Novidades da empresa

E-Malt news

Americas: Heineken appoints Alex Carreteiro as Regional President Americas

Europe: Europe�s beer market continues to contract for the fifth consecutive year

UK: AHDB releases 2026/2027 recommended lists of cereals and oilseeds

USA, MD: Watchtower Brewing Company becomes Aberdeen�s first brewery

Nossos maltes

Nossos lúpulos

New Hops

Nossos fermentos

Nossas especiarias

Nossos candy sugars

Nossas tampinhas

-

Kegcaps 64 mm, Marrom 154 Sankey S-type (EU) (1000/caixa)

Adicionar

Kegcaps 64 mm, Marrom 154 Sankey S-type (EU) (1000/caixa)

Adicionar

-

Kegcaps 69 mm, Verdes 147 Grundey G-type (850/caixa)

Adicionar

Kegcaps 69 mm, Verdes 147 Grundey G-type (850/caixa)

Adicionar

-

Kegcaps 64 mm, Azuis 141 Sankey S-type (EU) (1000/caixa)

Adicionar

Kegcaps 64 mm, Azuis 141 Sankey S-type (EU) (1000/caixa)

Adicionar

-

Kegcaps 69 mm, Marrom 141 Grundey G-type (850/caixa)

Adicionar

Kegcaps 69 mm, Marrom 141 Grundey G-type (850/caixa)

Adicionar

-

Kegcaps 64 mm, Vermelhas 1485 Sankey S-type (EU) (1000/caixa)

Adicionar

Kegcaps 64 mm, Vermelhas 1485 Sankey S-type (EU) (1000/caixa)

Adicionar

Receitas de cerveja e uísque

Certificados

Sugestão

Australia: Malt, malting barley facing export headwinds

Australia: Malt, malting barley facing export headwinds

Australia is one of the world’s leading exporters of premium malting barley, but not this year, as economic pressures impact its major market, China, Grain Central reported on August 13.

They have China looking for fair average quality, or FAQ, barley, to malt for a price-conscious domestic market, and export to customers in Asia who previously bought up big from Australian maltsters.

The trend is squeezing margins for Australian growers and malt exporters, and was addressed in both the Grain Industry of Western Australia barley forum last week, and at the Australian Grains Industry Conference the week before, ahead of what could well be a bumper Australian barley harvest.

Latest Australian Bureau of Statistics data paint the picture: Australia exported 4.02 million tonnes (Mt) of feed barley, including FAQ, and 980,934t of malting to China in the nine months to 30 June 2025.

This compares with 3.66Mt of feed including FAQ and 1.82Mt of malting in the previous corresponding period.

Comments around this are not critical of China, which in August 2023 returned to the fold as Australia’s key barley customer after it removed an 80.5pc tariff imposed in May 2020.

They do, however, raise questions about how effective Australia is in marketing a premium product amid slowed growth in global beer demand.

Speaking at AGIC, and recently back from a trip to China, Riordan Group chief commercial officer Mark Lewis said Australia’s rebranding of FAQ barley as Malt MV might be the answer.

“As an industry, I think we’ve kind of dropped the ball a little bit; it’s a challenge to everyone in the room to say let’s rebrand at least how we’re selling that product,” Mr Lewis said in AGIC 2025’s Australian Market Review – Outlook, Challenges and Opportunities panel session.

“Let’s call our FAQ Malt MV: multi-variety.

“It gets ‘malt’ back into the name and it…brings some premiumisation into that product that we’re trying to sell.

“I think that would go a long way in helping us to enhance our premium product that we’re growing here in Australia.”

Currently, Grain Trade Australia standards offer Malt 1, 2 and 3 classifications, Food Grade, primarily for the Japanese market, and Barley, or BAR, 1 and 2 for feed.

If bulk-handling sites cannot receive grower deliveries into its Malt segregations, they are delivered as feed, and sometimes create stack averages to malting specs, with hatches then sold as FAQ.

On the marketing side, those selling fob or c&f cargoes cannot always extract a premium for Malt barley, and sell as FAQ through a lack of other options.

“The challenge I see is how can we rebrand what we’re doing in that space, understanding the cost pressures in China are what they are.”

Riordan Grain is a FOB seller of barley to China and other destinations, and in years past has also shipped processed malt in bulk.

Mr Lewis quantified the size of China’s malt surplus, saying its annual malting capacity has built to a “massive” 5-5.5Mt against their domestic use of around 3Mt.

While China is not thought to have built up its malting capacity with exports in mind, Mr Lewis said malt, like China’s electric vehicles, was being shipped out in increased volume to reflect lacklustre local sales.

“At the moment, the domestic market is very flat.”

“Over time, it’s really a question of what’s going to be happen with that Chinese consumer and are they going to be able to respond to that over-capacity, or will they shut down capacity, and the impact that has for some of our manufacturing product…like malt barley.”

Boortmalt is one of the world’s, and Australia’s, leading maltsters, and its Geelong-based barley procurement specialist Simon Robertson told the GIWA barley forum the global malt and brewing market “hasn’t been beer and skittles” lately.

On the malt front, Australia’s projected loss of market share looks to have shifted directly to China.

“We can see this in terms of malt exports from Australia each year; we were flying in 2022,” Mr Robertson said, referring to shipments in excess of 800,000t.

“For ’25, the way we’re tracking, we’re going to be just over half a million tonnes.”

On the flipside, China’s malt exports look set to almost double in two years from a little over 400,000t shipped in 2023.

“We’re seeing huge growth in Chinese malt exports to the point where potentially they’re going to get close to 800,000t.”

