E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

我们的麦芽

Our Hops

New Hops

Our Yeasts

Our Spices

Our Sugars

Our Caps

证书

-

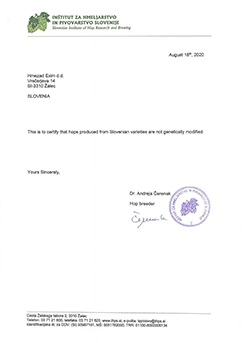

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

-

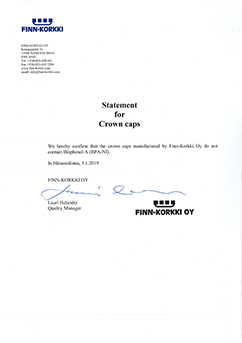

Crown Caps Finnkorkki Statement

Crown Caps Finnkorkki Statement

-

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

Malt Attestation of conformity for non-irradiation, non-ionization, and the absence of nanomaterials 2024 (ENG)

-

House of Hops - Non GMO / Non Ionization Certificate 2022-2023

House of Hops - Non GMO / Non Ionization Certificate 2022-2023

-

Hops Hopfenveredlung St.Johann, HAACP Certificate 2021-2024

Hops Hopfenveredlung St.Johann, HAACP Certificate 2021-2024

建议

India: Bira 91 reportedly grappling with serious financial and operational challenges

India: Bira 91 reportedly grappling with serious financial and operational challenges

India’s craft beer maker Bira 91 is reportedly grappling with serious financial and operational challenges. The company’s latest audit report, combined with mounting employee unrest, highlights deep structural issues that threaten its stability, according to a report by The Economic Times.

The FY24 audit by Walker Chandiok & Co, part of Grant Thornton International, revealed that B9 Beverages, the parent company of Bira 91, faces significant market, credit and liquidity risks. The report noted that the group’s net worth has fully eroded, with liabilities surpassing assets by ₹619.6 crore as of March 31, 2024. Negative cash flows of ₹84 crore and accumulated losses of ₹1,904 crore were also recorded.

The auditors said that these conditions suggest a material uncertainty that could cast doubt on the company’s ability to continue. Despite this, founder Ankur Jain stated that it is not uncommon for growth-stage businesses to have higher current liabilities than current assets, the news report said.

In a related development, the Ministry of Corporate Affairs (MCA) asked B9 Beverages to ensure timely compliance with regulations, after the company requested an extension for holding its FY25 annual general meeting. The Registrar of Companies granted a three-month extension on September 4. Jain described the MCA notice as “standard boilerplate language” used by many firms seeking procedural permissions.

The FY24 audit report also highlighted that management remains confident in its ability to meet obligations, citing expected capital infusions and future cash flow projections. However, the company is facing operational difficulties, including halted production and steep job cuts, The Economic Times reported.

Internal unrest has escalated, with over 250 employees petitioning the board and major investors, including Japan’s Kirin Holdings, Peak XV Partners, and lender Anicut Capital, for a leadership change. The petition cited delayed salaries and reimbursements, lack of transparency, corporate governance failures and pending vendor payments.

Several employees claimed salaries had been delayed for up to six months, with provident fund and tax contributions not up to date. Pending dues reportedly total around ₹50 crore. The workforce has reduced from over 700 employees last year to roughly 260, The Economic Times had reported last week.

Amid the turmoil, Bira 91 is exploring its largest-ever fundraise of $132 million. Term sheets reviewed by news agency Reuters indicate the company seeks $50 million through equity and $82 million via structured credit. Jain confirmed multiple offers from investors but did not disclose names. Funds are expected to support working capital and settle overdue payments.

Founded in 2015, Bira 91 gained a foothold in India’s growing craft beer market but competes in a highly regulated sector dominated by global giants like AB InBev, Carlsberg, and Heineken. While valued at around $450 million two years ago, and having raised $210 million to date, the company now faces a battle to stabilise operations and address internal conflicts.

后退