expecting depletions and shipments to decline between high single digits to low single digits, compared to previous guidance of down low single digit to up low single digit. However, the company raised its gross margin forecast to between 46% and 47.3%, up from the previous range of 44% to 46.5%.

The company has been actively returning cash to shareholders, repurchasing $110.5 million in shares from December 30, 2024, to July 18, 2025. Boston Beer ended the quarter with $212.4 million in cash and no debt.

Înapoi

Fermentis GMO-free Declaration

Fermentis GMO-free Declaration

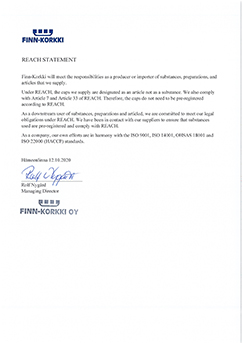

Crown Caps Finnkorkki REACH Statement

Crown Caps Finnkorkki REACH Statement

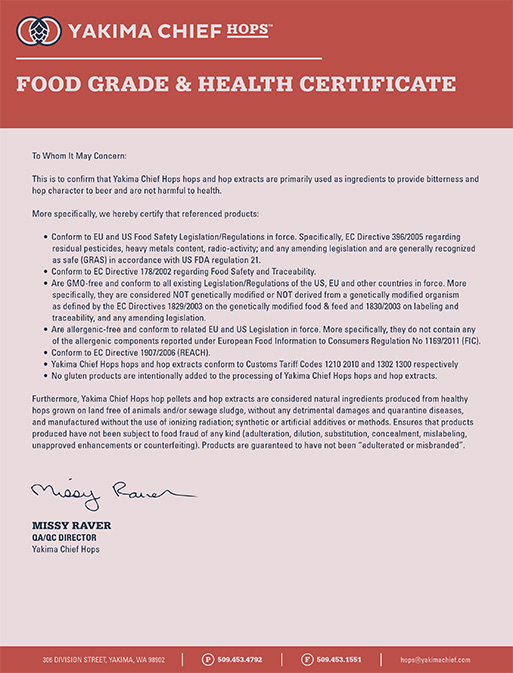

Hops Yakima Chief, Food Grade & Health Certificate

Hops Yakima Chief, Food Grade & Health Certificate

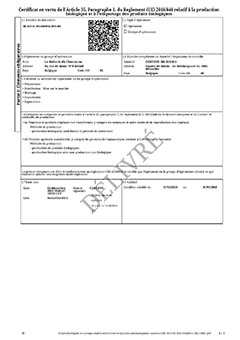

Certificat BIO FR: Malt, Houblon, Sucre - juillet 2025- mars 2028

Certificat BIO FR: Malt, Houblon, Sucre - juillet 2025- mars 2028

Fagron Spices, GMO-free Certificate 2022

Fagron Spices, GMO-free Certificate 2022