E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Vores malt

Vores humle

New Hops

Vores gær

Vores krydderier

Vores sukker

Vores kapsler

-

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

-

CC29mm TFS-PVC Free, White with oxygen scav.(7000/papkasse)

Tilføj kurv

CC29mm TFS-PVC Free, White with oxygen scav.(7000/papkasse)

Tilføj kurv

-

Kegcaps 64 mm, Gold 116 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

Kegcaps 64 mm, Gold 116 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

-

Kegcaps 64 mm, White 86 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

Kegcaps 64 mm, White 86 Sankey S-type (EU) (1000/papkasse)

Tilføj kurv

-

Kegcaps 69 mm, Grøn 147 Grundey G-type (850/papkasse)

Tilføj kurv

Kegcaps 69 mm, Grøn 147 Grundey G-type (850/papkasse)

Tilføj kurv

Certifikater

-

Fagron Spices, IFSFood Certificate 16089, EN 2024

Fagron Spices, IFSFood Certificate 16089, EN 2024

-

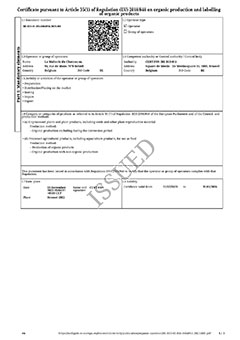

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Jul 2025-Mar 2028

-

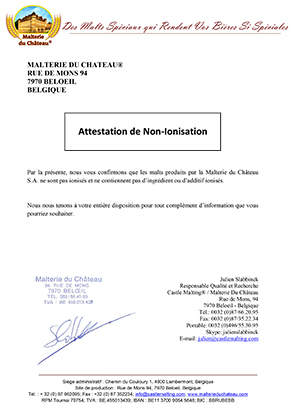

Castle Malting Malt Non Ionization Certificate FR

Castle Malting Malt Non Ionization Certificate FR

-

Hops Hopfenveredlung St.Johann, Certificate ISO 22000:2005 2021-2024

Hops Hopfenveredlung St.Johann, Certificate ISO 22000:2005 2021-2024

-

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Malt Attestation of Conformity for pesticides and contaminants 2024 (ENG)

Forslag

China: China Resources Beer CEO resigns

China: China Resources Beer CEO resigns

Hou Xiaohai has resigned as executive director and chairman of China Resources Beer to focus on “other personal engagements”, Yahoo! Finance reported on June 27.

Xiaohai will also step down as a member of three of the brewer's committees, the company said in a Hong Kong stock-exchange filing.

Xiaohai, who served as the company's CEO since 2016, assumed the role of chairman in April 2023.

Zhao Chunwu, an executive director and China Resources Beer’s president, will “temporarily” assume the chairman’s duties during the transition period.

China Resources Beer, which owns the Snow beer brand, is a subsidiary of state-owned China Resources (Holdings) Company Limited (CRH). It focuses on the manufacturing, sales, and distribution of alcoholic beverages.

In 2024, the company reported a consolidated turnover of 38.63bn yuan ($5.39bn), down 0.8% on a year earlier.

China Resources Beer makes the bulk of its revenue from brewing but the turnover of its beer division dipped 1% to 36.49bn yuan. Nevertheless, the company said its "sales volume and turnover performance outperformed some of the peers".

Turnover from baijiu grew 4% to 2.15bn yuan.

Excluding impairment losses, earnings before interest and taxes (EBIT) rose by 2.9% to 6.34bn yuan.

Profit for the year stood at 4.76bn yuan, down from 5.21bn yuan in 2023.

In October, China Resources Beverage, another CRH subsidiary, raised over $600m through its Hong Kong listing.

The company is the second-largest producer of packaged drinking water in China and the largest in the purified water category.

Its portfolio includes C’estbon and L’eau water brands, as well as Zhi Ben Qing Run herbal tea, Mi Shui juices, and Mulene sports drinks.

Tilbage