“China generally is using a lot of Australian barley, and re-exporting as malt.”

“If we look at the supply side, what we are seeing is increasing malting capacity and that’s coming from China.”

In recent years, that has come from the likes of COFCO and Supertime.

“We’re also seeing an increase in South America…and that’s new capacities coming on line.”

Overall, he said decreasing demand and increasing capacity were “creating a lot of competition in the marketplace”.

In the global beer market, increased growth has come from Russia, Mexico, and Brazil, which along with Germany, the United States, and China, account for half the world’s beer markets.

“A lot of that growth is coming from Russia.”

China’s beer production fell in 2024 from the previous year, but overall, Mr Robertson said 2025 looks like it will exceed the 1pc growth seen in 2024.

“Things look a little bit better for 2025.”

He said recent years have shown that beer is not recession proof, and after 2020’s COVID-related decline in beer consumption, and the rebound of 2021, a decline started in 2022 to buck the idea that beer production could maintain annual growth of 1.5-2pc.

“In 2023, that was…the first time beer faced these headwinds that are coming from international economic conditions.”

While barley in Australia and other major producing nations is a good fit agronomically, and has potential to go into the feed market if it does not hit malting specifications, Mr Robertson said global factors have influenced its pricing.

“In ’24, we’ve seen compressed premiums for malting over feed; I don’t see that changing in 2025.”

“Partly that’s coming from global beer growth – we’re only seeing that in emerging markets and not so much more mature markets.”

While beer production globally has been decreasing, Mr Robertson said brewers have managed to increase their margins, but that was not flowing through to the maltster.

“What we’re really looking for is for their volumes to increase.”

Mr Robertson said Australian malt exporters were competing head to head with malt made in China from Australian barley.

“We’re seeing significant pressure from China…we’re not seeing a huge variation in FAQ barley that’s being supplied to Chinese maltsters and Malt 1 we’re using in Australia.

“If you look at what the Chinese are buying from Western Australia, 75-80pc of it’s Maximus; it meets a malt specification, it’s germinating, they’re taking 4Mt of it and…maybe they’re able to do tests at destination and use what they can, and the malt they make is good malt.”

When forum participants were asked by WA-based economist Professor Ross Kingwell what has happened to Australia’s comparative advantage in malt production, Barrett Burston Malting’s general manager operations Paul Rigoni said production costs were a contributing factor to its erosion.

“Energy costs are a real bugbear; our industrial relations don’t compete with a country like China,” Mr Rigoni said.

“The drivers are all forcing the pricing down.

Mr Rigoni said while Australian malt competes well on quality, customers were “becoming more and more sensitive” to price, a mindset not expected to change without a shift in market dynamics.

“It’s a tough gig.”

In the shipping year to September 2024, ABS data indicates Australia exported 7.91Mt of barley, with 37pc, or 2.94Mt, classified as malting.

In the first nine months of the 2024-25 shipping year, 6.85Mt of barley has been exported, with only 17pc, or 1.15Mt, classified as malting.

The lower proportion of malting in 2024-25 so far indicates not just what is happening in China, but also the impact of a very tough growing season in South Australia, which reduced Australia’s export surplus of malting barley.

Australia was forecast by ABARES on June 3 to produce 12.8Mt of barley from the upcoming harvest, down from 13.3Mt harvested in 2024-25.

In its latest Foreign Agricultural Service report posted July 25, the USDA forecast new-crop Australian barley at 13Mt,

FAS Canberra has maintained its Australian total barley export forecast at 6.5Mt for 2025-26, down 1Mt from the upwardly revised 2024-25 estimate of 7.5Mt.

The drop in exports occurred despite barley production for 2025-26 being only 300,000t lower than the previous year.

“The primary reason for the expected decrease in exports is the exceptionally strong export demand during MY 2024-25, which is forecast to draw down ending stocks to below-average levels,” the report stated.

“As a result, a portion of MY 2025-26 production is expected to be retained bringing domestic stocks back up to more typical levels, thereby limiting availability for export.”

Voltar

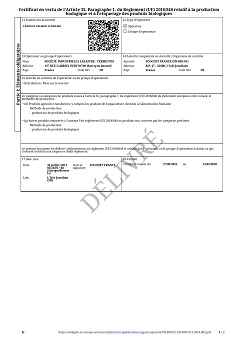

Fermentis - Certificate ECOCERT Bio production et produits 2022-2026

Fermentis - Certificate ECOCERT Bio production et produits 2022-2026

Malt Kosher Certificate July 2025-June 2026

Malt Kosher Certificate July 2025-June 2026

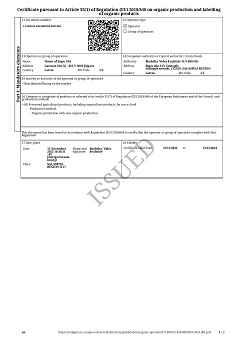

House of Hops Organic Certificate 2025

House of Hops Organic Certificate 2025

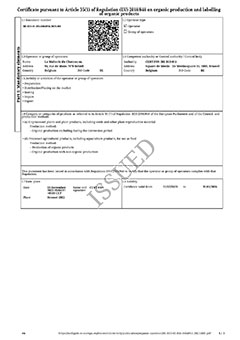

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Dec 2023-Mar 2026

Organic Certificate ENG: Malt, Hops, Spices and Sugar - Dec 2023-Mar 2026

Fagron Spices, Kosher Certificate 2024

Fagron Spices, Kosher Certificate 2024