Noticias de Empresa

E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Nuestras maltas

Nuestros lúpulos

New Hops

Nuestras levaduras

Nuestras especias

Nuestros azúcares

Nuestras tapas

-

Tapas 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/caja)

Añadir al carrito

Tapas 26mm TFS-PVC Free, Zinc opaque col. 20633 (10000/caja)

Añadir al carrito

-

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

Crown Caps 26 mm TFS-PVC Free, Negras col. 2217 Beer Season (10000/caja)*

Añadir al carrito

-

Kegcaps 74 mm, Verdes 147 Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Verdes 147 Flatfitting A-type (700/caja)

Añadir al carrito

-

Kegcaps 74 mm, Doradas 116 Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Doradas 116 Flatfitting A-type (700/caja)

Añadir al carrito

-

Kegcaps 74 mm, Orange 43 Flatfitting A-type (700/caja)

Añadir al carrito

Kegcaps 74 mm, Orange 43 Flatfitting A-type (700/caja)

Añadir al carrito

Recetas de Cerveza

Certificados

Sugerencia

Ireland: Drinks industry demanding a 10% cut in alcohol excise

Ireland: Drinks industry demanding a 10% cut in alcohol excise

Ireland's drinks industry is demanding a 10% cut in alcohol excise in the October Budget that it says should be the first step in a multi-year plan to align excise rates with those seen across most other EU countries, Irish Examiner reported on August 25.

The Drinks Industry Group of Ireland (DIGI) said consumers here pay 11 times more excise duty on beer than Germans, and 80 times more excise on wine than the French.

They published a report on August 25 by economist Anthony Foley, which shows that overall excise duty on beer, wine and spirits in Ireland is the second highest in EU and UK, with only Finnish customers paying more. Broken down by drinks category, Ireland has the second highest excise tax on wine, the third highest on beer and the third highest on spirits.

They also point out that the steep rate of excise is separate to the VAT that is also applied on alcohol purchases, meaning the Government takes a combined total of between 27% to 29% of the price of every drink sold in a pub or restaurant.

DIGI said the high rate of tax is hard to justify given that the average consumption of alcohol per adult in Ireland has fallen by more than one third (34.3%) since 2001 and now stands at the EU average.

Along with the cost burden for the consumer, DIGI pointed to the 2,100 pubs which have closed permanently. "It’s predicted that a further 600-1,000 could close over the next decade unless the Government takes action to reduce the excessive costs imposed on pubs," Secretary of DIGI, Donall O’Keeffe, said.

"These pubs are at the heart of their communities – they are the social and economic hub of many areas and act as a draw for tourists into Ireland, yet we are imposing punishing rates of tax that makes it nearly impossible for them to survive. That is why we’re urging the Government to cut excise by 10% in the upcoming Budget in order to offer these family businesses a chance of survival into the next decade."

The DIGI secretary added that the Irish Government needs to look at how other governments across Europe value their local drinks industries by not imposing punitive rates of tax on them. “The French government understands the importance of its wine industry which is reflected in the lower rate of excise it applies on it – it's a similar story with Germany and its famous beer industry. The Irish pub and many of our drinks are also famous around the world and yet they attract punitive rates of tax. Given the changing circumstances in international trade, it’s time for the Government to reflect on this.”

Regresar

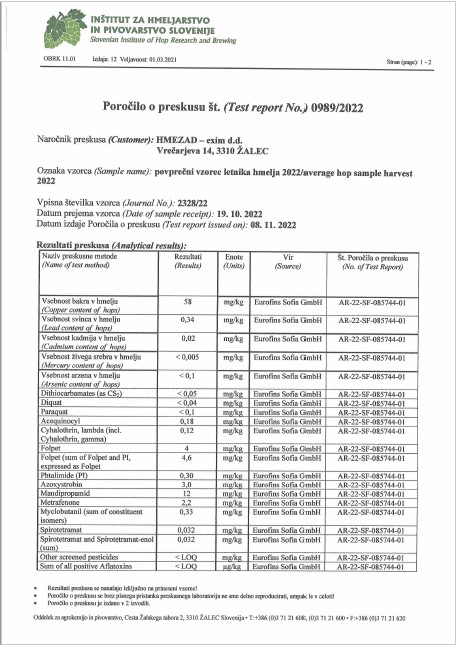

Hmezad Hops, Heavy Metals Certificate 2022

Hmezad Hops, Heavy Metals Certificate 2022

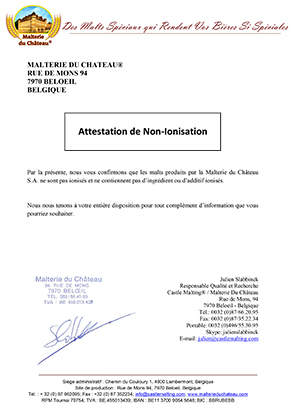

Castle Malting Malt Non Ionization Certificate FR

Castle Malting Malt Non Ionization Certificate FR

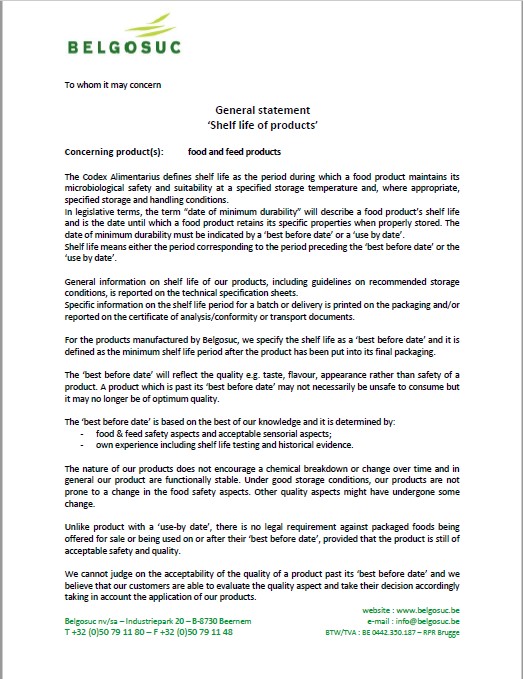

Belgosuc Sugar, Certificate, shelf_life_of_products (EN)

Belgosuc Sugar, Certificate, shelf_life_of_products (EN)

Barth Haas Hops: Organic Certificate 2024-2026

Barth Haas Hops: Organic Certificate 2024-2026

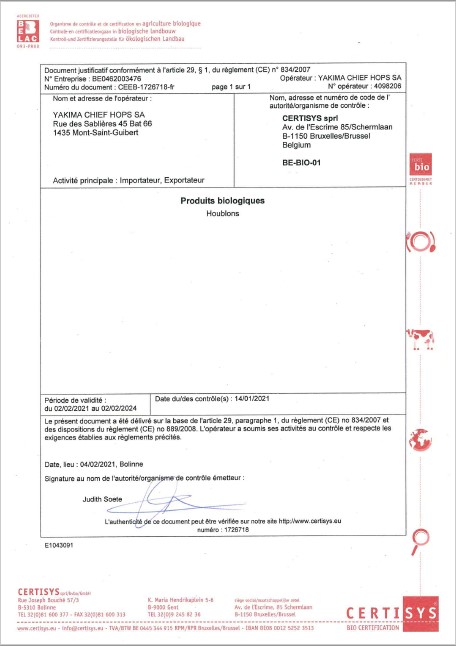

Hops Yakima Chief, Certificate Bio 2021-2024

Hops Yakima Chief, Certificate Bio 2021-2024