Notizie Aziendali

E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

I nostri malti

-

CHÂTEAU PEATED

Aggiungi al carrello

CHÂTEAU PEATED

Aggiungi al carrello

-

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

CHÂTEAU WHEAT MUNICH LIGHT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

-

CHÂTEAU CARA HONEY NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

CHÂTEAU CARA HONEY NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

-

CHÂTEAU AROME NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

CHÂTEAU AROME NATURE (MALTO BIOLOGICO)

Aggiungi al carrello

-

MALT CHÂTEAU SPELT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

MALT CHÂTEAU SPELT NATURE® (MALTO BIOLOGICO)

Aggiungi al carrello

I nostri luppoli

Luppoli nuovi

I nostri lieviti

Le nostre spezie

I nostri zuccheri

I nostri tappi

-

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

CC29mm TFS-PVC Free, Rosso with oxygen scav.(7000/box)

Aggiungi al carrello

-

CC29mm TFS-PVC Free, Blu without oxygen scav.(7500/box)

Aggiungi al carrello

CC29mm TFS-PVC Free, Blu without oxygen scav.(7500/box)

Aggiungi al carrello

-

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

Crown Caps 26mm TFS-PVC Free, Purple col. 2277 (10000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Beige 65 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

-

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Kegcaps 64 mm, Brown 154 Sankey S-type (EU) (1000/box)

Aggiungi al carrello

Ricette per birra

Certificati

Suggerimento

USA: US beer volumes expected to fall about 5% this year

USA: US beer volumes expected to fall about 5% this year

Barclays warned that weak beer demand and economic strain will weigh on volumes and investor sentiment on the U.S. beer sector for some time as it downgraded Constellation Brands and Molson Coors, Investing.com reported on September 12.

Analysts downgraded Corona beer maker Constellation to Equal weight from Overweight.

Molson Coors , which has Coors and Miller beer brands, was cut to Underweight from Equal weight given a lack of catalysts after another disappointing summer selling season.

“Just as consumer spend has been measured & careful, so too are we taking a more selective stance… and frankly we struggle to think of a positive catalyst for US beer trends, and investor sentiment towards the category,” analysts at Barclays added.

Barclays now expects U.S. beer volumes to fall about 5% in 2025 before moderating to a 2% annual decline in later years.

Analysts cited pressure on lower-income consumers and the Hispanic cohort, a key driver of industry sales, as a major headwind.

Constellation, which gets about 40% of its beer revenue from Hispanic consumers, faces added risk from immigration policy curbing social gatherings, Barclays said.

Surveys show Hispanic beer buyers are increasingly worried about their finances, leading to sharper declines in purchase rates compared with the broader population.

Molson Coors is seen as more vulnerable given its reliance on light beer brands, while Constellation’s high-end Mexican portfolio offers relative resilience.

Still, Barclays trimmed its growth expectations for both companies, saying industry malaise and shifting consumer habits leave little room for near-term recovery.

Torna

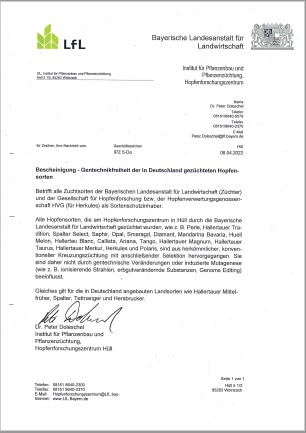

Hops, HVG, non-GMO Certificate 2022, EN

Hops, HVG, non-GMO Certificate 2022, EN

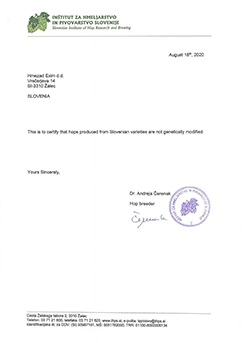

Hmezad Hops, Genetically Free Certificate 2022

Hmezad Hops, Genetically Free Certificate 2022

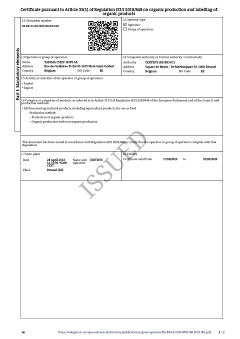

Hops Yakima Chief, Certificate Bio 2023-2026

Hops Yakima Chief, Certificate Bio 2023-2026

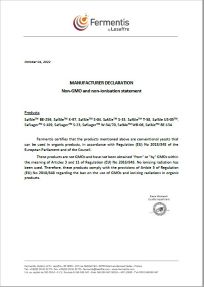

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

Fermentis Yeast- Non GMO declaration, non-ionisation_beer

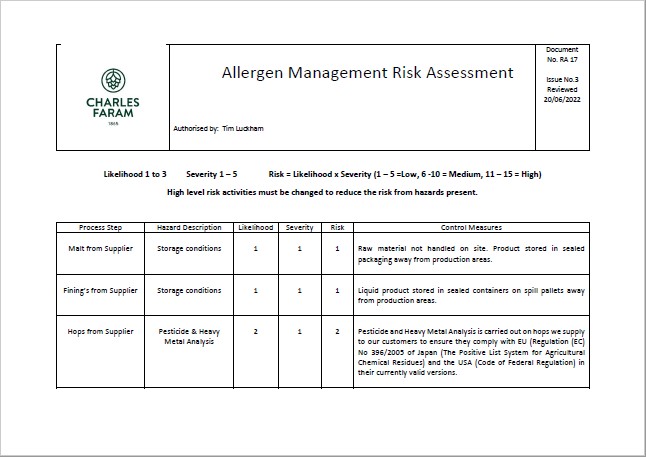

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022

ChF Hops, RA17 Allergen Management Risk Assessment, EN 2022